FL RTS-6 2013-2025 free printable template

Show details

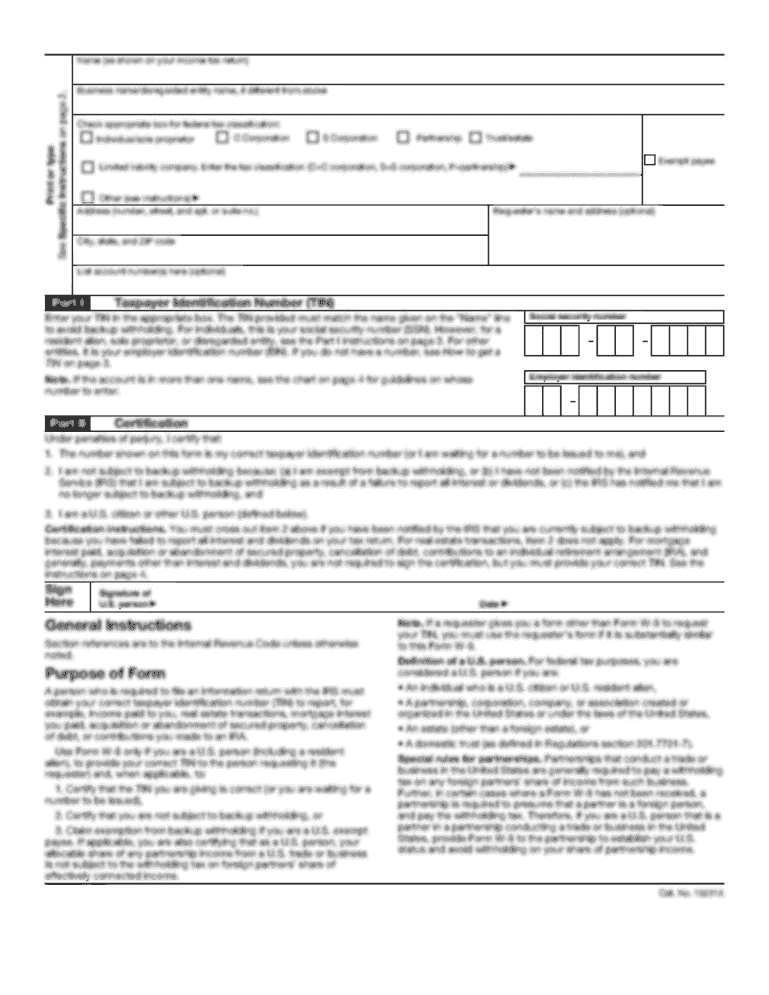

All copies should be sent to the state of Florida Department of Revenue P. O. Box 6510 Tallahassee FL 32314-6510. SSNs obtained for tax administration purposes are confidential under sections 213. 053 and 119. 071 Florida Statutes and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at www. floridarevenue. Floridarevenue. com Page 2 ELECTION continued 8. This election if approved shall remain operative as to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL RTS-6

Edit your FL RTS-6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL RTS-6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL RTS-6 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL RTS-6. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out FL RTS-6

How to fill out FL RTS-6

01

Step 1: Obtain a copy of the FL RTS-6 form from the appropriate state agency website.

02

Step 2: Fill in your personal information, including name, address, and contact details at the top of the form.

03

Step 3: Provide the required financial information as directed in the sections of the form, ensuring accuracy.

04

Step 4: Include any necessary supporting documentation that may be requested.

05

Step 5: Review the completed form for any errors or omissions.

06

Step 6: Sign and date the form at the designated area.

07

Step 7: Submit the form by the deadline, either in person or through the prescribed submission method.

Who needs FL RTS-6?

01

Anyone who needs to report or reconcile certain financial information as required by Florida state regulations.

02

Individuals or businesses eligible for certain tax exemptions or adjustments that require them to submit this form.

03

Accountants or tax professionals assisting clients who have tax obligations in Florida.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit FL RTS-6 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your FL RTS-6 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get FL RTS-6?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific FL RTS-6 and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the FL RTS-6 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your FL RTS-6.

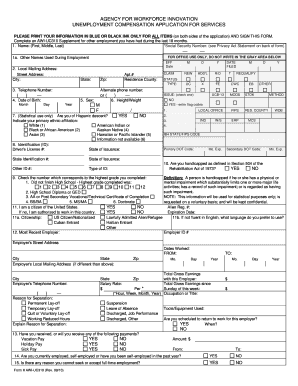

What is FL RTS-6?

FL RTS-6 is a form used by employers in Florida to report and remit reemployment tax to the Florida Department of Revenue.

Who is required to file FL RTS-6?

Employers in Florida who have payroll and are subject to reemployment tax are required to file FL RTS-6.

How to fill out FL RTS-6?

To fill out FL RTS-6, employers need to provide their business information, total wages paid to employees, the amount of reemployment tax owed, and any credits or adjustments.

What is the purpose of FL RTS-6?

The purpose of FL RTS-6 is to ensure that employers report and account for the reemployment tax due, which funds unemployment benefits for those who are unemployed in Florida.

What information must be reported on FL RTS-6?

FL RTS-6 requires employers to report total taxable wages, the number of employees, the amount of reemployment tax due, and any necessary adjustments or credits.

Fill out your FL RTS-6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL RTS-6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.