NY NYLIAC 21575 2016 free printable template

Show details

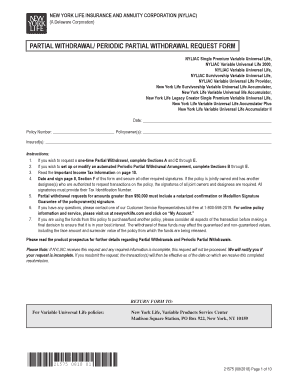

Print Next NEW YORK LIFE INSURANCE AND ANNUITY CORPORATION (SYRIAC) (A Delaware Corporation) PARTIAL WITHDRAWAL/ PERIODIC PARTIAL WITHDRAWAL REQUEST FORM SYRIAC Single Premium Variable Universal Life,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYLIAC 21575

Edit your NY NYLIAC 21575 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYLIAC 21575 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYLIAC 21575 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY NYLIAC 21575. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYLIAC 21575 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYLIAC 21575

How to fill out NY NYLIAC 21575

01

Obtain the NY NYLIAC 21575 form from the official NYLIAC website or your insurance representative.

02

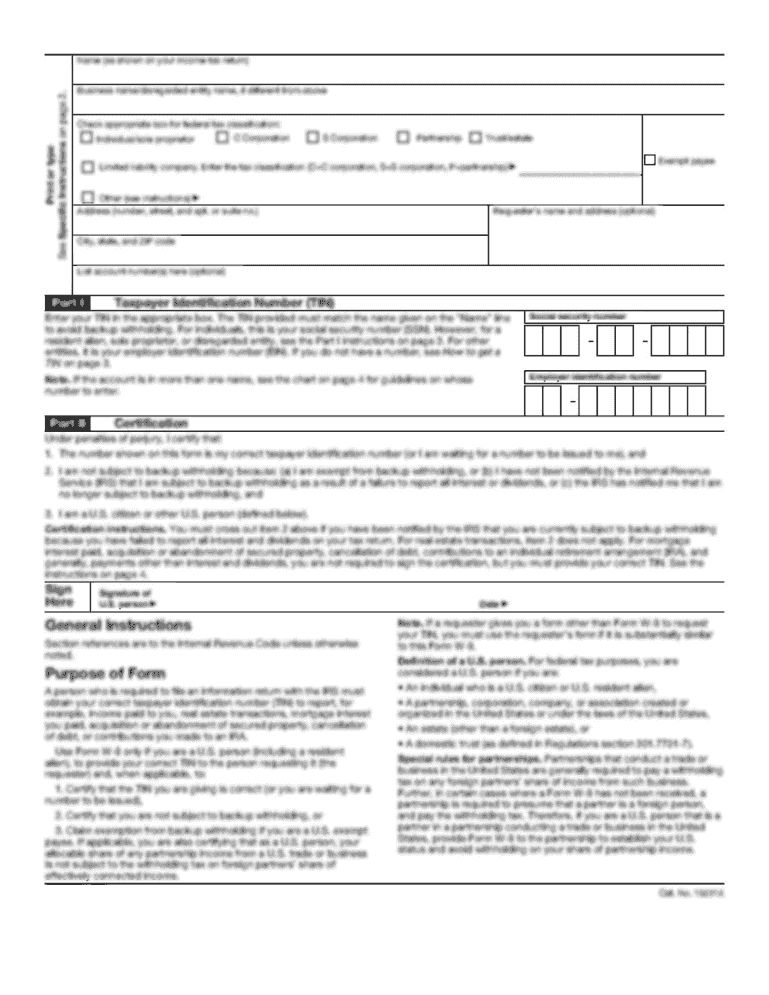

Fill in the policyholder's personal information, including name, address, and contact details.

03

Provide details about the insurance coverage being requested, such as type of policy and coverage amounts.

04

Include any necessary medical history or background information as required by the form.

05

Sign and date the form at the designated area.

06

Submit the completed form to the appropriate NYLIAC office or agent.

Who needs NY NYLIAC 21575?

01

Individuals seeking life insurance or annuity products through NYLIAC.

02

Policyholders wanting to update their existing coverage or make changes to their policy.

03

Financial advisors or agents assisting clients with policy applications.

Instructions and Help about NY NYLIAC 21575

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for New York Life to pay you?

A: Once your claim is approved, we process payments immediately. It takes about seven days for direct deposits to show up in your bank account or 7 – 10 business days to receive a check in the mail.

Can I borrow from my New York Life Insurance?

You can choose from either a traditional or a IRA.

Does New York Life Insurance still exist?

Find the right life insurance policy for your needs. Learn which type of life insurance is right for you. New York Life is here to protect your family, now and in the future.

How do I contact NY Life?

1-800-225-5695 If you have specific questions about your policy, claim, or application-our customer service experts are happy to help.

What is the phone number for New York Life Insurance?

One of the many benefits of being a New York Life Whole Life policy owner is the loan feature, which is a guaranteed option. You can borrow up to the maximum loan value from your policy's cash value, generally on a tax-free basis. You are entitled to access this feature without any applications or credit approval.

What is partial withdrawal in insurance?

You can partially withdraw money from unit-linked life insurance policies, but this will automatically decrease the sum assured for two years from the date of withdrawal. The sum assured is restored to the original level after two years provided no further partial withdrawal is made during those two years.

Is NY life a reputable company?

Over the company's 177 year history, New York Life has established itself as a reputable life insurance provider, with a top-notch financial stability rating from AM Best and solid indicators of customer satisfaction from other third-party sources.

How does partial withdrawal work?

The part of the premium that gets invested, gets divided into units, each with a specified value. In case of any emergencies, ULIPs allow you to redeem some of those units and withdraw money equivalent to those units.

How do I cancel my subscription to NY Life?

If you need to cancel your New York Life Insurance Policy, you can do so by contacting customer service at 800-225-5695.

Does New York Life pay out?

Declaring a dividend for the 169th consecutive year underscores the company's commitment to financial strength, mutuality, and delivering ongoing value to policy owners. New York Life has paid in excess of $1 billion in dividends every year since 1990 and more than $46 billion in total dividend payouts over that time.

What is partial withdrawal in life insurance policy?

You can partially withdraw money from unit-linked life insurance policies, but this will automatically decrease the sum assured for two years from the date of withdrawal.

How do I claim my New York life insurance policy?

Call (800) CALL-NYL and say the word “Claims” at any time. Our service team is available 8:00am to 7:00pm ET, Monday through Friday. When you call, please have the following information available: Deceased Insured/Annuitant's Name.

Can I borrow from my New York Life insurance?

One of the many benefits of being a New York Life Whole Life policy owner is the loan feature, which is a guaranteed option. You can borrow up to the maximum loan value from your policy's cash value, generally on a tax-free basis. You are entitled to access this feature without any applications or credit approval.

How do I pull money out of my life insurance?

There are three main ways to get cash out of your policy. You can borrow against your cash account typically with a low-interest life insurance loan, withdraw the cash (either as a lump sum or in regular payments), or you can surrender your policy.

Can I withdraw money from my New York life insurance policy?

If your death benefit needs change, you can take a loan or withdraw a portion of the cash value to supplement various financial needs such as helping pay college tuition7. You can borrow or withdraw money from your cash value whenever you like.

Is partial withdrawal allowed in LIC?

After the completion of the lock-in period, you can make partial withdrawals. However, this flexibility that ULIPs offer comes with a few terms and conditions. Typically, there is no fixed limit on the amount which you can withdraw from your active ULIP policy.

How to withdraw money from New York Life Insurance policy?

You can receive your cash value on an annual or monthly basis through an automatic deposit into your bank account or in the form of a check. Loans or surrenders will reduce the cash value and death benefit.

How do I contact NY life insurance?

1-800-225-5695 If you have specific questions about your policy, claim, or application-our customer service experts are happy to help.

How do I claim my New York Life Insurance?

Call (800) CALL-NYL and say the word “Claims” at any time. Our service team is available 8:00am to 7:00pm ET, Monday through Friday. When you call, please have the following information available: Deceased Insured/Annuitant's Name.

What means partial withdrawal?

Partial Withdrawal means any part of the Fund withdrawn by the policyholder during the period of contract. Sample 1Sample 2Sample 3. Partial Withdrawal means any part of fund that is encashed / withdrawn by the Policyholder during the term of policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY NYLIAC 21575 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign NY NYLIAC 21575 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute NY NYLIAC 21575 online?

pdfFiller has made filling out and eSigning NY NYLIAC 21575 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out the NY NYLIAC 21575 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign NY NYLIAC 21575. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is NY NYLIAC 21575?

NY NYLIAC 21575 is a form used by New York Life Insurance and Annuity Corporation for reporting certain financial information related to insurance policies and annuities.

Who is required to file NY NYLIAC 21575?

Individuals or entities that hold or manage insurance policies and annuities issued by New York Life Insurance and Annuity Corporation are typically required to file this form.

How to fill out NY NYLIAC 21575?

To fill out NY NYLIAC 21575, first gather necessary documentation regarding the insurance policies or annuities. Follow the instructions on the form to enter policyholder information, policy details, and any financial figures as required.

What is the purpose of NY NYLIAC 21575?

The purpose of NY NYLIAC 21575 is to ensure compliance with state regulations by providing a standardized report of financial information related to insurance and annuity products.

What information must be reported on NY NYLIAC 21575?

Information that must be reported on NY NYLIAC 21575 typically includes policyholder details, policy numbers, types of policies, coverage amounts, and any applicable financial transactions related to the policies.

Fill out your NY NYLIAC 21575 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYLIAC 21575 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.