IN ST-108E 2008 free printable template

Show details

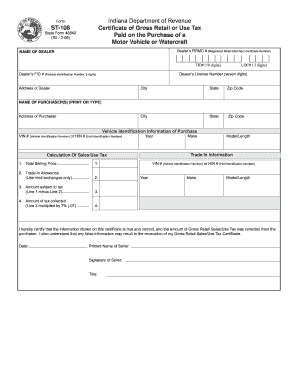

Form Indiana Department of Revenue Cert?came of Gross Retail or Use Tax EXEMPTION for the Purchase of a Motor Vehicle or Watercraft ST-108E State Form 48841 (R4 / 3-08) NAME OF DEALER s RMC # (Registered

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN ST-108E

Edit your IN ST-108E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN ST-108E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN ST-108E online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IN ST-108E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN ST-108E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN ST-108E

How to fill out IN ST-108E

01

Obtain the IN ST-108E form from the appropriate tax authority website or office.

02

Provide your full name and address in the designated fields.

03

Enter your Social Security Number or Employer Identification Number as required.

04

Specify the types of purchases you are claiming exemption for and the reason for exemption.

05

List the sellers from whom you made the purchases.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form according to the instructions provided, either by mail or electronically if permitted.

Who needs IN ST-108E?

01

Businesses or organizations making tax-exempt purchases in certain jurisdictions.

02

Resellers who need to document their tax-exempt status for sales tax exemption purposes.

03

Non-profit organizations that qualify for tax-exempt status under applicable laws.

Fill

form

: Try Risk Free

People Also Ask about

What is a ST 108 form in Indiana?

The ST-108 allows the dealer to indicate the amount of tax collected from the purchaser. The dealer is then required to submit the sales/use tax to the Department of Revenue on a sales and use tax report.

How do I get a resale certificate in Indiana?

Indiana does not require registration with the state for a resale certificate. How can you get a resale certificate in Indiana? To get a resale certificate in Indiana, you will need to fill out the Indiana General Sales Tax Exemption Certificate (ST-105).

How much is a resellers license in Indiana?

How Much Does a Sales Tax Permit in Indiana Cost? There is a $25 registration fee to apply for a sales tax permit in Indiana. If applying online, there is an additional $1 charge to cover the credit card fee.

How do I get a resale tax certificate in Indiana?

Indiana does not require registration with the state for a resale certificate. How can you get a resale certificate in Indiana? To get a resale certificate in Indiana, you will need to fill out the Indiana General Sales Tax Exemption Certificate (ST-105).

Does Indiana sales tax exemption expire?

There is typically no fee to renew an exemption. Of the 11 states, all but two (Alabama and Indiana) exempt entities for five year periods.

What qualifies for tax exempt in Indiana?

While the Indiana sales tax of 7% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Indiana.Other tax-exempt items in Indiana. CategoryExemption StatusFood and MealsMachineryEXEMPTRaw MaterialsEXEMPTUtilities & FuelEXEMPT19 more rows

What is the sales tax on a car in Ohio?

Ohio's 5.75% sales tax rate applies to all car sales, but your specific rate will also depend on your county and local taxes.

What are the sales tax rules for Indiana?

If your business sells goods or tangible personal property, you'll need to register to collect a seven percent sales tax. This registration allows you to legally conduct retail sales in the state of Indiana.

What is Form ST 108 in Indiana?

The ST-108 allows the dealer to indicate the amount of tax collected from the purchaser. The dealer is then required to submit the sales/use tax to the Department of Revenue on a sales and use tax report.

What qualifies for sales tax exemption in Indiana?

Purchases of tangible personal property, accommodations, or utilities made directly by the United States government, its agencies, and instrumentalities are exempt from Indiana sales tax. Sales by these same entities are also exempt from sales tax.

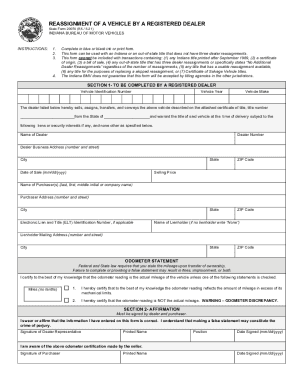

How do I fill out a title application in Indiana?

0:41 4:13 Indiana Title Transfer Instructions - Seller - YouTube YouTube Start of suggested clip End of suggested clip Reading exactly as it appears on the odometer. And the space provided. That's not required that'sMoreReading exactly as it appears on the odometer. And the space provided. That's not required that's more than 10 years. Old. Make sure that you don't include tents.

How long are Indiana tax exempt certificates valid?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IN ST-108E in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your IN ST-108E as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify IN ST-108E without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IN ST-108E into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit IN ST-108E on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign IN ST-108E on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is IN ST-108E?

IN ST-108E is a tax exemption certificate used in Indiana to claim exemptions from sales and use taxes for certain transactions.

Who is required to file IN ST-108E?

Businesses or individuals making tax-exempt purchases in Indiana are required to file IN ST-108E.

How to fill out IN ST-108E?

To fill out IN ST-108E, provide the purchaser's name, address, the type of exemption being claimed, and the signature of the purchaser or authorized representative.

What is the purpose of IN ST-108E?

The purpose of IN ST-108E is to document tax-exempt purchases and ensure compliance with Indiana tax laws.

What information must be reported on IN ST-108E?

IN ST-108E requires reporting the purchaser's details, exemption type, the sales tax account number, and the signature of the purchaser.

Fill out your IN ST-108E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN ST-108e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.