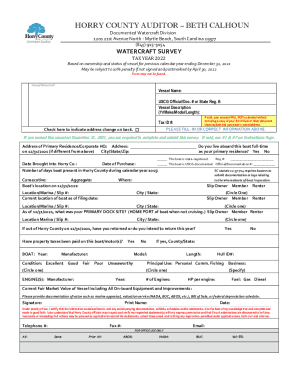

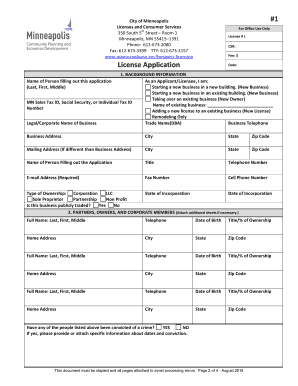

SC PR-26 2021 free printable template

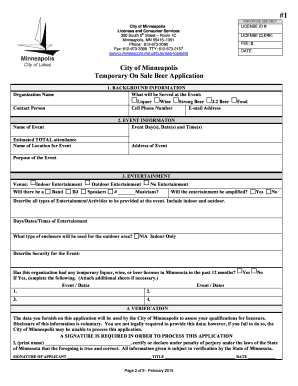

Get, Create, Make and Sign horry county tax

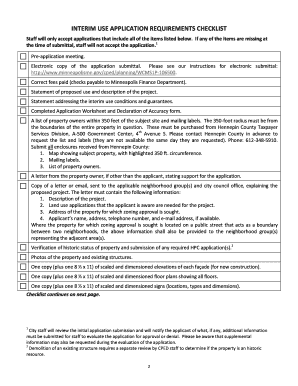

How to edit horry county tax online

Uncompromising security for your PDF editing and eSignature needs

SC PR-26 Form Versions

How to fill out horry county tax

How to fill out SC PR-26

Who needs SC PR-26?

Instructions and Help about horry county tax

So just the other day I received a call from a gentleman he was asking about a home that's on the market asking price 250 99 it's in the Myrtle Beach area, and he asked me how much the annual property taxes were I looked the information up for him and came out to about eight hundred and fifty dollars per year he thought I was kidding him he could not believe that the annual property tax was so low on this particular home I get that question a lot you know how does a county figure out how much the annual property taxes are well the county takes the fair market value of the home which in this case well use the asking price of 250 99 and its multiplied times four percent and the value you come up with from that gives you the assessed value you then take that amount times the countywide millage rate which currently is 0 point 2026 and that gives you an amount but wait it gets even better there's currently a school operations credit, so you take that amount multiplied it times point 1 202 and that gives you the annual property tax so in this case its 250 99 times four percent gives you ten thousand three hundred ninety-six dollars you then take that times the point 2026 the county military that gives you two thousand one hundred six dollars and 22 cents, and then you take that times the school operations credit which is 0 point 1 202 and that gives you an amount of 1000 249 and sixty cents, so you subtract that from the previous value and that gives you an annual rate for your property taxes at eight hundred fifty-six dollars and sixty-two cents now it is different if it's and is it's a second home or an investment property and not your primary residence in that case you would take that same fair market value to 99 and multiply times six percent and that gives you an assessment of 15000 594 you then take that times the millage rate of point 2026 and that gives you an annual rate of property tax of 3159 dollar, so you can see there's a significant difference there now if you are a homeowner in Horry County and you did not go to the assessors' office after you purchased your home to let them know that it is actually your primary home I suggest you do that tomorrow because it will save you a significant amount of money now if you have any other questions about Myrtle Beach real estate I'm always happy to help I'm mark doing with Remix southern shores, and you can reach me via text or phone at 8436 859 326 have a great day you

People Also Ask about

How to calculate Horry County South Carolina property tax?

When can I apply for homestead exemption in SC?

Is every Horry County resident required to complete pt100 form?

What is the SC PT100 form for?

Who has to file SC PT 100?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in horry county tax without leaving Chrome?

How do I fill out horry county tax using my mobile device?

How do I edit horry county tax on an iOS device?

What is SC PR-26?

Who is required to file SC PR-26?

How to fill out SC PR-26?

What is the purpose of SC PR-26?

What information must be reported on SC PR-26?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.