What is indemnity insurance definition?

Indemnity insurance, also known as liability insurance, is a type of insurance policy that protects individuals or businesses against financial losses or legal liabilities. It provides coverage for damages or losses that may occur due to unforeseen events or accidents. In simple terms, indemnity insurance is designed to offer peace of mind and financial protection in the event of unexpected expenses or legal claims.

What are the types of indemnity insurance definition?

There are several types of indemnity insurance that individuals or businesses can consider, depending on their specific needs. These types include:

Professional indemnity insurance: This type of insurance is tailored for professionals in various industries, such as lawyers, doctors, architects, and consultants. It provides protection against claims of professional negligence or errors and omissions.

Public liability insurance: Public liability insurance covers claims made by third parties, such as customers or members of the public, for injuries or damages that occur on the insured property or during the course of business activities.

Product liability insurance: Product liability insurance protects against claims or lawsuits arising from damages or injuries caused by products manufactured or sold by the insured.

Employer's liability insurance: This type of insurance is mandatory for employers and provides coverage for claims made by employees who have suffered workplace injuries or illnesses.

Directors and officers liability insurance: Directors and officers liability insurance protects the personal assets of directors and officers of a business in the event of legal claims alleging wrongful acts or decisions.

Cyber liability insurance: Cyber liability insurance helps businesses cope with the financial losses and legal liabilities associated with data breaches, cyber attacks, or other cyber-related incidents.

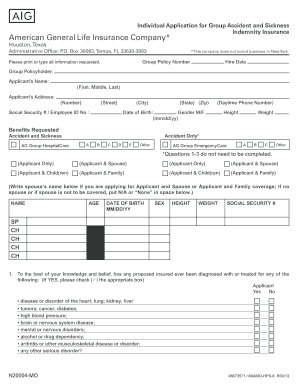

How to complete indemnity insurance definition

Completing an indemnity insurance definition requires careful consideration of specific requirements and goals. Here are the steps to complete the process:

01

Assess your needs: Determine the type and amount of coverage you require based on your industry, business activities, and potential risks.

02

Research insurance providers: Research and compare different insurance providers to find the one that offers the best coverage, pricing, and customer service.

03

Request quotes: Contact insurance providers and request quotes for the desired coverage. Compare the quotes to find the most suitable option.

04

Review policy terms: Carefully review the terms and conditions of the selected insurance policy, including coverage limits, exclusions, and deductibles.

05

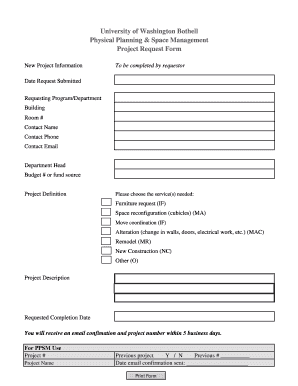

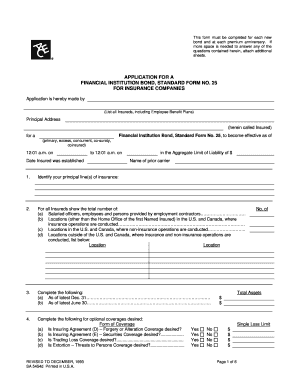

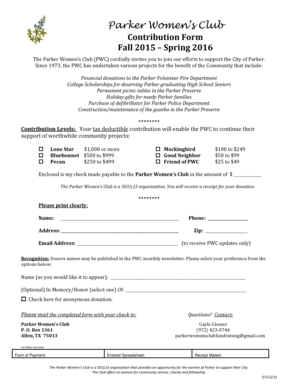

Complete application forms: Fill out the necessary application forms provided by the insurance company, providing accurate and detailed information.

06

Submit required documents: Submit any required documents, such as proof of business registration or licenses, to complete the application process.

07

Pay premiums: Once the application is approved, pay the required premiums to activate the insurance coverage.

08

Keep insurance documentation: Keep all documentation related to your indemnity insurance policy in a safe and easily accessible place.

09

Regularly review and update: Review your insurance coverage periodically to ensure it still meets your needs, and update it accordingly if necessary.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.