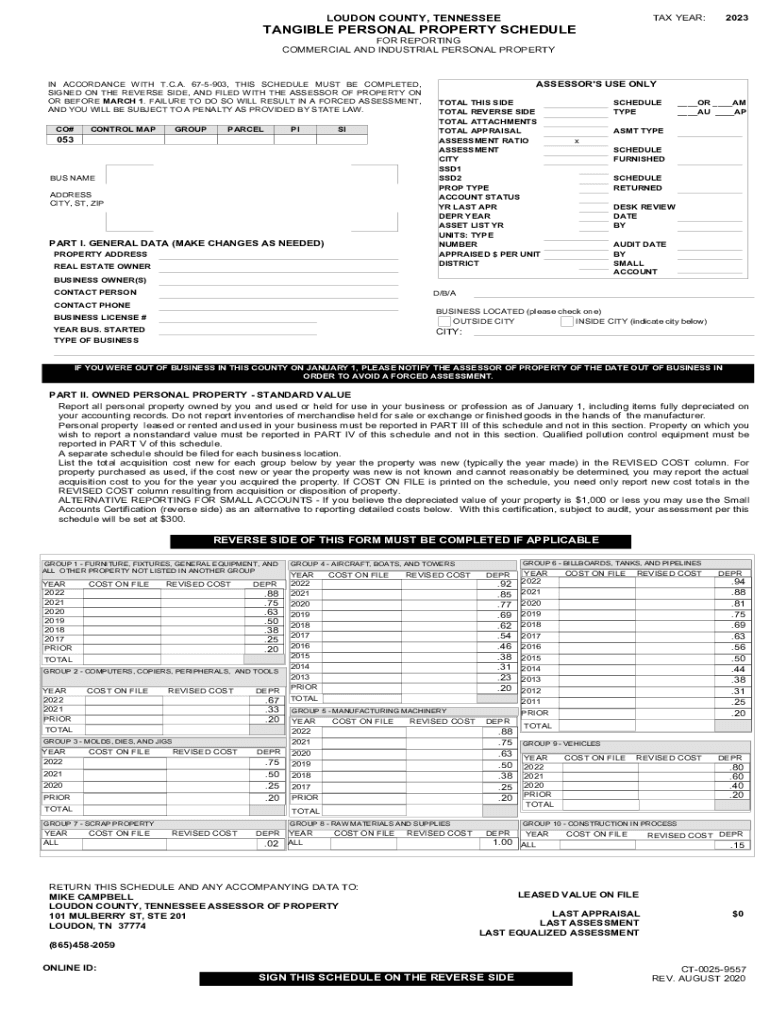

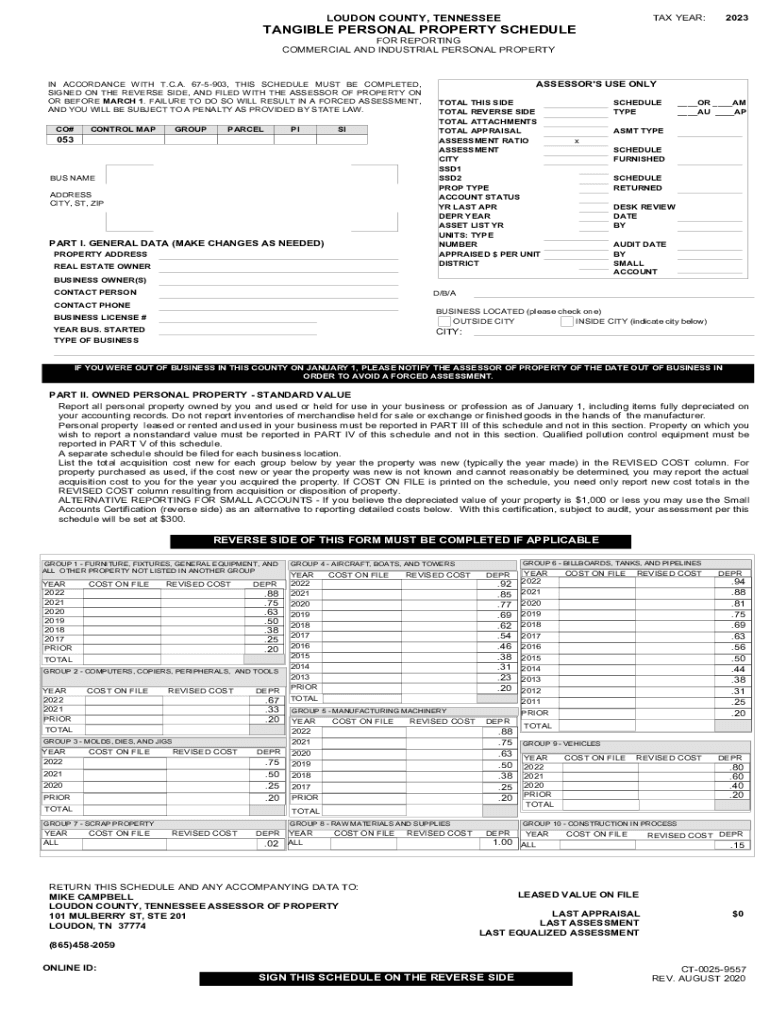

TN CT-0025-9557 - Loudon County 2023 free printable template

Show details

With this certification subject to audit your assessment per this schedule will be set at 300. REVERSE SIDE OF THIS FORM MUST BE COMPLETED IF APPLICABLE GROUP 1 - FURNITURE FIXTURES GENERAL EQUIPMENT AND ALL OTHER PROPERTY NOT LISTED IN ANOTHER GROUP YEAR COST ON FILE REVISED COST DEPR GROUP 4 - AIRCRAFT TOWERS AND BOATS GROUP 6 - BILLBOARDS TANKS AND PIPELINES PRIOR 33 471 13 461 19 438 71 055 302 144 TOTAL 442 141 GROUP 2 - COMPUTERS COPIERS PE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tn tangible personal property form

Edit your tn tangible personal property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 00259557 word form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 00259557 add online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ct 0025 9557 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN CT-0025-9557 - Loudon County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tennessee ct0025 9557 form

How to fill out TN CT- - Loudon County

01

Obtain the TN CT- form for Loudon County from the official state or county website.

02

Fill out your name and address in the designated sections at the top of the form.

03

Provide accurate information regarding your tax identification number.

04

Enter the date of the transaction related to the form.

05

Complete the section detailing the amount of taxes owed or any necessary deductions.

06

Review the form for any errors or missing information.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate Loudon County tax office by the specified deadline.

Who needs TN CT- - Loudon County?

01

Individuals or businesses that are required to report and pay taxes in Loudon County.

02

Taxpayers looking to claim deductions or credits associated with Loudon County tax obligations.

03

Any person or entity engaging in business activity within Loudon County that necessitates compliance with local tax regulations.

Fill

tennessee ct 00259557

: Try Risk Free

People Also Ask about ct 00259557 modify

How are property taxes billed in Tennessee?

Property tax bills are mailed to the owner of record. New owners should contact their title company or review their closing statement to determine who is responsible for paying the taxes. Payment of property tax depends on when the property is transferred. Unpaid taxes continue to accrue against the property.

How is personal property tax calculated in Tennessee?

The ASSESSMENT RATIO for the different classes of property is established by state law (residential and farm @ 25% of appraised value, commercial/industrial @ 40% of appraised value and personalty @ 30% of appraised value). The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

At what age do you stop paying property taxes in Tennessee?

Own their principal place of residence in a participating county and/or city. Be 65 years of age or older by the end of the year in which the application is filed. Have an income from all sources that does not exceed the county income limit established for that tax year.

What is the tangible personal property tax in Tennessee?

Tangible Personal Property In Tennessee, personal property is assessed at 30% of its value for commercial and industrial property and 55% of its value for public utility property.

What is the depreciation life of tangible personal property?

Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Tangible personal property is always depreciated over either a five- or seven-year period using straight-line depreciation but is eligible for accelerated depreciation as well.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ct 00259557 edit without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your ct 00259557 text into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I fill out the ct 00259557 online form on my smartphone?

Use the pdfFiller mobile app to fill out and sign ct 00259557 download on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out ct0025 9557 file on an Android device?

Use the pdfFiller mobile app to complete your ct0025 9557 form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is TN CT- - Loudon County?

TN CT- is a form used in Loudon County, Tennessee for business tax purposes, specifically for reporting business activity and income.

Who is required to file TN CT- - Loudon County?

Businesses operating in Loudon County that meet certain revenue thresholds are required to file TN CT-.

How to fill out TN CT- - Loudon County?

To fill out TN CT-, provide your business name, address, revenue information, and any other required details, then submit it to the appropriate county office.

What is the purpose of TN CT- - Loudon County?

The purpose of TN CT- is to report and assess business tax liabilities for entities operating within Loudon County.

What information must be reported on TN CT- - Loudon County?

TN CT- must report the business name, address, federal tax identification number, gross revenue, and any other relevant financial information.

Fill out your TN CT- - Loudon County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ct0025 9557 Doc is not the form you're looking for?Search for another form here.

Keywords relevant to ct 00259557 template

Related to ct 00259557 editor

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.