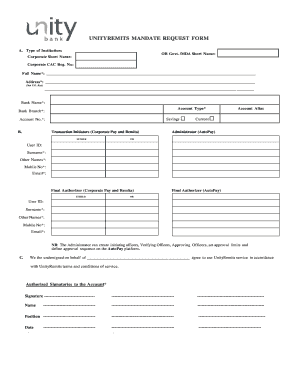

Get the free unity small finance bank rtgs form pdf download

Show details

D Verified By CSO Name. Signature Staff Id Stamp/Date Authorized By BSM Business Process Improvement Department. Type of Account Retail Corporate sole Signatory Token Type NUBAN Account Number Hardware Software Mobile Number Email Address User ID Token Delivery Alternative 1 Pick Up Delivery to Address It is your responsibility to keep your Internet Banking details safe and under your control. Do not reveal your Log On password it is your signature. Signature Date Day...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unity small finance bank neft form

Edit your unity small finance bank forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unity small finance bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unity small finance bank online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit unity small finance bank. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unity small finance bank

How to fill out unity small finance bank:

01

Visit the official website of Unity Small Finance Bank.

02

Look for the "Account Opening" or "Apply Now" option on the homepage.

03

Click on it and select the type of account you want to open (e.g., savings account, current account, etc.)

04

Fill in all the required personal details such as your name, address, contact information, etc.

05

Provide the necessary documents like your identity proof, address proof, and photograph.

06

Review all the information entered to ensure accuracy.

07

Submit the application online or download the form and mail it to the designated address.

Who needs unity small finance bank:

01

Individuals who are looking for a reliable banking institution to manage their finances.

02

Small business owners who need banking services to support their business operations.

03

People who prefer a bank that offers personalized customer service and a wide range of banking products.

04

Individuals who want to open a savings account or fixed deposit account to save and grow their money.

05

Students who need a student banking account for their financial needs.

06

Individuals who want to take advantage of the bank's investment and wealth management services.

07

Customers who want to avail loans or credit facilities for various purposes like education, business, or personal needs.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unity small finance bank?

Unity Small Finance Bank is a small finance bank incorporated in India in 2018. It provides banking and financial services to retail, business and institutional customers. The bank offers savings accounts, current accounts, loan products, debit and credit cards, digital banking, mutual funds, insurance, and more. Unity Small Finance Bank has a network of over 300 branches and 2,000 ATMs across India.

Who is required to file unity small finance bank?

A unity small finance bank must be registered with the Reserve Bank of India (RBI) as a Non-Banking Financial Company (NBFC). The registration process requires applicants to submit an application and supporting documents, including financial statements, to the RBI.

How to fill out unity small finance bank?

1. Visit the official website of Unity Small Finance Bank and click on the ‘Apply Now’ button.

2. Select the type of account that you wish to open (savings, current, or fixed deposit).

3. Enter your personal details like name, address, contact number, etc.

4. Provide documents for identity and address proof.

5. Enter your bank account details like account number, IFSC code, etc.

6. Enter the amount that you wish to deposit.

7. Enter the bank’s account number where you wish to transfer the amount from.

8. Upload the documents that are required for the account opening.

9. Review and submit the application form.

10. You will receive a confirmation email or SMS on your registered email or mobile number.

What is the purpose of unity small finance bank?

The purpose of Unity Small Finance Bank is to provide comprehensive banking and financial services specifically tailored for the needs of the unbanked and underbanked population, including small enterprises, micro-entrepreneurs, low-income individuals, and rural communities. The bank aims to promote financial inclusion by offering affordable and accessible banking products and services, such as savings accounts, loans, insurance, remittance services, and more. Unity Small Finance Bank's purpose is to empower individuals and businesses with the tools and resources they need to enhance their financial well-being and contribute to the country's economic development.

What information must be reported on unity small finance bank?

The information that must be reported on Unity Small Finance Bank may vary depending on the specific regulatory requirements of the jurisdiction in which the bank operates. However, generally, the following information may be required:

1. Financial Statements: The bank must report its financial statements, which include the balance sheet, income statement, cash flow statement, and statement of changes in equity. These statements provide an overview of the bank's financial performance and position.

2. Regulatory Compliance: The bank needs to report its compliance with various regulatory requirements, such as capital adequacy ratios, liquidity ratios, and operational guidelines set by the regulatory authorities. This ensures that the bank is operating within the legal framework and maintains the necessary financial stability.

3. Risk Management: The bank must report its risk management practices, including the identification, assessment, and mitigation of various risks like credit risk, market risk, liquidity risk, and operational risk. This helps assess the bank's ability to manage and mitigate potential risks.

4. Disclosures: The bank needs to make various disclosures to ensure transparency and accountability. This may include information about related party transactions, contingent liabilities, loan portfolios, investment portfolios, and other significant financial and non-financial information.

5. Corporate Governance: The bank must report its corporate governance practices, including the composition of the board of directors, committees, executive compensation, and adherence to the corporate governance code or regulations applicable to the bank.

6. Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: The bank needs to report its adherence to AML and KYC regulations to prevent money laundering and terrorist financing activities. This involves reporting customer due diligence processes, suspicious transaction reporting, and other AML/KYC measures implemented by the bank.

7. Audited Financial Statements: Unity Small Finance Bank is required to have its financial statements audited by external auditors. The auditors will provide an independent opinion on the fairness of the financial statements and compliance with accounting principles.

It's important to note that specific reporting requirements may vary from jurisdiction to jurisdiction and can be subject to changes in regulatory frameworks. Therefore, it is always advised to refer to the relevant regulatory authorities for the accurate and up-to-date reporting requirements for Unity Small Finance Bank.

How do I edit unity small finance bank on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share unity small finance bank from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out unity small finance bank on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your unity small finance bank. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit unity small finance bank on an Android device?

You can edit, sign, and distribute unity small finance bank on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your unity small finance bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unity Small Finance Bank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.