NY NYLIAC 21575 2013 free printable template

Show details

Next Print... NEW YORK LIFE INSURANCE AND ANNUITY CORPORATION (SYRIAC) (A Delay are Corporation) PARTIAL WITHDRAWAL/ PERIODIC PARTIAL WITHDRAWAL REQUEST FORM SYRIAC Single Premium Variable Universal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYLIAC 21575

Edit your NY NYLIAC 21575 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYLIAC 21575 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY NYLIAC 21575 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY NYLIAC 21575. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYLIAC 21575 Form Versions

Version

Form Popularity

Fillable & printabley

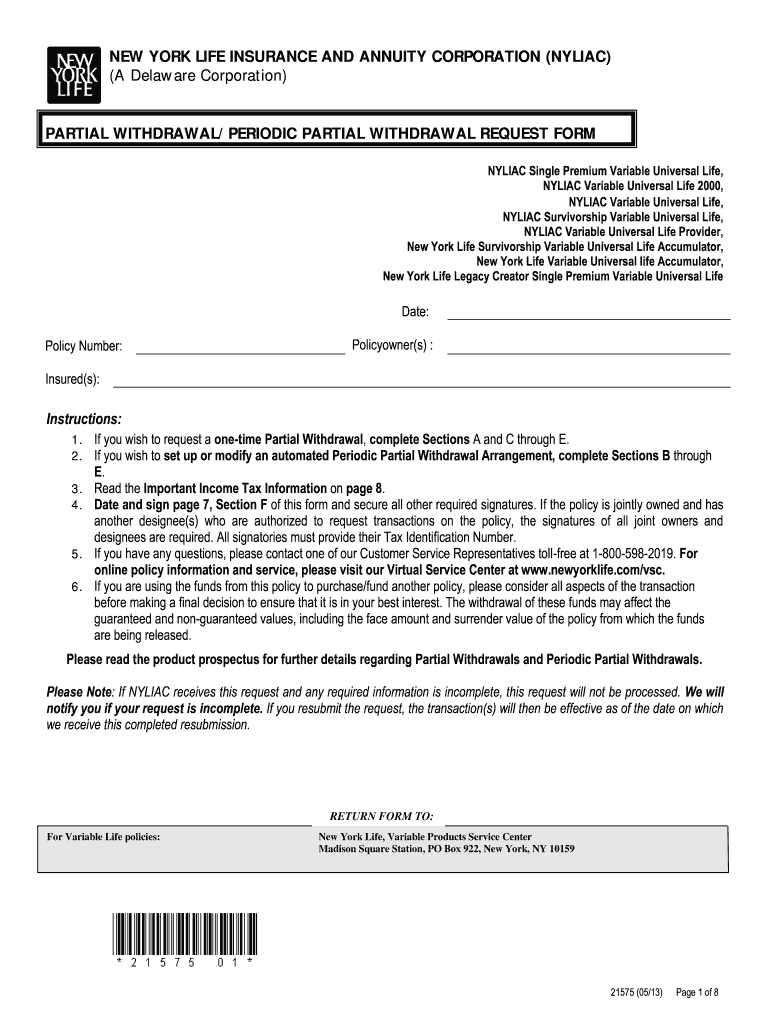

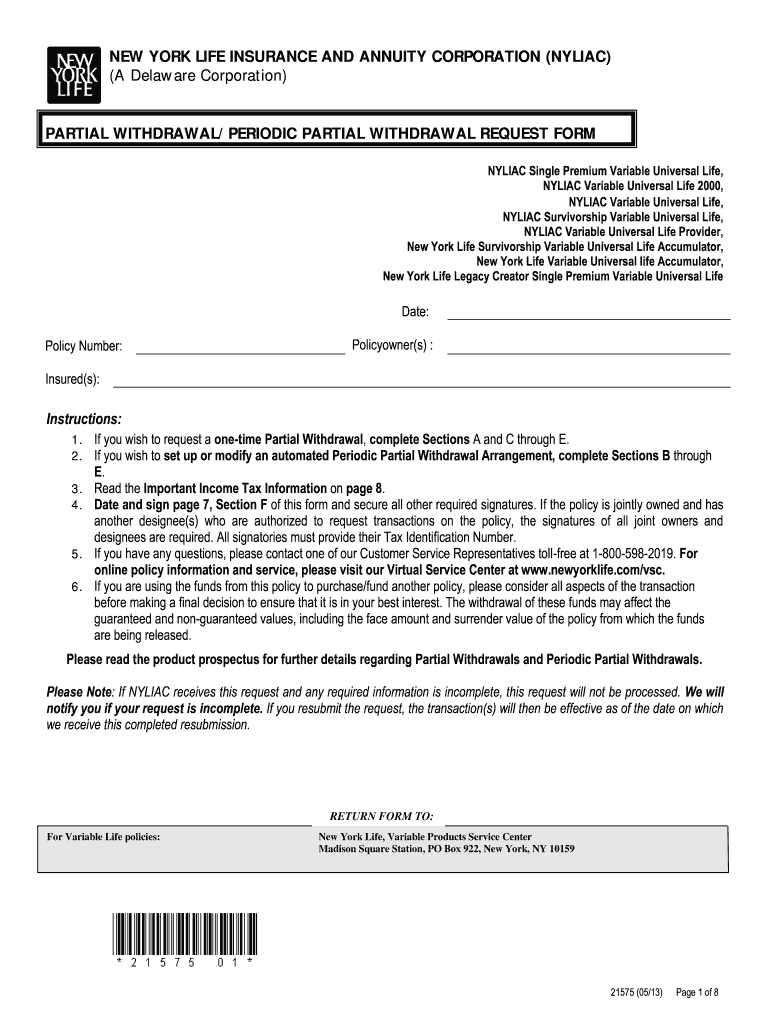

How to fill out NY NYLIAC 21575

How to fill out NY NYLIAC 21575

01

Obtain the NY NYLIAC 21575 form from the official website or your insurance agent.

02

Fill in your personal information at the top of the form, including your name, address, and policy number.

03

Carefully read the instructions provided with the form to ensure you understand the requirements.

04

Complete each section of the form as required, providing accurate and truthful answers.

05

If there are any optional sections, decide whether to complete them based on your situation.

06

Review the completed form to ensure all information is filled out correctly and completely.

07

Sign and date the form at the designated area to certify that the information is accurate.

08

Submit the form to the appropriate NYLIAC department, following the provided submission guidelines.

Who needs NY NYLIAC 21575?

01

Individuals who are policyholders with NYLIAC and need to make changes or updates to their insurance policy.

02

New clients applying for coverage under NYLIAC who require information and documentation for their application.

03

Beneficiaries of existing policies who need to declare claims or updates.

04

Anyone looking to understand their coverage options and responsibilities under their current insurance policy.

Instructions and Help about NY NYLIAC 21575

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for New York Life to pay you?

A: Once your claim is approved, we process payments immediately. It takes about seven days for direct deposits to show up in your bank account or 7 – 10 business days to receive a check in the mail.

Can I borrow from my New York Life Insurance?

You can choose from either a traditional or a IRA.

Does New York Life Insurance still exist?

Find the right life insurance policy for your needs. Learn which type of life insurance is right for you. New York Life is here to protect your family, now and in the future.

How do I contact NY Life?

1-800-225-5695 If you have specific questions about your policy, claim, or application-our customer service experts are happy to help.

What is the phone number for New York Life Insurance?

One of the many benefits of being a New York Life Whole Life policy owner is the loan feature, which is a guaranteed option. You can borrow up to the maximum loan value from your policy's cash value, generally on a tax-free basis. You are entitled to access this feature without any applications or credit approval.

What is partial withdrawal in insurance?

You can partially withdraw money from unit-linked life insurance policies, but this will automatically decrease the sum assured for two years from the date of withdrawal. The sum assured is restored to the original level after two years provided no further partial withdrawal is made during those two years.

Is NY life a reputable company?

Over the company's 177 year history, New York Life has established itself as a reputable life insurance provider, with a top-notch financial stability rating from AM Best and solid indicators of customer satisfaction from other third-party sources.

How does partial withdrawal work?

The part of the premium that gets invested, gets divided into units, each with a specified value. In case of any emergencies, ULIPs allow you to redeem some of those units and withdraw money equivalent to those units.

How do I cancel my subscription to NY Life?

If you need to cancel your New York Life Insurance Policy, you can do so by contacting customer service at 800-225-5695.

Does New York Life pay out?

Declaring a dividend for the 169th consecutive year underscores the company's commitment to financial strength, mutuality, and delivering ongoing value to policy owners. New York Life has paid in excess of $1 billion in dividends every year since 1990 and more than $46 billion in total dividend payouts over that time.

What is partial withdrawal in life insurance policy?

You can partially withdraw money from unit-linked life insurance policies, but this will automatically decrease the sum assured for two years from the date of withdrawal.

How do I claim my New York life insurance policy?

Call (800) CALL-NYL and say the word “Claims” at any time. Our service team is available 8:00am to 7:00pm ET, Monday through Friday. When you call, please have the following information available: Deceased Insured/Annuitant's Name.

Can I borrow from my New York Life insurance?

One of the many benefits of being a New York Life Whole Life policy owner is the loan feature, which is a guaranteed option. You can borrow up to the maximum loan value from your policy's cash value, generally on a tax-free basis. You are entitled to access this feature without any applications or credit approval.

How do I pull money out of my life insurance?

There are three main ways to get cash out of your policy. You can borrow against your cash account typically with a low-interest life insurance loan, withdraw the cash (either as a lump sum or in regular payments), or you can surrender your policy.

Can I withdraw money from my New York life insurance policy?

If your death benefit needs change, you can take a loan or withdraw a portion of the cash value to supplement various financial needs such as helping pay college tuition7. You can borrow or withdraw money from your cash value whenever you like.

Is partial withdrawal allowed in LIC?

After the completion of the lock-in period, you can make partial withdrawals. However, this flexibility that ULIPs offer comes with a few terms and conditions. Typically, there is no fixed limit on the amount which you can withdraw from your active ULIP policy.

How to withdraw money from New York Life Insurance policy?

You can receive your cash value on an annual or monthly basis through an automatic deposit into your bank account or in the form of a check. Loans or surrenders will reduce the cash value and death benefit.

How do I contact NY life insurance?

1-800-225-5695 If you have specific questions about your policy, claim, or application-our customer service experts are happy to help.

How do I claim my New York Life Insurance?

Call (800) CALL-NYL and say the word “Claims” at any time. Our service team is available 8:00am to 7:00pm ET, Monday through Friday. When you call, please have the following information available: Deceased Insured/Annuitant's Name.

What means partial withdrawal?

Partial Withdrawal means any part of the Fund withdrawn by the policyholder during the period of contract. Sample 1Sample 2Sample 3. Partial Withdrawal means any part of fund that is encashed / withdrawn by the Policyholder during the term of policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY NYLIAC 21575 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including NY NYLIAC 21575, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the NY NYLIAC 21575 in Gmail?

Create your eSignature using pdfFiller and then eSign your NY NYLIAC 21575 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out NY NYLIAC 21575 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NY NYLIAC 21575 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NY NYLIAC 21575?

NY NYLIAC 21575 is a form used for filing certain information related to New York Life Insurance Company, specifically regarding life insurance activities and related taxes.

Who is required to file NY NYLIAC 21575?

Entities and individuals who engage in business activities related to life insurance in New York are required to file NY NYLIAC 21575.

How to fill out NY NYLIAC 21575?

To fill out NY NYLIAC 21575, you need to complete the required sections of the form, including personal and business information, financial data, and any other relevant details as specified in the form instructions.

What is the purpose of NY NYLIAC 21575?

The purpose of NY NYLIAC 21575 is to collect data and ensure compliance with New York state regulations pertaining to life insurance activities.

What information must be reported on NY NYLIAC 21575?

The information that must be reported on NY NYLIAC 21575 includes policyholder details, premium amounts, claims paid, and any other pertinent financial information related to life insurance operations.

Fill out your NY NYLIAC 21575 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYLIAC 21575 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.