IRS 1099-MISC Preparation & Reporting for DRS Users 2008-2025 free printable template

Show details

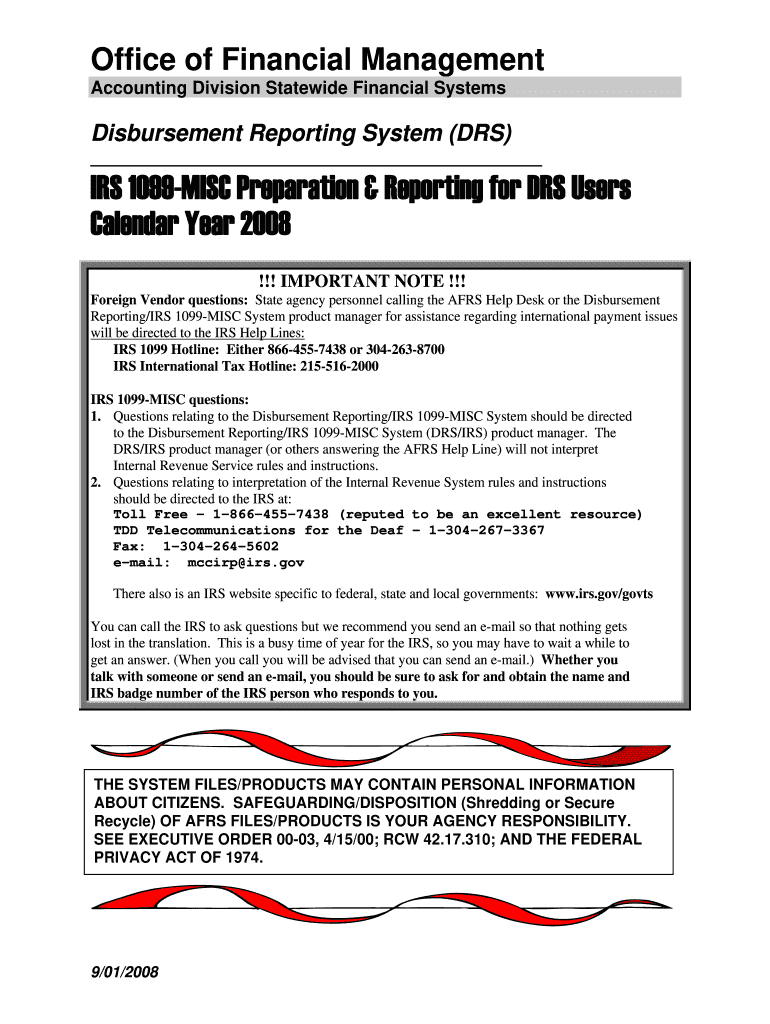

Office of Financial Management Accounting Division Statewide Financial Systems Disbursement Reporting System (DRS) IRS 1099-MISC Preparation & Reporting for DRS Users Calendar Year 2008 !!! IMPORTANT

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1099-MISC Preparation Reporting for DRS Users

Edit your IRS 1099-MISC Preparation Reporting for DRS Users form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1099-MISC Preparation Reporting for DRS Users form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1099-MISC Preparation Reporting for DRS Users online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 1099-MISC Preparation Reporting for DRS Users. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IRS 1099-MISC Preparation Reporting for DRS Users

How to fill out IRS 1099-MISC Preparation & Reporting for DRS Users

01

Gather all necessary information: Collect the names, addresses, and Tax Identification Numbers (TINs) of payees.

02

Determine the correct amounts: Identify the amounts paid to each payee during the tax year that need to be reported.

03

Choose the appropriate form: Ensure you have the correct IRS 1099-MISC form for reporting.

04

Complete the form: Fill in the payee's information, including their name, address, TIN, and the payment amounts in the correct boxes.

05

Provide copies to payees: After completing the form, send copies to each payee by the IRS deadline, typically January 31st.

06

Submit to the IRS: File the completed 1099-MISC forms with the IRS by the required deadline, usually by the end of February if submitted by paper, or March if filed electronically.

Who needs IRS 1099-MISC Preparation & Reporting for DRS Users?

01

Independent contractors and freelancers who provide services and receive payments.

02

Businesses that pay individuals or unincorporated entities for services rendered totaling $600 or more in a calendar year.

03

Partnerships and LLCs that report payments made to non-corporate entities for services.

04

Any entity that is required to report various payments made to vendors, businesses, and other service providers.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you don't File 1099-G on taxes?

IRS reporting Once the IRS thinks that you owe additional tax on your unreported 1099 income, it will usually notify you and retroactively charge you penalties and interest beginning on the first day they think that you owed additional tax.

What's the difference between a W-2 and a 1099-G?

Where 1099 forms differ from W-2 forms is in tax withholdings. Taxes are not usually withheld by the payer for 1099 forms. As a freelancer, you're responsible for estimating your taxes and paying the self-employment tax in addition to your income tax.

Is there a new 1099 form for 2022?

New federal forms in the 1099 series reporting miscellaneous information and nonemployee compensation are to be used starting in tax year 2022, not 2021, an Internal Revenue Service official said Jan.

What is the purpose of a 1099-G?

Form 1099-G is a report of income you received from the Department of Revenue during the calendar year. The Internal Revenue Service (IRS) requires government agencies to report to the IRS certain payments made during the year because those payments are considered gross income to the recipient.

Did 1099 forms change for 2022?

In January 2022, these 1099 forms were revised again. Recipients use Form 1099-NEC and Form 1099-MISC to file their federal and any applicable state tax returns. Form 1099-NEC doesn't entirely replace Form 1099-MISC for payers needing to report other miscellaneous types of payments besides nonemployee compensation.

What is the latest 1099 form?

The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used.

Why did I receive a 1099-G from the IRS?

Federal, state, or local governments file this form if they made payments of: Unemployment compensation. State or local income tax refunds, credits, or offsets. Reemployment trade adjustment assistance (RTAA) payments.

Is there a difference between 1099 and 1099-g?

Different types of payment are found in different boxes. One would get a 1099-G to report income received as unemployment or income from the state regarding a return usually, while a 1099-MISC is a way of paying income to a contractor.

Will a 1099-G affect my tax return?

Form 1099G reports the total taxable income we issue you in a calendar year, and is reported to the IRS. As taxable income, these payments must be reported on your federal tax return, but they are exempt from California state income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IRS 1099-MISC Preparation Reporting for DRS Users in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your IRS 1099-MISC Preparation Reporting for DRS Users in minutes.

Can I create an electronic signature for signing my IRS 1099-MISC Preparation Reporting for DRS Users in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IRS 1099-MISC Preparation Reporting for DRS Users directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out IRS 1099-MISC Preparation Reporting for DRS Users on an Android device?

Complete your IRS 1099-MISC Preparation Reporting for DRS Users and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is IRS 1099-MISC Preparation & Reporting for DRS Users?

IRS 1099-MISC Preparation & Reporting for DRS Users involves the process of preparing and filing the 1099-MISC form for users of the Department of Revenue Services (DRS), which is required to report various types of income other than wages.

Who is required to file IRS 1099-MISC Preparation & Reporting for DRS Users?

Any individual or business that has paid $600 or more to a non-employee, such as freelancers, independent contractors, or other service providers during a tax year is required to file IRS 1099-MISC.

How to fill out IRS 1099-MISC Preparation & Reporting for DRS Users?

To fill out IRS 1099-MISC, you will need to provide information such as the payee's name, address, taxpayer identification number (TIN), and the total amount paid in the appropriate boxes. Ensure that all sections are complete and accurate before submission.

What is the purpose of IRS 1099-MISC Preparation & Reporting for DRS Users?

The purpose of IRS 1099-MISC Preparation & Reporting is to ensure compliance with federal tax laws by reporting payments made to non-employees, which helps the IRS track income and prevent tax evasion.

What information must be reported on IRS 1099-MISC Preparation & Reporting for DRS Users?

The information that must be reported includes the recipient’s name, address, TIN, the total payments made to them during the year, and the type of payment categorized in the relevant boxes, such as rents, prizes, and awards.

Fill out your IRS 1099-MISC Preparation Reporting for DRS Users online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1099-MISC Preparation Reporting For DRS Users is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.