Get the free Indemnity agreement for surety bail bond sun surety insurance

Show details

INDEMNITY AGREEMENT FOR SURETY BAIL BOND

SUN SURETY INSURANCE COMPANY & ALLIANCE BAIL BONDS LLC.

THIS AGREEMENT made between the undersigned, ___ (hereinafter called Indemnity(s),

SUN SURETY INSURANCE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indemnity agreement for surety

Edit your indemnity agreement for surety form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indemnity agreement for surety form via URL. You can also download, print, or export forms to your preferred cloud storage service.

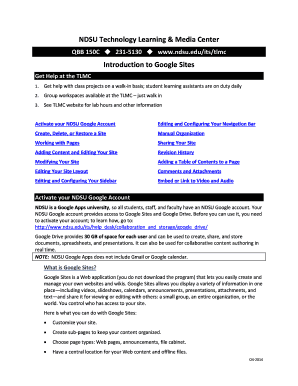

Editing indemnity agreement for surety online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit indemnity agreement for surety. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indemnity agreement for surety

How to fill out indemnity agreement for surety?

01

Begin by reviewing the indemnity agreement form provided by the surety company or legal expert. Ensure that you understand the terms and requirements outlined in the agreement.

02

Fill in the introductory section of the agreement, which typically includes the names and contact information of all parties involved. This includes the principal (the party seeking surety), the surety company, and the obligee (the party protected by the surety bond).

03

Specify the type of surety bond being issued by providing the bond number or other relevant identification details. This helps ensure that the agreement is linked to the correct bond and guarantees.

04

Clearly state the scope and purpose of the agreement. Describe the duties and obligations of the principal towards the surety company and the obligee. Make sure to include any specific terms or conditions outlined in the original bond agreement.

05

Outline the indemnification provision. This section typically involves the principal agreeing to indemnify and hold the surety company harmless from any claims, expenses, or losses incurred as a result of issuing the bond. Refer to the bond agreement to include any specific language required.

06

If required, provide collateral information. Some indemnity agreements require the principal to provide collateral as security for the surety company. Detail the nature and value of the collateral being pledged, ensuring accuracy and transparency.

07

Sign the indemnity agreement. All parties involved should sign and date the document to indicate their acceptance and understanding of the terms outlined. Consider obtaining notary or witness signatures, if needed, for added legal security.

Who needs indemnity agreement for surety?

01

Individuals or businesses seeking surety bonds to satisfy contractual or legal obligations may need an indemnity agreement for surety. This includes contractors, construction companies, and other professionals who require bonds as a condition of performing their work.

02

Surety companies also require indemnity agreements from their clients to protect themselves from potential losses or claims. These agreements establish the responsibilities and indemnification obligations of the principal party seeking the bond.

03

The obligee, typically the party protected by the surety bond, may also require the principal to provide an indemnity agreement. This ensures that the obligee is financially protected in case of default, non-performance, or other breaches of contract by the principal.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send indemnity agreement for surety for eSignature?

When you're ready to share your indemnity agreement for surety, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get indemnity agreement for surety?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the indemnity agreement for surety in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my indemnity agreement for surety in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your indemnity agreement for surety and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is indemnity agreement for surety?

An indemnity agreement for surety is a legal contract where one party agrees to be financially responsible for the debts or obligations of another party.

Who is required to file indemnity agreement for surety?

The party providing the surety bond is typically required to file the indemnity agreement for surety.

How to fill out indemnity agreement for surety?

To fill out an indemnity agreement for surety, the parties involved must provide their personal and financial information, as well as details about the surety bond.

What is the purpose of indemnity agreement for surety?

The purpose of an indemnity agreement for surety is to protect the surety from financial loss in case the bonded party fails to fulfill their obligations.

What information must be reported on indemnity agreement for surety?

The indemnity agreement for surety must include details about the bonded party, the surety bond, and the terms of the agreement.

Fill out your indemnity agreement for surety online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indemnity Agreement For Surety is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.