Get the free Pro-Rata Rule for after-tax money in an IRA

Show details

Members SIPC non-bank affiliates of Wells Fargo Company. 2012 Wells Fargo Advisors 0712-1131 ECG-725815. Eligible rollover distributions from an employer-sponsored retirement plan balance can be directly rolled to a Roth IRA. The same pro-rata rule applies when calculating the taxes due on a Roth conversion. However the pro-rata rule does not apply to Roth IRA distributions. These conversions can be made through a direct rollover of or an amount can be distributed from the plan and rolled...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pro-rata rule for after-tax

Edit your pro-rata rule for after-tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pro-rata rule for after-tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pro-rata rule for after-tax online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pro-rata rule for after-tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pro-rata rule for after-tax

How to fill out pro-rata rule for after-tax

01

Start by gathering all the relevant financial documents and information related to your after-tax contributions, such as statements or records of contributions made.

02

Determine the total value of your after-tax contributions that you have made to the specific account, usually a retirement account.

03

Calculate the total value of all the contributions made to the account, including both pre-tax and after-tax contributions.

04

Divide the total value of your after-tax contributions by the total value of all contributions to get the pro-rata percentage.

05

Multiply the pro-rata percentage by the earnings or gains in the account to calculate the portion that is attributable to your after-tax contributions.

06

Report the pro-rata portion of earnings or gains on your tax return according to the applicable rules and guidelines.

07

Consult with a tax professional or financial advisor if you have any specific questions or concerns about filling out the pro-rata rule for after-tax contributions.

Who needs pro-rata rule for after-tax?

01

Individuals who have made after-tax contributions to their retirement accounts.

02

Individuals who want to ensure they are accurately reporting and accounting for their after-tax contributions and its impact on taxes.

03

Individuals with complex retirement account structures, such as multiple accounts or rollovers, where pro-rata calculations may be necessary.

04

Individuals who want to optimize their tax planning strategies and potentially take advantage of certain tax benefits or deductions related to after-tax contributions.

05

Individuals who want to be in compliance with tax laws and regulations regarding after-tax contributions and reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pro-rata rule for after-tax without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your pro-rata rule for after-tax into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out pro-rata rule for after-tax using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign pro-rata rule for after-tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit pro-rata rule for after-tax on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign pro-rata rule for after-tax right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

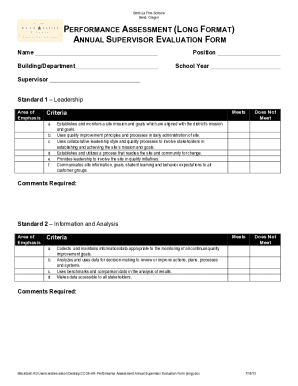

What is pro-rata rule for after-tax?

Pro-rata rule for after-tax ensures that distributions from a retirement account are made in proportion to the pre-tax and after-tax contributions.

Who is required to file pro-rata rule for after-tax?

Individuals with retirement accounts containing both pre-tax and after-tax contributions are required to file pro-rata rule for after-tax.

How to fill out pro-rata rule for after-tax?

To fill out pro-rata rule for after-tax, one must calculate the ratio of pre-tax and after-tax contributions and apply this ratio to each distribution.

What is the purpose of pro-rata rule for after-tax?

The purpose of pro-rata rule for after-tax is to ensure fair distribution of retirement funds and avoid tax consequences.

What information must be reported on pro-rata rule for after-tax?

The information that must be reported on pro-rata rule for after-tax includes the total value of the retirement account, the amount of pre-tax and after-tax contributions, and the distribution amounts.

Fill out your pro-rata rule for after-tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pro-Rata Rule For After-Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.