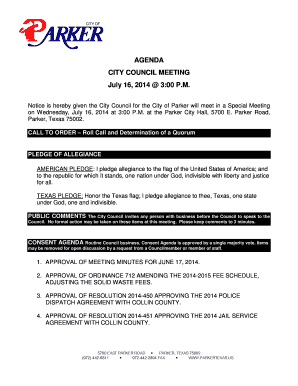

PA DoR RCT-121C 2014 free printable template

Show details

No dashes (-) or slashes (/) to be used in any fields, this includes Date, VEIN, Phone and ZIP 1213012105 OFFICIAL USE ONLY RCT-121C (09-14) Date Received (Official Use Only) PAGE 1 OF 3 GROSS PREMIUMS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DoR RCT-121C

Edit your PA DoR RCT-121C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DoR RCT-121C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA DoR RCT-121C online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA DoR RCT-121C. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR RCT-121C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DoR RCT-121C

How to fill out PA DoR RCT-121C

01

Obtain the PA DoR RCT-121C form from the relevant authority's website or office.

02

Carefully read the instructions provided at the top of the form.

03

Fill in your personal details as requested, including name, address, and contact information.

04

Provide any necessary identification numbers, such as Social Security Number or Tax ID.

05

Complete the section detailing the purpose of the request.

06

If required, attach any supporting documents that justify your request.

07

Double-check all information for accuracy and completeness.

08

Sign the form where indicated and date it.

09

Submit the form through the suggested method, whether by mail, email, or in person.

Who needs PA DoR RCT-121C?

01

Individuals or entities seeking authorization for a specific action or benefit that requires the PA DoR RCT-121C form.

02

Applicants who are involved in healthcare, legal, or governmental processes that necessitate this documentation.

03

Compliance officers and administrators managing regulatory requirements related to the application.

Instructions and Help about PA DoR RCT-121C

Fill

form

: Try Risk Free

People Also Ask about

Where is the Pennsylvania Department of Revenue?

Pennsylvania Department of Revenue Logo of the DORAgency overviewFormed1927JurisdictionState government of PennsylvaniaHeadquarters11th Floor, Strawberry Square, Harrisburg, Pennsylvania 40°15′43″N 76°52′52″W2 more rows

Where do I file pa40?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Jan 31, 2022

How do I contact the Revenue?

Call (01) 858 9843 between the hours of 9.30am to 1.30pm, Monday to Friday.

Who files a PA-40 form?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

How do I contact the PA Department of State?

Customers can gain entrance to the North Office Building through the Main Capitol. You may reach the bureau by telephone by calling (717) 787-1057 or by facsimile at (717) 783-2244.

What is the PA local tax form called?

Taxpayer Annual Local Earned Income Tax Return (CLGS-32-1)

Do I need to attach w2 to PA-40?

You may need to submit other information such as copies of military orders (if on active duty outside Pennsylvania), Form(s) W-2 (if your employer withheld additional PA income tax), and tax returns you filed in other states (when requesting a PA Resident Credit).

What does the PA Department of Revenue do?

The department is responsible for administering the Commonwealth of Pennsylvania's tax programs and services. This includes collecting most tax levies, as well as various fees, fines and other monies due the commonwealth.

What is a pa40 form?

2021 Pennsylvania Income Tax Return (PA-40)

Where can I download PA tax forms?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

Why am I not getting a PA tax refund?

There are a number of reasons why your Pennsylvania state refund may be delayed, including the following: If the department needs to verify information reported on your return or request. additional information, the process will take longer. If you have math errors on your tax return or have other adjustments.

What happens if I dont pay Pa taxes?

If you're delinquent on your Pennsylvania property taxes, you could lose your home through a tax sale. People who own real property have to pay property taxes. The government uses the money that these taxes generate to pay for schools, public services, libraries, roads, parks, and the like.

What is PA-40?

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

Why would I get a letter from the PA Department of Revenue?

The PA Department of Revenue is using these letters as a tool to protect taxpayers and prevent others from trying to file a false tax return in their name. There are three types of ID validation letters that may be issued by the Department.

Is there a PA state tax form?

The most common Pennsylvania income tax form is the PA-40. This form is used by Pennsylvania residents who file an individual income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the PA DoR RCT-121C form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PA DoR RCT-121C and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out PA DoR RCT-121C on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your PA DoR RCT-121C. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out PA DoR RCT-121C on an Android device?

Use the pdfFiller app for Android to finish your PA DoR RCT-121C. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is PA DoR RCT-121C?

PA DoR RCT-121C is a tax form used in Pennsylvania for reporting corporate income and franchise taxes.

Who is required to file PA DoR RCT-121C?

Corporations doing business in Pennsylvania and subject to the corporate net income tax are required to file PA DoR RCT-121C.

How to fill out PA DoR RCT-121C?

To fill out PA DoR RCT-121C, corporations must provide financial information including revenues, expenses, and tax calculations as outlined in the instructions for the form.

What is the purpose of PA DoR RCT-121C?

The purpose of PA DoR RCT-121C is to calculate and report the amount of corporate net income tax owed to the state of Pennsylvania.

What information must be reported on PA DoR RCT-121C?

The information that must be reported includes total income, deductions, and any applicable credits related to corporate taxes.

Fill out your PA DoR RCT-121C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR RCT-121c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.