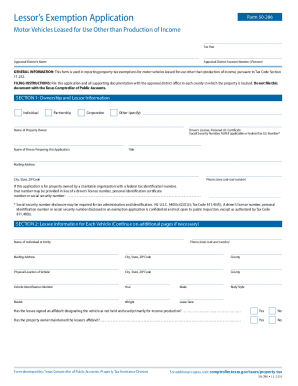

TX Comptroller 50-286 2017 free printable template

Show details

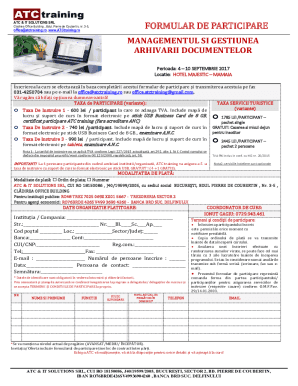

Texas Comptroller of Public AccountsForm50286Lessors Application for Personal Use Lease Automobile Exemption Appraisal Districts Telephone (area code and number) Address, City, State, ZIP CodeGENERAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-286

Edit your TX Comptroller 50-286 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-286 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 50-286 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX Comptroller 50-286. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-286 Form Versions

Version

Form Popularity

Fillable & printabley

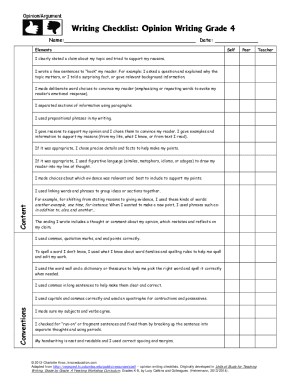

How to fill out TX Comptroller 50-286

How to fill out TX Comptroller 50-286

01

Obtain the TX Comptroller 50-286 form from the Texas Comptroller's website or your local office.

02

Provide the name and contact information of the entity or individual applying.

03

Fill in the property information, including the type of property and its location.

04

Clearly state the reason for the exemption sought under the applicable tax code.

05

Attach any required documentation that supports your claim for the exemption.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the appropriate local appraisal district office by the deadline.

Who needs TX Comptroller 50-286?

01

Individuals or businesses seeking property tax exemptions in Texas.

02

Property owners applying for specific tax exemptions, such as those related to charitable organizations, religious institutions, or educational purposes.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from motor vehicle sales tax in Texas?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Do I have to pay personal property tax on a leased vehicle in Texas?

No tax is due on the lease payments made by the lessee under a lease agreement. Also, no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. Any tax paid by the lessee when the motor vehicle was titled and registered in Texas was paid in the name of and for the lessor.

What is the property tax on vehicles in Texas?

The rate is 6.25 percent and is calculated on the purchase price of the vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Will a trade-in reduce the taxable value?

How do I transfer my leased car to Texas?

Applying for registration Visit the local Texas tax office. Fill in an Application for Texas Certificate of Title form. You need to provide proof of ID, ownership, car insurance, and vehicle inspection. The registration incurs a standard fee of $51.75 (additional fees may apply)

Do you pay sales tax on a leased vehicle in Texas?

Leased Vehicles Lease payments are not taxed in Texas. The lessor pays 6.25 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas. The taxable value of private-party purchases of leased (used) motor vehicles may be based on 80 percent of the SPV.

How does leasing a car work in Texas?

Leasing a car in Texas is usually cheaper than financing, but you return the car to the dealer at the end of your lease term. has serious advantages, from saving on your monthly car costs to reducing your risk if you end up hating the car.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in TX Comptroller 50-286 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing TX Comptroller 50-286 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the TX Comptroller 50-286 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your TX Comptroller 50-286.

How do I complete TX Comptroller 50-286 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your TX Comptroller 50-286, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is TX Comptroller 50-286?

TX Comptroller 50-286 is a form used by property owners in Texas to report their eligibility for certain exemptions, primarily related to property taxes.

Who is required to file TX Comptroller 50-286?

Property owners who wish to claim certain property tax exemptions, such as exemptions for the disabled or elderly, are required to file TX Comptroller 50-286.

How to fill out TX Comptroller 50-286?

To fill out TX Comptroller 50-286, provide your personal information, details about the property, and specify the exemption you are applying for. Make sure to follow the instructions provided on the form.

What is the purpose of TX Comptroller 50-286?

The purpose of TX Comptroller 50-286 is to allow eligible property owners to apply for tax exemptions, thereby potentially reducing their property tax liabilities.

What information must be reported on TX Comptroller 50-286?

TX Comptroller 50-286 requires reporting of personal identification information, property details, the nature of the exemption being claimed, and any necessary documentation to support the exemption request.

Fill out your TX Comptroller 50-286 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-286 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.