TN CT-0025-9557 - Loudon County 2014 free printable template

Show details

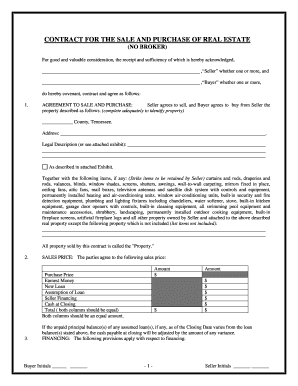

With this certification subject to audit your assessment per this schedule will be set at 300. REVERSE SIDE OF THIS FORM MUST BE COMPLETED IF APPLICABLE GROUP 1 - FURNITURE FIXTURES GENERAL EQUIPMENT AND ALL OTHER PROPERTY NOT LISTED IN ANOTHER GROUP YEAR COST ON FILE REVISED COST DEPR GROUP 4 - AIRCRAFT TOWERS AND BOATS GROUP 6 - BILLBOARDS TANKS AND PIPELINES PRIOR 33 471 13 461 19 438 71 055 302 144 TOTAL 442 141 GROUP 2 - COMPUTERS COPIERS PE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN CT- - Loudon County

Edit your TN CT- - Loudon County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN CT- - Loudon County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TN CT- - Loudon County online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TN CT- - Loudon County. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN CT-0025-9557 - Loudon County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN CT- - Loudon County

How to fill out TN CT- - Loudon County

01

Gather necessary financial information and documentation.

02

Obtain the TN CT- form for Loudon County from the official website or local government office.

03

Fill out the applicant's basic information, including name, address, and social security number.

04

Provide detailed information about the income sources, expenses, and deductions.

05

Review all filled sections to ensure accuracy and completeness.

06

Sign and date the form in the appropriate section.

07

Submit the completed form by mail or in person at the designated Loudon County office, ensuring to keep a copy for records.

Who needs TN CT- - Loudon County?

01

Individuals or businesses residing in Loudon County who need to report their income and pay local taxes.

02

New residents of Loudon County who must fill out the form as part of their tax obligations.

03

Self-employed individuals operating within Loudon County requiring to declare their income and business expenses.

Fill

form

: Try Risk Free

People Also Ask about

How are property taxes billed in Tennessee?

Property tax bills are mailed to the owner of record. New owners should contact their title company or review their closing statement to determine who is responsible for paying the taxes. Payment of property tax depends on when the property is transferred. Unpaid taxes continue to accrue against the property.

How is personal property tax calculated in Tennessee?

The ASSESSMENT RATIO for the different classes of property is established by state law (residential and farm @ 25% of appraised value, commercial/industrial @ 40% of appraised value and personalty @ 30% of appraised value). The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

At what age do you stop paying property taxes in Tennessee?

Own their principal place of residence in a participating county and/or city. Be 65 years of age or older by the end of the year in which the application is filed. Have an income from all sources that does not exceed the county income limit established for that tax year.

What is the tangible personal property tax in Tennessee?

Tangible Personal Property In Tennessee, personal property is assessed at 30% of its value for commercial and industrial property and 55% of its value for public utility property.

What is the depreciation life of tangible personal property?

Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Tangible personal property is always depreciated over either a five- or seven-year period using straight-line depreciation but is eligible for accelerated depreciation as well.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find TN CT- - Loudon County?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific TN CT- - Loudon County and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the TN CT- - Loudon County in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your TN CT- - Loudon County in seconds.

How can I edit TN CT- - Loudon County on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing TN CT- - Loudon County, you can start right away.

What is TN CT- - Loudon County?

TN CT- - Loudon County is a specific tax form used in Loudon County, Tennessee, for reporting various local taxes.

Who is required to file TN CT- - Loudon County?

Individuals and businesses operating in Loudon County that are subject to local taxes are required to file TN CT- - Loudon County.

How to fill out TN CT- - Loudon County?

To fill out TN CT- - Loudon County, you need to provide relevant personal and business information, income details, and tax calculations as per the form's instructions.

What is the purpose of TN CT- - Loudon County?

The purpose of TN CT- - Loudon County is to facilitate the proper reporting and collection of local taxes to support county services and infrastructure.

What information must be reported on TN CT- - Loudon County?

The information that must be reported on TN CT- - Loudon County includes taxpayer identification details, income earned, applicable deductions, tax owed, and any other required financial information.

Fill out your TN CT- - Loudon County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN CT- - Loudon County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.