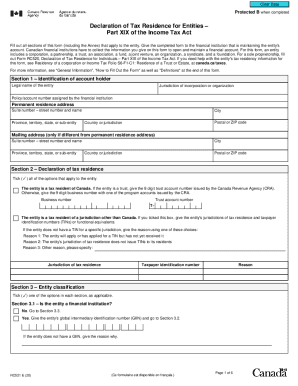

RC521 2017 free printable template

Show details

Refer to Info Source at cra.gc.ca/gncy/tp/nfsrc/nfsrc-eng. html Personal Information Bank CRA PPU 047. 2 Does the financial institution meet all of these criteria It is a resident of a non-participating jurisdiction see cra.gc.ca/tx/bsnss/tpcs/slps/fnncl/crs/jrsdctns-eng. If you need help with your tax residency information for this form see Residency of a corporation at cra.gc.ca/tx/nnrsdnts/bsnss/bs-rs-eng. For more details about acceptable TINs go to oecd....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign RC521

Edit your RC521 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RC521 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RC521 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit RC521. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RC521 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RC521

How to fill out RC521

01

Gather all relevant personal information, including your name, address, and identification details.

02

Access the RC521 form from the designated source, such as the official website or office.

03

Carefully read the instructions provided with the form to understand what information is required.

04

Begin filling out the form by entering your personal information in the appropriate fields.

05

Provide any necessary financial or income details as specified in the form.

06

Review your entries for accuracy and completeness before submitting.

07

Sign and date the form where required.

08

Submit the completed form through the designated submission method (online, by mail, etc.).

Who needs RC521?

01

Individuals who are required to report their income or financial status for tax purposes.

02

Those applying for certain government benefits or services that require financial disclosure.

03

Tax professionals assisting clients with their filings.

Fill

form

: Try Risk Free

People Also Ask about

How do I declare myself as a non-resident of Canada?

Residency status do not have significant residential ties in Canada and any of the following applies: You live outside Canada throughout the tax year. You stay in Canada for less than 183 days in the tax year.

How do I inform my CRA of leaving Canada?

by phone using our Individual Income Tax Enquiries line at 1-800-959-8281. (The CRA will ask you for your name, address, social insurance number, date of birth, and other information from your tax return or notice of assessment.)

What is my tax residency Canada?

The most important thing to consider when determining your residency status in Canada for income tax purposes is whether or not you maintain, or you establish, significant residential ties with Canada. Significant residential ties to Canada include: a home in Canada. a spouse or common-law partner in Canada.

Why does my bank need to know my tax residency?

Why are you receiving this letter? The letter is intended to fulfill the bank's due diligence obligations under both the OECD Common Reporting Standard (all countries of “tax residence” except the United States) and FATCA (whether you are a “tax resident” of the United States).

How do I declare non residency in Canada?

Residency status normally, customarily, or routinely live in another country and are not considered a resident of Canada. do not have significant residential ties in Canada and any of the following applies: You live outside Canada throughout the tax year. You stay in Canada for less than 183 days in the tax year.

Do I need to file a Canadian tax return as a non-resident?

A lot of non-residents don't need to file a Canadian tax return if they pay withholding tax on their Canadian-sourced income. But if you receive rental, acting or pension income you may be able to choose to file a return and pay tax on taxable income instead of paying the withholding tax on gross income.

Why is CIBC asking for my tax residency?

CRS requires financial institutions to identify clients who are residents of foreign countries other than the United States. CIBC identifies such clients by obtaining client attestation of foreign tax residency as part of the account open process. CIBC reports client information and account details to the CRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my RC521 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your RC521 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send RC521 for eSignature?

When you're ready to share your RC521, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the RC521 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign RC521 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is RC521?

RC521 is a form required by the Canada Revenue Agency (CRA) for reporting certain types of income or tax information.

Who is required to file RC521?

Individuals or entities that have specific income types, such as capital gains or certain investments, are generally required to file RC521.

How to fill out RC521?

To fill out RC521, gather relevant financial documents, provide personal identification information, and accurately report the required income and deductions as specified in the form's instructions.

What is the purpose of RC521?

The purpose of RC521 is to ensure proper reporting and taxation of applicable income types, aiding the CRA in effective tax administration.

What information must be reported on RC521?

Information that must be reported on RC521 includes personal details, income types, amounts, and any applicable deductions or credits related to the reported income.

Fill out your RC521 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rc521 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.