SC PR-26 2014 free printable template

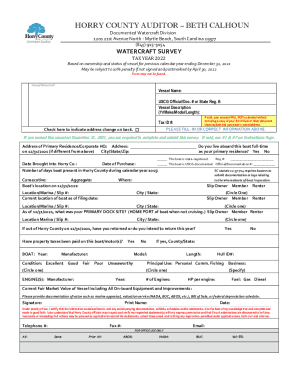

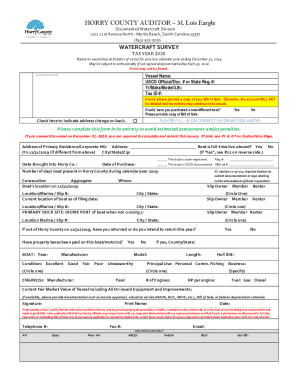

Get, Create, Make and Sign horry county pt 100

Editing horry county pt 100 online

Uncompromising security for your PDF editing and eSignature needs

SC PR-26 Form Versions

How to fill out horry county pt 100

How to fill out SC PR-26

Who needs SC PR-26?

Instructions and Help about horry county pt 100

Hi this is Julia M Spencer I'm a real estate adviser investor and enthusiast, and I'm filming here in front of a government building located in Horry County Hour Y in South Carolina and of course whenever I travel, and I was just on vacation at Myrtle Beach South Carolina I tried to find out what is the county and what are the tax sale foreclosure proceedings in that particular county and I make videos, and I'll teach you guys how to do that, so I found out that South Carolina is a tax lien state it functions a lot like Georgia and which is actually really cool because it borders Georgia, so I could just flip over the border and try to check out the tax sales here but just the process is a little different in this county right now it's actually March 17th 2016 as I'm making this video this is st. Patrick's Day today it's not a's not a public holiday, so obviously the place is packed but basically on March 17th which is today and if taxes have not been paid they are considered delinquent and the county is going to send notices to the taxpayers with property taxes today and basically now the slow process starts in this particular County they have sales only three times a year they're in October November and December the first Monday of October November and December, and they advertise for four consecutive weeks on Thursdays in the legal newspaper prior to each of those sales the properties that they're going to auction off and this is actually the location where the sale is going to happen I don't know if you can see this but let me just walk over here a little, but you can see right in the middle in between those two buildings it looks like a courthouse kind of entryway and that will be where the sale is going to be conducted so for more information like this go visit my website I have it always added, and I'm always adding more counties and more states and the procedures protects Oh foreclosure how to invest your money with tax Oh foreclosure make lots of money with go to my website subscribe to my newsletter today WW Julia M Spencer calm and download your free guide to real estate investing thank you for your free guide to real estate investing visit Julia M Spencer calm.

People Also Ask about

How to calculate Horry County South Carolina property tax?

When can I apply for homestead exemption in SC?

Is every Horry County resident required to complete pt100 form?

What is the SC PT100 form for?

Who has to file SC PT 100?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my horry county pt 100 in Gmail?

How can I edit horry county pt 100 from Google Drive?

How can I send horry county pt 100 to be eSigned by others?

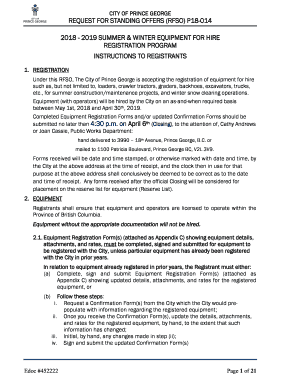

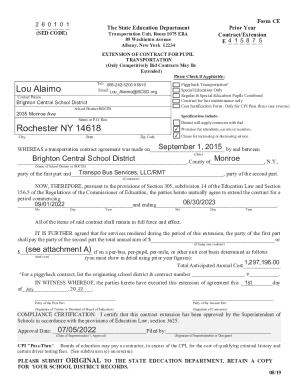

What is SC PR-26?

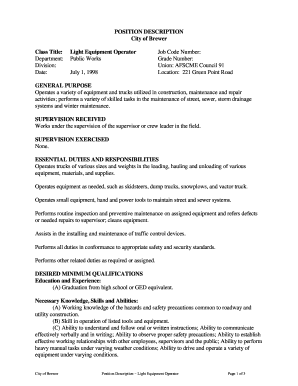

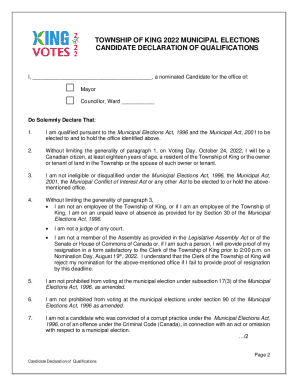

Who is required to file SC PR-26?

How to fill out SC PR-26?

What is the purpose of SC PR-26?

What information must be reported on SC PR-26?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.