PR Form 483.20 2016 free printable template

Show details

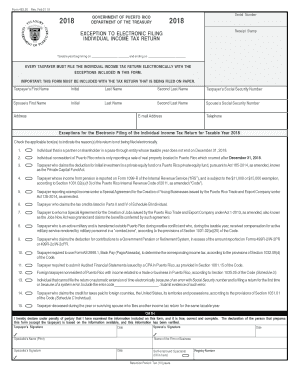

Form 483.20 Rev. Feb 06 17 2016 Rev. 4 Nov 15 GOVERNMENT OF PUERTO RICO DEPARTMENT OF THE TREASURY Serial Number 2016 Receipt Stamp EXCEPTION TO ELECTRONIC FILING INDIVIDUAL INCOME TAX RETURN Taxable

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PR Form 48320

Edit your PR Form 48320 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PR Form 48320 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PR Form 48320 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PR Form 48320. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR Form 483.20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR Form 48320

How to fill out PR Form 483.20

01

Begin by obtaining the PR Form 483.20 from the appropriate government website or office.

02

Fill in your personal details such as name, address, and contact information at the top of the form.

03

Provide information about your immigration status and any relevant case numbers in the designated fields.

04

Carefully read the instructions regarding required supporting documents and gather them as needed.

05

Complete all sections of the form as prompted, ensuring accuracy and clarity.

06

Review the form for any errors or omissions before submitting.

07

Sign and date the form at the bottom, as required.

08

Submit the completed PR Form 483.20 along with any supporting documents to the specified address.

Who needs PR Form 483.20?

01

Individuals applying for permanent residency who are required to submit specific information to immigration authorities.

02

Those who have received instructions to complete the PR Form 483.20 as part of their immigration process.

Fill

form

: Try Risk Free

People Also Ask about

What does PR mean on tax return?

A partnership must designate a partnership representative on its tax return for each taxable year unless it makes a valid election out of the centralized partnership audit regime. The designation of a partnership representative for one taxable year is effective only for that taxable year.

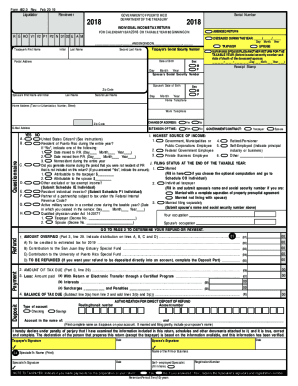

Does Puerto Rico have a state tax form?

Filing Puerto Rico & U.S. Tax Returns. Generally, if you are a Puerto Rico bona fide resident, you must file a Puerto Rico tax return. If you are not a bona fide resident of Puerto Rico, you must file both a Puerto Rico tax return and a U.S. tax return.

What is a 1040 PR form?

Self-employed persons in Puerto Rico use Form 1040 (PR) to compute self-employment tax.

What is the difference between 1040 and 1040-PR?

Form 1040-PR is used to report and pay federal self-employment tax and claim the "Child Tax Credit. This form is used when a 1040-U.S. return does not need to be filed and the individual receives self-employment income.

What is form 499r?

The Withholding Exemption Certificate (Form 499 R-4.1) is the document used by the employee to notify his/her employer of the personal exemption, exemption for dependents and the allowance based on deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PR Form 48320 to be eSigned by others?

When you're ready to share your PR Form 48320, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the PR Form 48320 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your PR Form 48320 in seconds.

Can I create an eSignature for the PR Form 48320 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your PR Form 48320 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is PR Form 483.20?

PR Form 483.20 is a specific form used by certain taxpayers to report information related to their financial activities and obligations as required by regulatory authorities.

Who is required to file PR Form 483.20?

Individuals or entities engaged in regulated financial activities, such as businesses or organizations receiving funding from government programs, may be required to file PR Form 483.20.

How to fill out PR Form 483.20?

To fill out PR Form 483.20, taxpayers should accurately enter their financial information as prompted on the form, ensuring all required sections are completed and supporting documentation is attached.

What is the purpose of PR Form 483.20?

The purpose of PR Form 483.20 is to collect information for compliance and monitoring purposes and to ensure that taxpayers meet their financial reporting obligations.

What information must be reported on PR Form 483.20?

PR Form 483.20 requires taxpayers to report information such as income, expenses, sources of funding, and other relevant financial data.

Fill out your PR Form 48320 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR Form 48320 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.