IRS W-8BEN 2017 free printable template

Show details

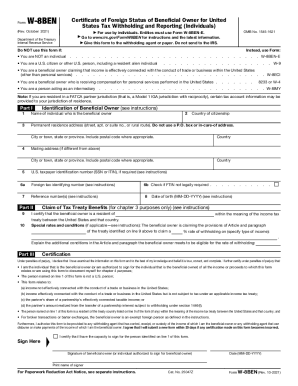

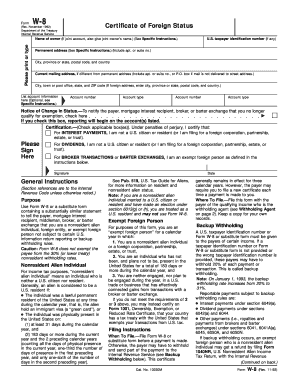

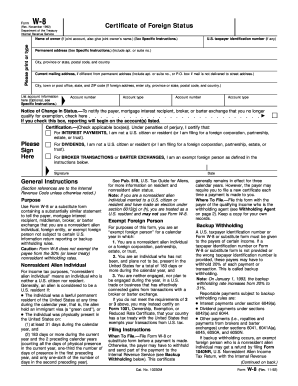

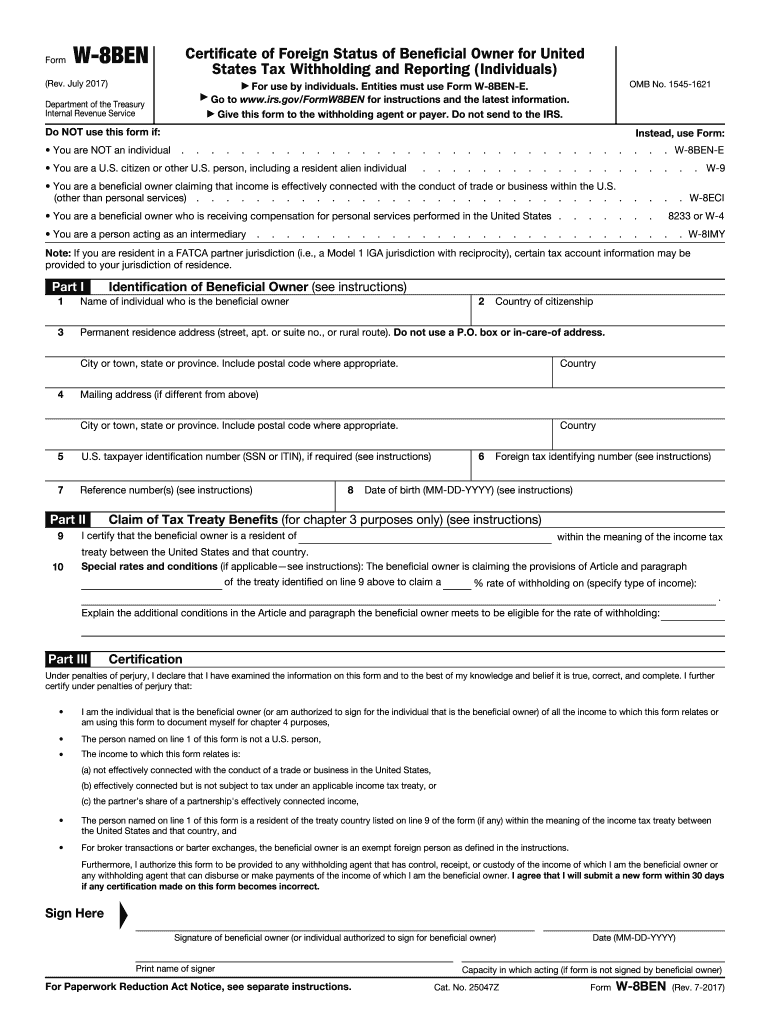

Entities must use Form W-8BEN-E. Go to www.irs.gov/FormW8BEN for instructions and the latest information. Give this form to the withholding agent or payer. W-8BEN-E You are a beneficial owner claiming that income is effectively connected with the conduct of trade or business within the U.S. other than personal services. Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Rev. July 2017 OMB No. 1545-1621 For use by...individuals. Do not send to the IRS* Department of the Treasury Internal Revenue Service Do NOT use this form if You are NOT an individual Instead use Form. W-8ECI You are a U*S* citizen or other U*S* person including a resident alien individual You are a person acting as an intermediary. W-9 8233 or W-4. W-8IMY Note If you are resident in a FATCA partner jurisdiction i*e* a Model 1 IGA jurisdiction with reciprocity certain tax account information may be provided to your jurisdiction of...residence. Part I Identification of Beneficial Owner see instructions Name of individual who is the beneficial owner Permanent residence address street apt. or suite no. or rural route. Do not use a P. O. box or in-care-of address. Country of citizenship City or town state or province. Include postal code where appropriate. Country Mailing address if different from above U*S* taxpayer identification number SSN or ITIN if required see instructions Reference number s see instructions Foreign tax...identifying number see instructions Date of birth MM-DD-YYYY see instructions Claim of Tax Treaty Benefits for chapter 3 purposes only see instructions I certify that the beneficial owner is a resident of within the meaning of the income tax treaty between the United States and that country. Special rates and conditions if applicable see instructions The beneficial owner is claiming the provisions of Article and paragraph of the treaty identified on line 9 above to claim a rate of withholding on...specify type of income Explain the additional conditions in the Article and paragraph the beneficial owner meets to be eligible for the rate of withholding Certification Under penalties of perjury I declare that I have examined the information on this form and to the best of my knowledge and belief it is true correct and complete. I further certify under penalties of perjury that I am the individual that is the beneficial owner or am authorized to sign for the individual that is the beneficial...owner of all the income to which this form relates or am using this form to document myself for chapter 4 purposes The person named on line 1 of this form is not a U*S* person The income to which this form relates is a not effectively connected with the conduct of a trade or business in the United States b effectively connected but is not subject to tax under an applicable income tax treaty or c the partner s share of a partnership s effectively connected income the United States and that...country and For broker transactions or barter exchanges the beneficial owner is an exempt foreign person as defined in the instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

How to fill out IRS W-8BEN

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

To edit the IRS W-8BEN tax form, you can use a reliable tool such as pdfFiller. This platform allows users to upload the PDF version of the form, make necessary changes, and save the edited document. It is essential to ensure that any modifications adhere to IRS guidelines to maintain compliance.

How to fill out IRS W-8BEN

Filling out the IRS W-8BEN form requires careful attention. Follow these steps to complete it:

01

Download the IRS W-8BEN form from the IRS website or use pdfFiller to access a fillable version.

02

Provide your name and country of citizenship in the first section.

03

Input your permanent residence address in the appropriate field.

04

Specify your U.S. Taxpayer Identification Number (TIN), if applicable.

05

Sign and date the form to validate it.

Check for accuracy before submission to prevent delays in processing.

About IRS W-8BEN 2017 previous version

What is IRS W-8BEN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-8BEN 2017 previous version

What is IRS W-8BEN?

The IRS W-8BEN is a tax form used by foreign individuals and entities to certify their foreign status. This form provides information about the individual's identity and residency status, which is necessary for tax withholding purposes in the United States.

What is the purpose of this form?

The purpose of the IRS W-8BEN tax form is to help foreign individuals claim a reduced withholding tax rate on certain payments they receive from U.S. sources. By certifying their foreign status, individuals can avoid being taxed at the higher rates applied to U.S. residents.

Who needs the form?

Foreign individuals and entities receiving income from U.S. sources, such as dividends, interest, or royalties, need to fill out the IRS W-8BEN form. This includes non-U.S. citizens who may not live in the U.S. but have financial dealings that involve U.S. taxation.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS W-8BEN form if you are a U.S. citizen or resident alien, or if you are receiving payments that are not subject to withholding under U.S. tax law. Additionally, certain tax-exempt entities may also be exempt, based on IRS guidelines.

Components of the form

The IRS W-8BEN form consists of several key components, including sections for personal information, certification of foreign status, and claim for tax treaty benefits, if applicable. Each section is designed to gather specific information required for tax compliance and to determine applicable withholding rates.

What are the penalties for not issuing the form?

Failure to issue the IRS W-8BEN form can result in penalties, including higher withholding tax rates on payments received. The IRS may impose a backup withholding rate of 24% on U.S. source income if the form is not submitted, affecting the overall income received by the foreign individual or entity.

What information do you need when you file the form?

When filing the IRS W-8BEN form, you will need the following information:

01

Your full name and country of citizenship.

02

Your permanent residence address.

03

Your U.S. Taxpayer Identification Number (if applicable).

04

Your foreign Tax Identification Number, if available.

05

Your signature and date to validate the form.

Is the form accompanied by other forms?

The IRS W-8BEN form is typically not submitted alongside other forms unless required by specific situations. However, it may be accompanied by a Form W-8BEN-E for entities or other related documentation to support claims for tax treaty benefits or exemptions.

Where do I send the form?

The IRS W-8BEN form is not submitted directly to the IRS. Instead, it should be provided to the U.S. withholding agent or financial institution that requests it. This could be a bank, broker, or any entity processing payments to you that are subject to U.S. tax withholding.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am really new at trying this out. The fax feature sounds like it would be very useful to me. I am very interested in learning about all the features offered through this service.

Just what I needed to fill out promptly and neatly PDF applications and forms.

See what our users say