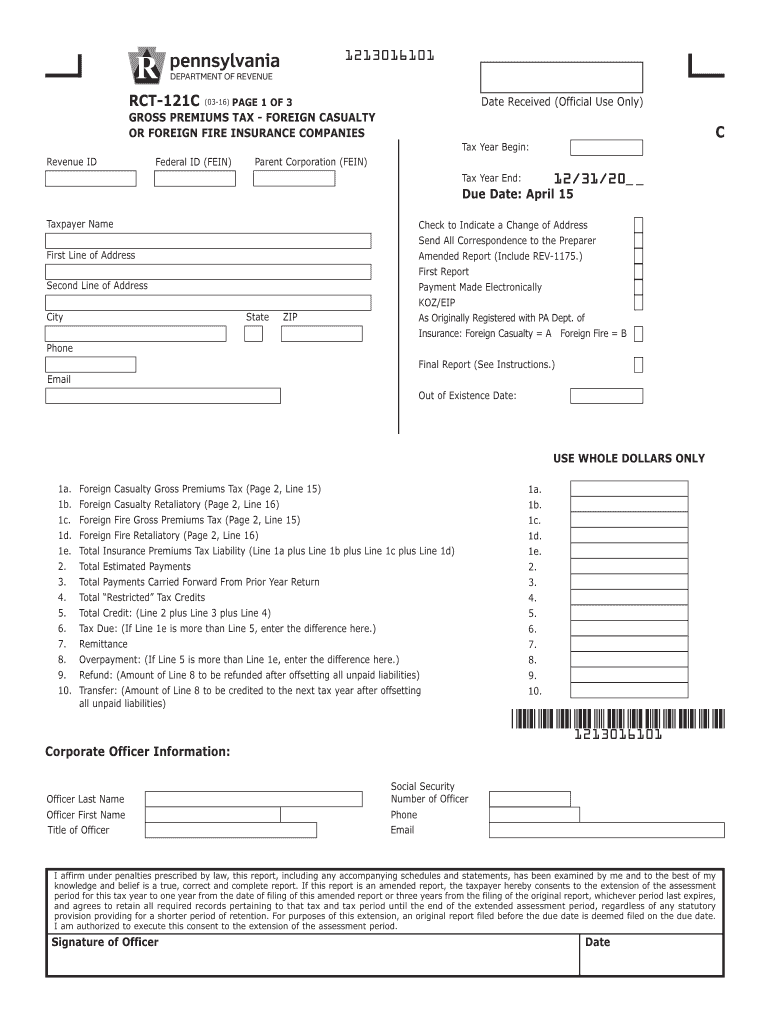

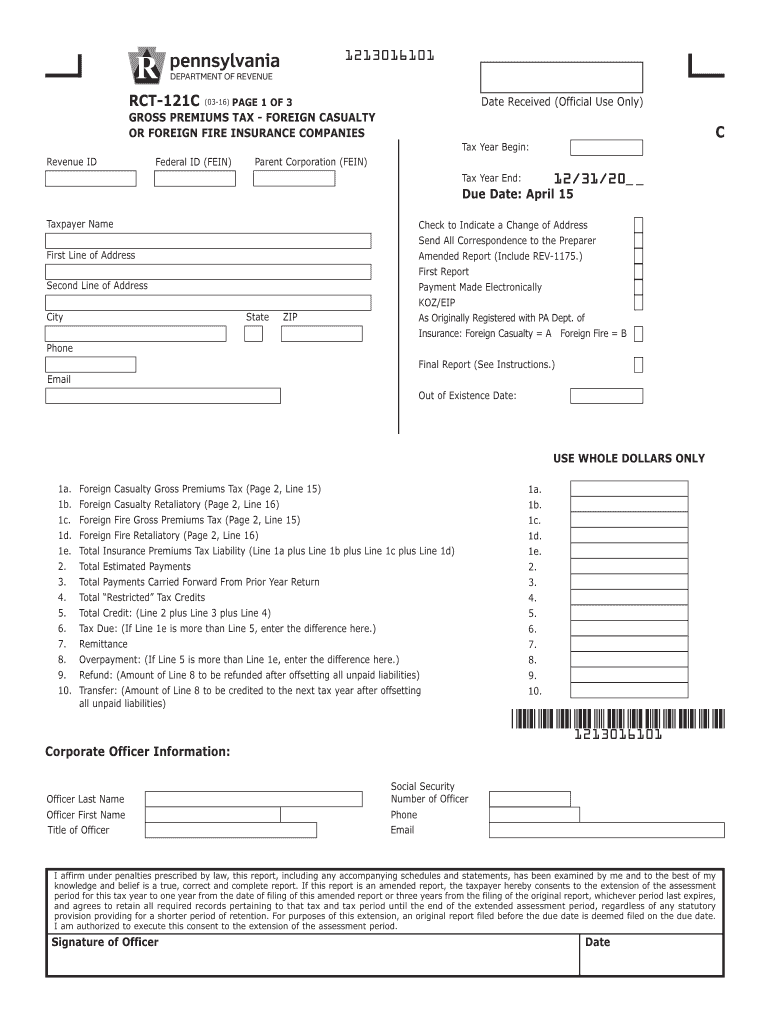

PA DoR RCT-121C 2016 free printable template

Show details

If registered with the PA Department of Insurance as a foreign fire Insurance company enter line 15 on Page 1 line 1c and enter line 16 on Page 1 line 1d. 17. State of Domicile 18. NAIC Number Preparer s Information Firm Name Firm FEIN Address Individual Preparer Name or PTIN Signature of Preparer rEtAlIAtOry wOrKShEEt - SchEDUlE Of tAXES ASSESSmEntS lIcEnSES AnD fEES PEnnSylVAnIA StAtE Of DOmIcIlE Premiums taxes Casualty and Fire Premiums Tax Ocean Marine Gross Profit Tax Life Premiums Tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DoR RCT-121C

Edit your PA DoR RCT-121C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DoR RCT-121C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA DoR RCT-121C online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA DoR RCT-121C. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR RCT-121C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DoR RCT-121C

How to fill out PA DoR RCT-121C

01

Gather necessary personal information, including your name, address, and contact details.

02

Obtain documentation related to the service or request you are seeking authorization for.

03

Fill out the patient information section accurately.

04

Complete the provider information section with the details of the healthcare provider administering the service.

05

Specify the service or treatment for which the prior authorization is being requested.

06

Provide any required clinical information or medical necessity documentation.

07

Review the form for completeness and accuracy before submission.

08

Submit the completed form to the appropriate insurance company or organization.

Who needs PA DoR RCT-121C?

01

Patients seeking prior authorization for medical services or treatments.

02

Healthcare providers submitting requests on behalf of their patients.

03

Insurance companies needing a formal request for coverage of specific services.

Instructions and Help about PA DoR RCT-121C

Fill

form

: Try Risk Free

People Also Ask about

Will I get a bigger tax refund in 2023?

(WWLP/Nexstar) — Taxpayers may need to prepare for smaller tax refunds in 2023. ing to the Internal Revenue Service, refunds could be smaller because taxpayers didn't receive stimulus payments this tax year.

How early can you file taxes 2022?

Even though taxes for most are due by April 18, 2022, you can e-file (electronically file) your taxes earlier. The IRS likely will begin accepting electronic returns anywhere between Jan. 15 and Feb. 1, 2022, when taxpayers should have received their last paychecks of the 2021 fiscal year.

When can I file my taxes for 2022 in 2023?

Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

How do I contact the IRS by phone?

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

When can I file my taxes 2023?

The filing deadline for the regular tax season will be April 18th, 2023 given that the normal April 15th deadline falls on the weekend and the Emancipation day holiday (April 17th) in DC. Approved extension filings will be due by October 18th, 2023.

How do I file my 2022 2023 tax return?

STEP1: -Visit the official Income Tax e-filing portal. STEP2: -Register or login to e-file your returns. STEP3: -Navigate to e-file and then click 'File Income Tax Return' once you have logged in to the portal.

When can I expect my refund 2022?

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return.

What is the earliest you can file taxes for 2022?

2022 tax filing season begins Jan. 24; IRS outlines refund timing and what to expect in advance of April 18 tax deadline. Internal Revenue Service.

What is the latest tax form 2022?

The due date for filing your tax return is typically April 15 if you're a calendar year filer. Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA DoR RCT-121C in Gmail?

PA DoR RCT-121C and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for the PA DoR RCT-121C in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your PA DoR RCT-121C and you'll be done in minutes.

How do I fill out the PA DoR RCT-121C form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign PA DoR RCT-121C and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is PA DoR RCT-121C?

PA DoR RCT-121C is a tax form used by businesses to report various tax-related information to the Pennsylvania Department of Revenue.

Who is required to file PA DoR RCT-121C?

Businesses operating in Pennsylvania that meet certain income thresholds or have specific tax obligations are required to file PA DoR RCT-121C.

How to fill out PA DoR RCT-121C?

To fill out PA DoR RCT-121C, gather necessary financial documents, enter required information in the designated fields, and ensure accuracy before submitting it to the Pennsylvania Department of Revenue.

What is the purpose of PA DoR RCT-121C?

The purpose of PA DoR RCT-121C is to collect tax-related information from businesses to ensure compliance with state tax laws and to assess tax liabilities.

What information must be reported on PA DoR RCT-121C?

PA DoR RCT-121C requires reporting of business income, deductions, and other relevant financial data as outlined in the form instructions.

Fill out your PA DoR RCT-121C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR RCT-121c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.