Indemnity Letter

What is an indemnity letter?

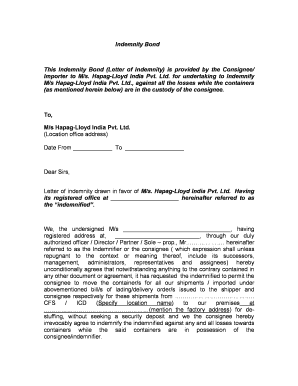

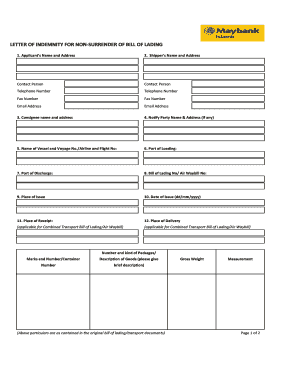

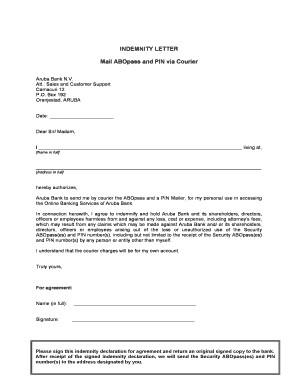

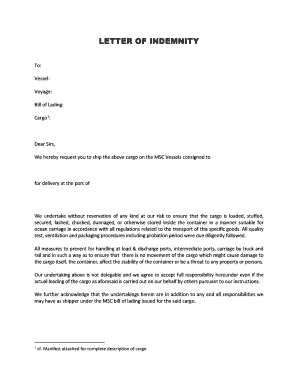

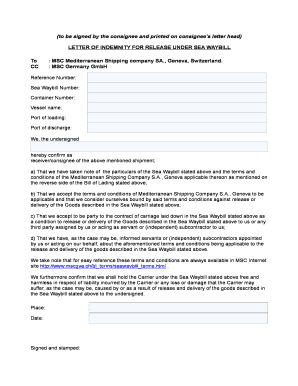

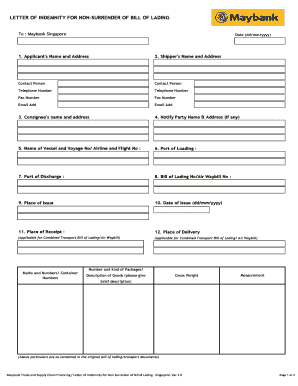

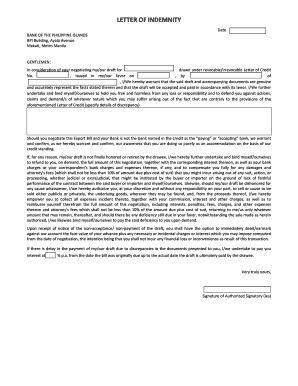

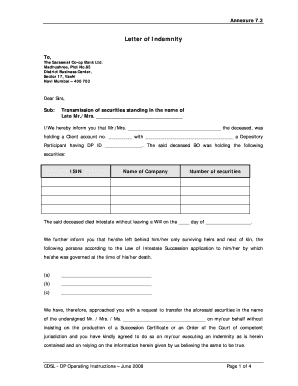

An indemnity letter is a legal document that provides protection against potential losses or damages by transferring responsibility from one party to another. It is commonly used in various situations to safeguard financial interests or minimize liability.

What are the types of indemnity letter?

There are several types of indemnity letters that serve different purposes. Some common types include:

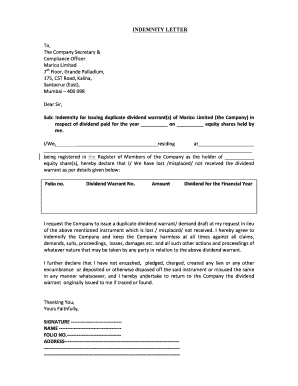

Indemnity letter for lost or stolen documents

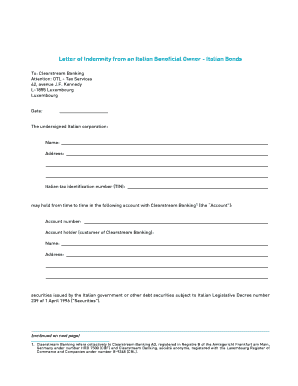

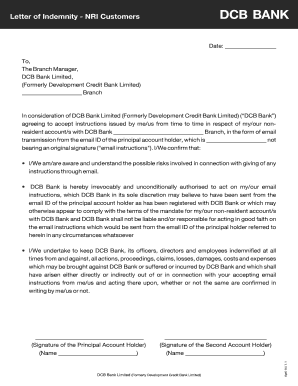

Indemnity letter for bank transactions

Indemnity letter for rental agreements

Indemnity letter for insurance claims

How to complete an indemnity letter

Completing an indemnity letter is a straightforward process. Here are the steps to follow:

01

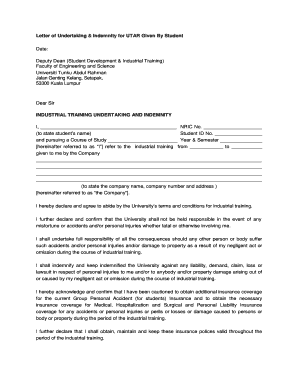

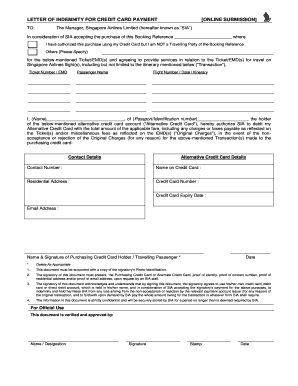

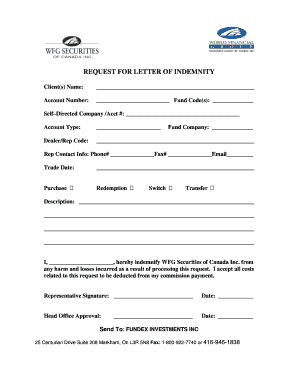

Start by stating the purpose of the indemnity letter. Clearly explain why it is being issued and what it seeks to protect against.

02

Provide detailed information about the parties involved, including their names, addresses, and contact details.

03

Include any relevant dates or time frames for which the indemnity will be valid.

04

Specify the scope and limitations of the indemnity, including any exclusions or exceptions.

05

Clearly outline the responsibilities and obligations of each party, including any conditions for triggering the indemnity.

06

Include any additional terms or conditions that may be necessary.

07

Ensure the indemnity letter is signed and dated by all parties involved.

08

Consider seeking legal advice or review if the indemnity letter involves complex legal matters.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out indemnity letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a Letter of indemnity?

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

What is an example of an indemnity?

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

What is Letter of Letter of indemnity?

A Letter of Indemnity (LOI) is a legally binding document that guarantees that certain conditions will be met in an agreement between two parties.

What is the rule of indemnity?

The rule of indemnity, or the indemnity principle, says that an insurance policy should not confer a benefit that is greater in value than the loss suffered by the insured. Indemnities and insurance both guard against financial losses and aim to restore a party to the financial status held before an event occurred.

How many types of indemnity are there?

There are basically 2 types of indemnity namely express indemnity and implied indemnity.

What are the methods of indemnity?

The indemnification method is one way to calculate the amount owed by one counterparty to another in the case of the early termination of a swap. The indemnification method requires the at-fault counterparty to compensate the responsible counterparty for all losses and damages caused by the early termination.

Related templates