SG Diners Club International Credit Limit free printable template

Show details

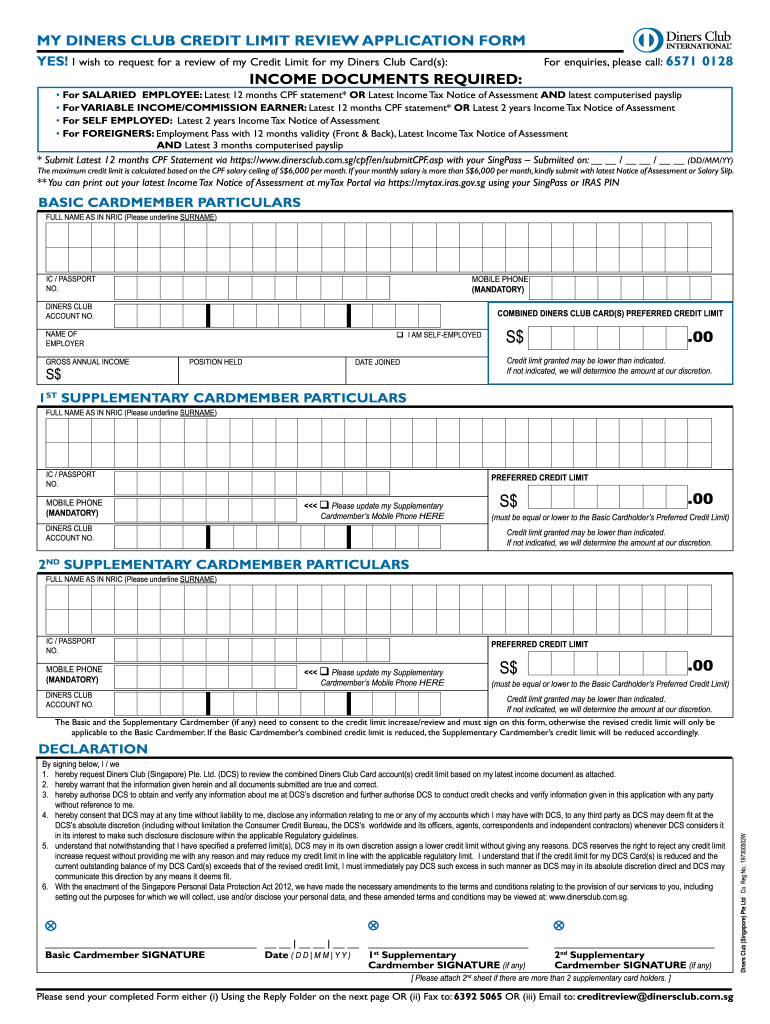

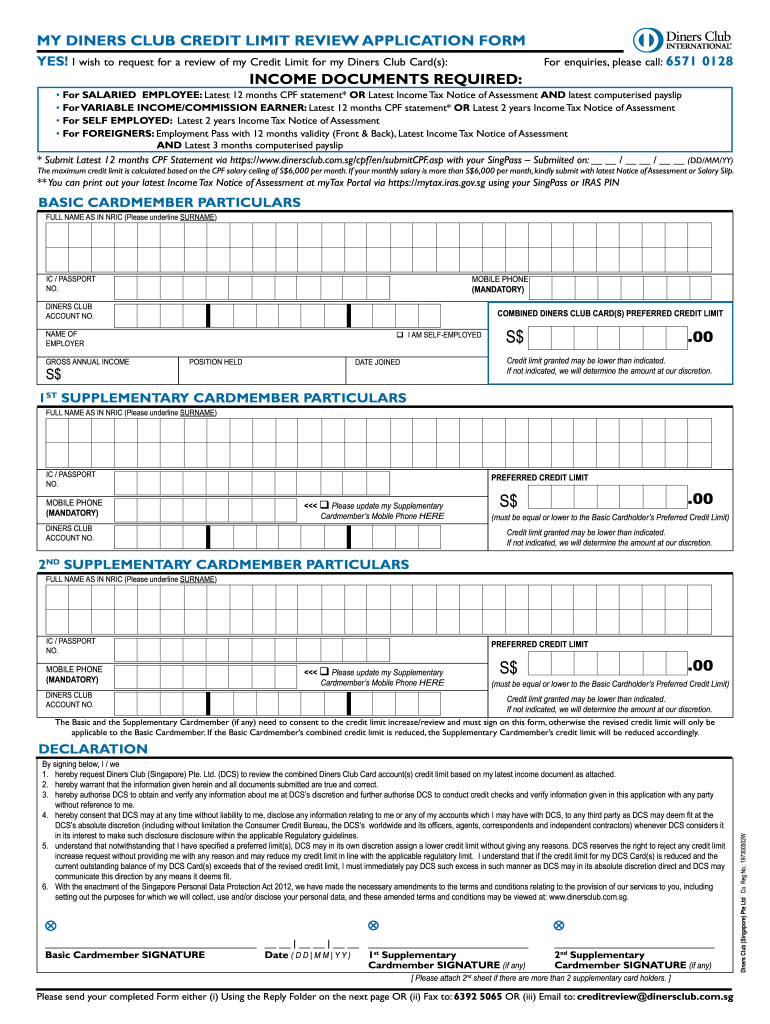

MY DINERS CLUB CREDIT LIMIT REVIEW APPLICATION FORM YES! I wish to request for a review of my Credit Limit for my Diners Club Card(s): For inquiries, please call: 6571 0128 INCOME DOCUMENTS REQUIRED:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign diners limit review form

Edit your diners limit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your diners limit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit diners credit limit review online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit diners credit limit review. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out diners credit limit review

How to fill out SG Diners Club International Credit Limit Review

01

Gather necessary documents such as income statements and existing credit information.

02

Log in to your SG Diners Club account on their official website.

03

Navigate to the Credit Limit Review section of your account.

04

Complete the online application form, ensuring all personal details are accurate.

05

Provide details of your current income and any other relevant financial information.

06

Review your application for accuracy before submission.

07

Submit the application and wait for confirmation from SG Diners Club.

08

Monitor your email for any updates or additional requests from the review team.

Who needs SG Diners Club International Credit Limit Review?

01

Current Diners Club members seeking a higher credit limit.

02

Individuals whose financial situation has changed and need a review.

03

Customers looking to improve their purchasing power for personal or business use.

Fill

form

: Try Risk Free

People Also Ask about

Is a $1,000 credit limit good?

A $1,000 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

How much should you spend on a $1000 credit limit?

In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time. One way to keep the balance below this threshold is to make smaller payments throughout the month.

What does a $1,000 dollar credit limit mean?

The credit limit is the total amount you can borrow, whereas available credit is the amount that is remaining for you to use, including if you carry a balance. For example, if you have a credit card with a $1,000 credit limit, and you charge $600, you have an additional $400 to spend.

Does Diners Club have a limit?

Your account has a credit limit, which may appear on your statement as a spend limit. The full amount of the credit limit is available to use where the card is honored. Subject to applicable law, we may reduce your credit limit at any time.

Is Diners Club a good card?

HDFC Diners Club Black Credit Card's reward rate is among the highest in India at 3.33% offering 5 points for every Rs. 150 spent. So, if you make a purchase worth Rs. 15,000, you get 500 reward points.

Is a $1,000 dollar credit limit good?

A $1,000 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute diners credit limit review online?

Completing and signing diners credit limit review online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for the diners credit limit review in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your diners credit limit review in minutes.

How do I fill out diners credit limit review using my mobile device?

Use the pdfFiller mobile app to fill out and sign diners credit limit review. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is SG Diners Club International Credit Limit Review?

SG Diners Club International Credit Limit Review is a process by which Diners Club assesses and updates the credit limit for its cardholders based on their spending habits, creditworthiness, and overall financial behavior.

Who is required to file SG Diners Club International Credit Limit Review?

Cardholders of SG Diners Club International who wish to adjust their credit limit or have been prompted by Diners Club based on their account status are required to file the review.

How to fill out SG Diners Club International Credit Limit Review?

To fill out the SG Diners Club International Credit Limit Review, cardholders should provide their personal details, current financial information, income details, and any relevant supporting documents as required by the review form.

What is the purpose of SG Diners Club International Credit Limit Review?

The purpose of the SG Diners Club International Credit Limit Review is to ensure that cardholders have an appropriate credit limit that reflects their financial status and spending habits, while also managing the risk for the credit issuer.

What information must be reported on SG Diners Club International Credit Limit Review?

The information that must be reported includes personal identification, current income, monthly expenses, employment status, credit history, and any other financial obligations that may impact the credit limit decision.

Fill out your diners credit limit review online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Diners Credit Limit Review is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.