CO DoR 104PN 2020 free printable template

Show details

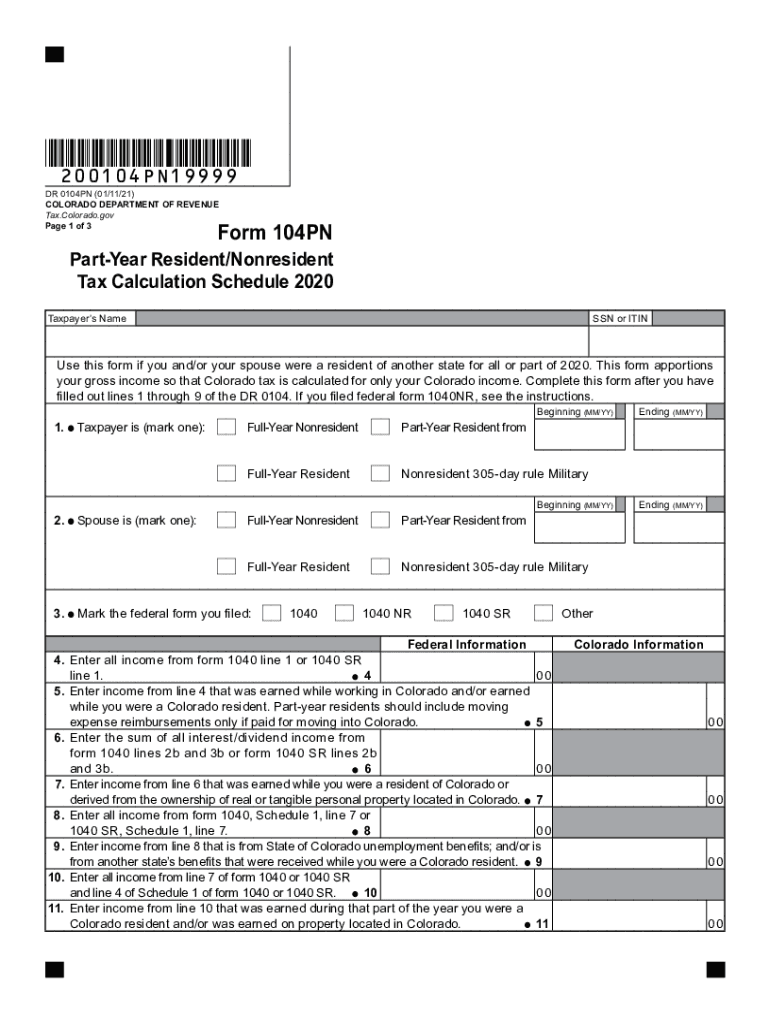

Subtract the amount on line 23 of Form 104PN from the amount on line 21 of Form 104PN. 25 26. Additions to Adjusted Gross Income. 180104PN19999 DR 0104PN 11/15/18 COLORADO DEPARTMENT OF REVENUE Colorado. gov/Tax Form 104PN Part-Year Resident/Nonresident Tax Calculation Schedule 2018 Taxpayer s Name SSN Use this form if you and/or your spouse were a resident of another state for all or part of 2018. This form apportions your gross income so that Colorado tax is calculated for only your Colorado...income. Complete this form after you have filled out lines 1 through 6 of the DR 0104. If you filed federal form 1040NR see the instructions. 1. Taxpayer is mark one 2. Spouse is mark one Beginning MM/YY Full-Year Nonresident Full-Year Resident Nonresident 305-day rule Military 3. Mark the federal form you filed 1040 NR Colorado Information 4. Enter all income from form 1040 line 1. 5. Enter income from line 4 that was earned while working in Colorado and/or earned while you were a Colorado...resident. Part-year residents should include moving expense reimbursements only if paid for moving into Colorado. 6. Enter all interest/dividend income from form 1040 lines 2b and 3b. derived from the ownership of real or tangible personal property located in Colorado. line 19. is from another state s benefits that were received while you were a Colorado resident. Ending MM/YY Other Federal Information lines 13 and 14. Name a Colorado resident and/or was earned on property located in Colorado....were a Colorado resident. 14. Enter all business and farm income from form 1040 Schedule 1 lines 12 and 18. 16. Enter all Schedule E income from form 1040 Schedule 1 line 17. and royalty income received or credited to your account during the part of the year you were a Colorado resident and/or partnership/S corporation/fiduciary income that is taxable to Colorado during the tax year. 18. Enter all other income from form 1040 Schedule 1 lines 10 11 and 21. List Type 20. Total Income. Enter amount...from form 1040 line 6. 21. Total Colorado Income. Enter the total from the Colorado column lines 5 7 9 11 13 15 17 and 19. 21 22. Enter all federal adjustments from form 23. Enter adjustments from line 22 as follows Educator expenses IRA deduction business expenses of reservists performing artists and fee-basis government officials health savings account deduction self-employment tax self-employed health insurance deduction SEP and SIMPLE deductions are allowed in the ratio of Colorado wages...and/or self-employment income to total wages and/or self-employment income. Student loan interest deduction alimony and tuition and fees deduction are allowed in the Colorado to federal total income ratio line 21 / line 20. Domestic production activities deduction is allowed in the Colorado to Federal QPAI ratio. Penalty paid on early withdrawals made while a Colorado resident. Moving expenses if you are moving into Colorado not if you are moving out. For treatment of other adjustments reported...on federal form 1040 Schedule 1 line 36 see FYI Income 6.

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

How to fill out CO DoR 104PN

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

To edit the CO DoR 104PN form, use a reliable PDF editor such as pdfFiller. Access the form and utilize the editing tools to input the necessary data. Save the changes to ensure that your modifications are captured correctly. If you need to make further changes, re-open the document and repeat the process.

How to fill out CO DoR 104PN

To fill out the CO DoR 104PN, follow these steps:

01

Download the form from an official source or access it through a PDF editor.

02

Input identifying information such as your name, address, and tax identification number.

03

Provide details relevant to the type of transaction or payment being reported.

04

Review the form for accuracy and completeness before submission.

About CO DoR 104PN 2020 previous version

What is CO DoR 104PN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR 104PN 2020 previous version

What is CO DoR 104PN?

The CO DoR 104PN refers to the Colorado Department of Revenue's payment notification form. It is used for reporting certain types of payments made by individuals or businesses to the state of Colorado. This form is essential for maintaining compliance with state tax obligations.

What is the purpose of this form?

The primary purpose of the CO DoR 104PN is to notify the Colorado Department of Revenue about specific tax-related payments. This enables accurate tracking and processing by the Department, ensuring that all parties meet their tax responsibilities effectively.

Who needs the form?

Individuals and businesses making certain payments to the state of Colorado are required to complete the CO DoR 104PN. This includes those engaging in taxable transactions that necessitate reporting to the Colorado Department of Revenue. It ensures compliance with state tax regulations.

When am I exempt from filling out this form?

You may be exempt from completing the CO DoR 104PN if your payments do not meet the threshold specified by the Colorado Department of Revenue or if you are making payments that are not subject to the reporting requirements outlined by the state.

Components of the form

The CO DoR 104PN consists of several key components, including sections for taxpayer information, details of payments, and transaction descriptions. Each component must be filled out accurately to ensure effective processing and compliance.

What are the penalties for not issuing the form?

Failing to issue the CO DoR 104PN can result in penalties imposed by the Colorado Department of Revenue. These penalties may include fines, interest accrued on unpaid taxes, and additional scrutiny during audits, which can complicate compliance efforts.

What information do you need when you file the form?

When filing the CO DoR 104PN, you will need your personal or business identification details, including the tax identification number, and specific information about the payments being reported. Accurate and complete information is crucial for successful filing.

Is the form accompanied by other forms?

The CO DoR 104PN may need to be filed alongside other tax forms depending on your individual tax situation. Always check with the Colorado Department of Revenue for any accompanying documents that may be necessary for your specific case.

Where do I send the form?

The completed CO DoR 104PN should be sent to the Colorado Department of Revenue at the designated address provided on the form. Ensure that you adhere to any additional filing guidelines to avoid delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has been GREAT lots of forms to choose from and easy to fill out.

It works great, and here is all I neeed for my job. GOD BLESS YOU ALL. GOOD WOEK

See what our users say