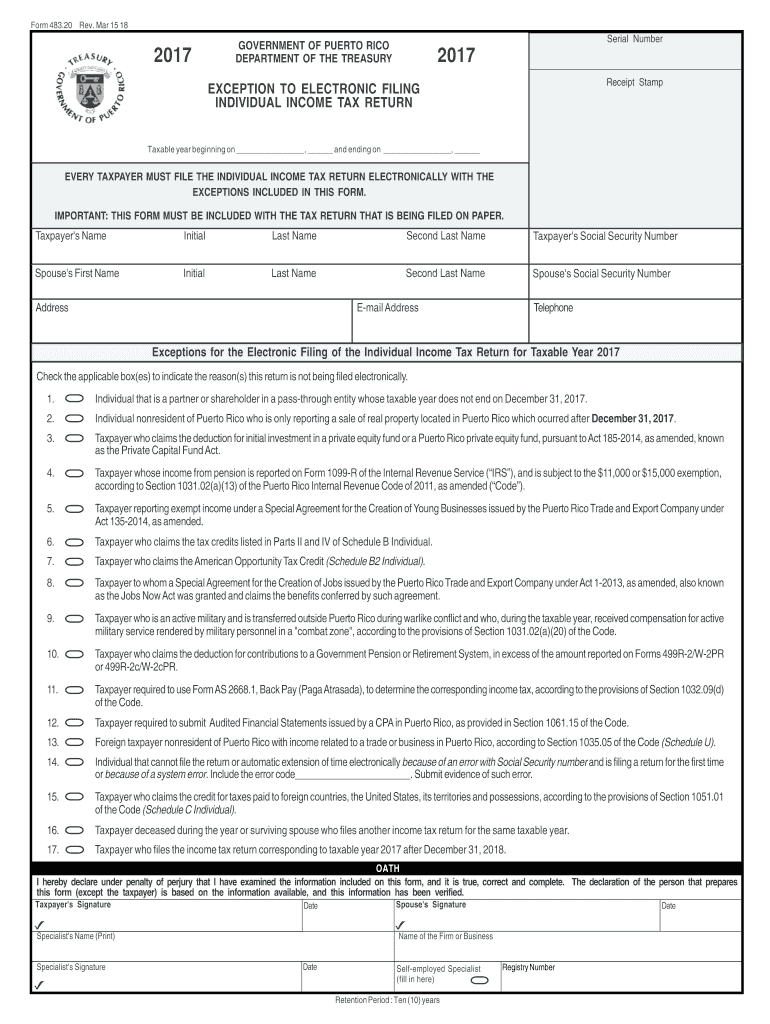

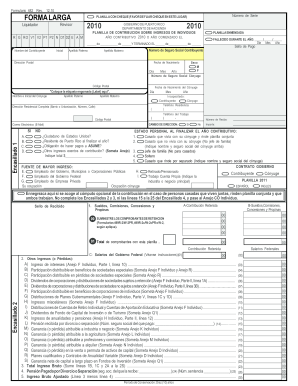

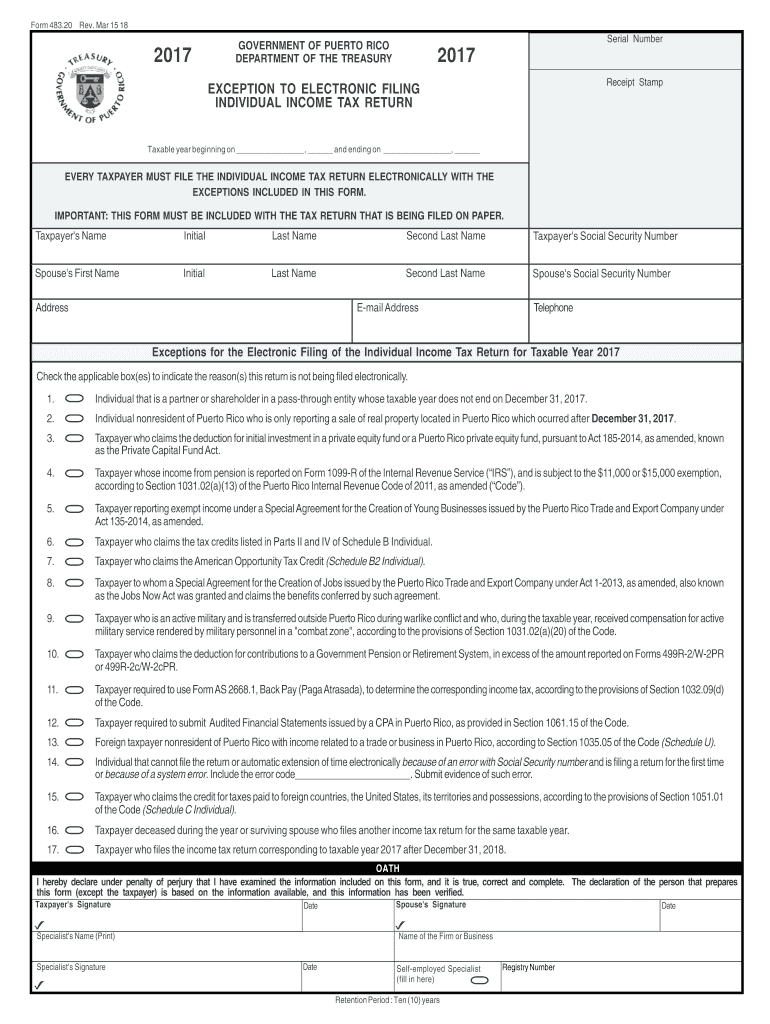

PR Form 483.20 2017 free printable template

Get, Create, Make and Sign PR Form 48320

Editing PR Form 48320 online

Uncompromising security for your PDF editing and eSignature needs

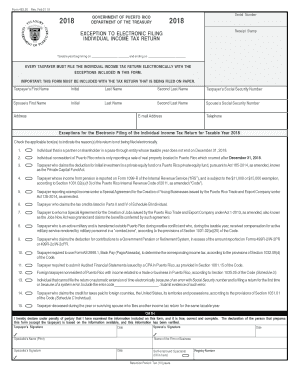

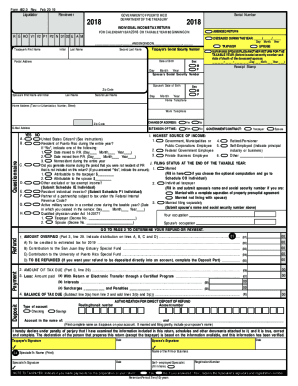

PR Form 483.20 Form Versions

How to fill out PR Form 48320

How to fill out PR Form 483.20

Who needs PR Form 483.20?

Instructions and Help about PR Form 48320

Hello friends so welcome back to another video today we will discuss different types of the forms which are being used by the US FDA here comes the form 482 form 482 is called as notice of inspection form as for Food and Drug Cosmetic Act section number 7 not for a-1 it is clearly mentioned that before any inspection FDA must present appropriate credentials and a written notice to the company or a facility which they are going to inspect so friends for 82 means it is a notice which is being given by the was FDA to a company which they are going to inspect next comes the form 483 form 483 is called as inspection observations form 483 is issued when inspector observed any significant objectionable condition during the instruction so form 483 will contain all the observations which are found during that the inspection now comes the form 484 form 484 is called as received of samples form suppose during instruction MDA inspector has collected some samples from the plant so in that case FDA inspector will give a received of the sample to the plant and that receipt of the sample is nothing but form 484 lastly we will discuss seer report so what is an IR report an IR report is nothing, but it is an establishment inspection report CIA report is prepared by the FDA inspector this report includes detailed information of the observations which are given in the form 483 based on the form 483 and report FDA will determine further action on the instructor facility that me tell you one thing that II IR the code can be classified into three types those three types are an AI o AI and we an am AI means no action indicator Oh AI means official action indicated and we AI means voluntary action indicated now let us understand these types of actions suppose are during inspection no objectionable condition was found or the condition form do not justify any regulate reaction in that case AI our report will be classified as an AI that is no action indicated next we will discuss Oh an i.e. that is official action indicated Oh a II just opposed it to Nazi means when an IR is classified as OAI e then the regulatory actions are recommended and that can be a warning letter or a tree inspection of the facility last comes the VA i.e. we AI means voluntary action indicator an IR will be classified as Vie when objectionable conditions were found what regulatory actions not taken because objectionable conditions do not met the threshold of the regulatory actions so with this I would like to wind up my video I hope after watching this video you people can easily differentiate between the various types of the forms like 482 483 484 e IR reports and its classification like AI vie Nazi what if still you people want to know more about these forms and its various types you will please visit to the Google and just type chapter 5 of FDA download the PDF and read it you will get a lot of information in that PDF so friends thank you so much for listening

People Also Ask about

What are the benefits of an LLC in Puerto Rico?

Do I need to file a Puerto Rico tax return?

How are LLCS taxed in Puerto Rico?

What are the rules for LLC in Puerto Rico?

Is income earned in Puerto Rico taxable in the US?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the PR Form 48320 in Chrome?

Can I edit PR Form 48320 on an iOS device?

Can I edit PR Form 48320 on an Android device?

What is PR Form 483.20?

Who is required to file PR Form 483.20?

How to fill out PR Form 483.20?

What is the purpose of PR Form 483.20?

What information must be reported on PR Form 483.20?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.