TX Comptroller 50-286 2020 free printable template

Show details

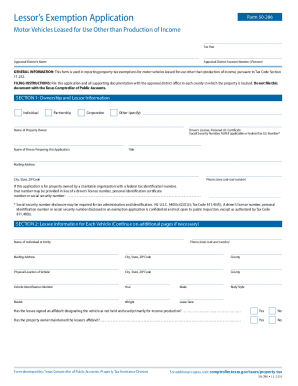

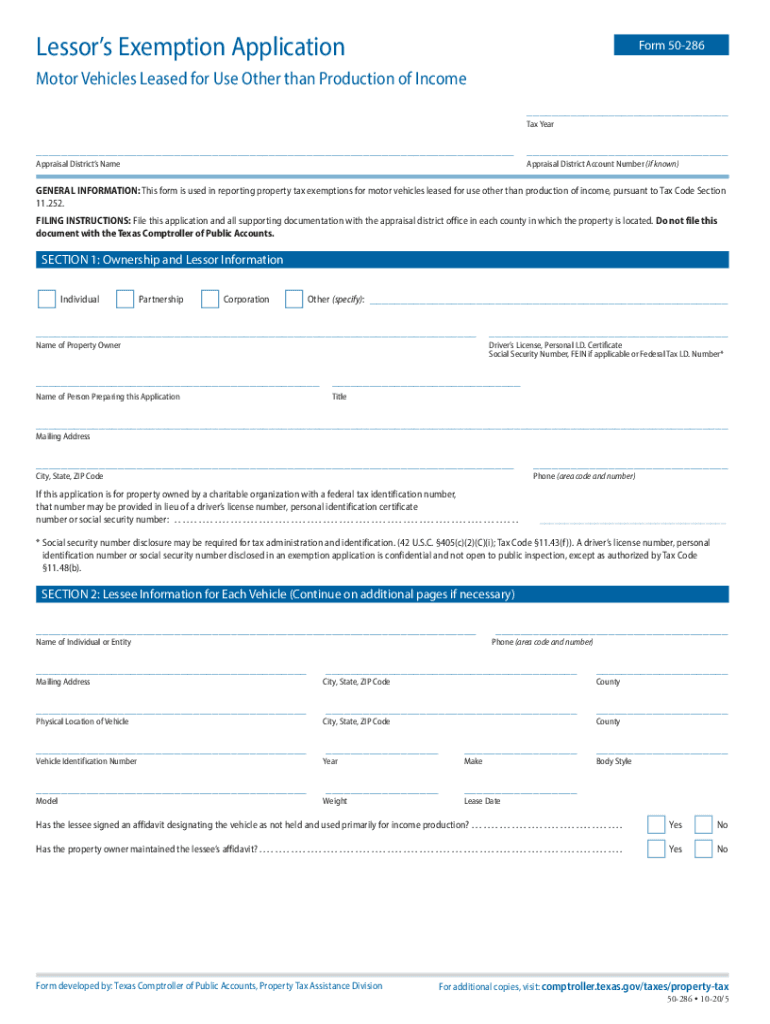

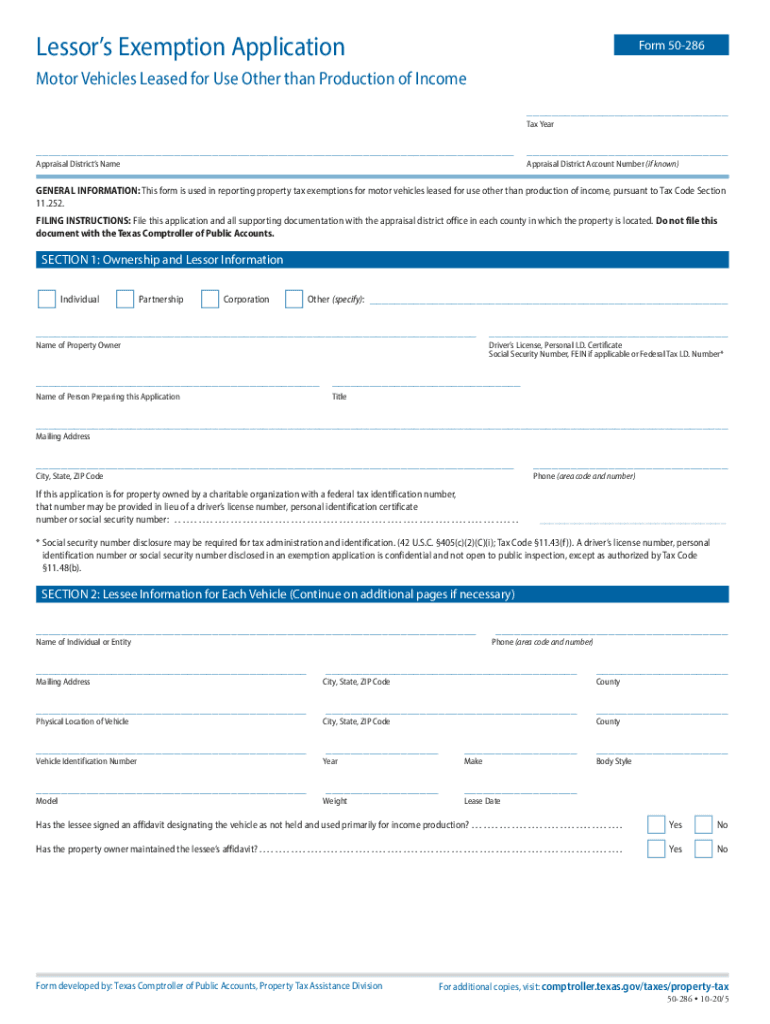

Lessors Exemption ApplicationForm 50286Motor Vehicles Leased for Use Other than Production of Income Tax Year Appraisal Districts Reappraisal District Account Number (if known)GENERAL INFORMATION:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-286

Edit your TX Comptroller 50-286 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-286 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-286 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller 50-286. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-286 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-286

How to fill out TX Comptroller 50-286

01

Download the TX Comptroller Form 50-286 from the Texas Comptroller's website.

02

Gather all necessary information, including property details, owner information, and tax exemption eligibility.

03

Fill out the top section of the form with the property owner's name, address, and contact information.

04

Provide specific details about the property, such as the location, type of property, and its use.

05

Indicate the reason for filing the exemption, ensuring it aligns with the eligibility criteria.

06

Attach any required documentation that supports the exemption request.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the appropriate local tax office before the deadline.

Who needs TX Comptroller 50-286?

01

Property owners in Texas who are seeking a property tax exemption need TX Comptroller 50-286.

02

Non-profit organizations, religious institutions, and entities applying for exemptions based on specific state laws may also need this form.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from motor vehicle sales tax in Texas?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Do I have to pay personal property tax on a leased vehicle in Texas?

No tax is due on the lease payments made by the lessee under a lease agreement. Also, no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. Any tax paid by the lessee when the motor vehicle was titled and registered in Texas was paid in the name of and for the lessor.

What is the property tax on vehicles in Texas?

The rate is 6.25 percent and is calculated on the purchase price of the vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Will a trade-in reduce the taxable value?

How do I transfer my leased car to Texas?

Applying for registration Visit the local Texas tax office. Fill in an Application for Texas Certificate of Title form. You need to provide proof of ID, ownership, car insurance, and vehicle inspection. The registration incurs a standard fee of $51.75 (additional fees may apply)

Do you pay sales tax on a leased vehicle in Texas?

Leased Vehicles Lease payments are not taxed in Texas. The lessor pays 6.25 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas. The taxable value of private-party purchases of leased (used) motor vehicles may be based on 80 percent of the SPV.

How does leasing a car work in Texas?

Leasing a car in Texas is usually cheaper than financing, but you return the car to the dealer at the end of your lease term. has serious advantages, from saving on your monthly car costs to reducing your risk if you end up hating the car.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TX Comptroller 50-286 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your TX Comptroller 50-286 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute TX Comptroller 50-286 online?

pdfFiller has made it simple to fill out and eSign TX Comptroller 50-286. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the TX Comptroller 50-286 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your TX Comptroller 50-286 in minutes.

What is TX Comptroller 50-286?

TX Comptroller 50-286 is a form used in Texas for reporting certain tax-related information to the Comptroller of Public Accounts, primarily concerning the distribution of public funds to local governmental entities.

Who is required to file TX Comptroller 50-286?

Entities that are receiving public funds from the state or local governmental entities in Texas are required to file TX Comptroller 50-286.

How to fill out TX Comptroller 50-286?

To fill out TX Comptroller 50-286, you need to provide information such as the entity's name, address, the nature of the funds received, and any other relevant financial details. Ensure accuracy in reporting to avoid penalties.

What is the purpose of TX Comptroller 50-286?

The purpose of TX Comptroller 50-286 is to ensure transparency and accountability in the distribution and use of public funds by requiring entities to report their financial activities to the state.

What information must be reported on TX Comptroller 50-286?

The information required includes the entity's identification details, the amounts received, the sources of funding, the uses of the funds, and any other pertinent financial data as prescribed by the Texas Comptroller's office.

Fill out your TX Comptroller 50-286 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-286 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.