RC521 2020-2025 free printable template

Show details

Please wait...

If this message is not eventually replaced by the proper contents of the document, your PDF

viewer may not be able to display this type of document.

You can upgrade to the latest version

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rc521 2020-2025 form

Edit your rc521 2020-2025 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rc521 2020-2025 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rc521 2020-2025 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rc521 2020-2025 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RC521 Form Versions

Version

Form Popularity

Fillable & printabley

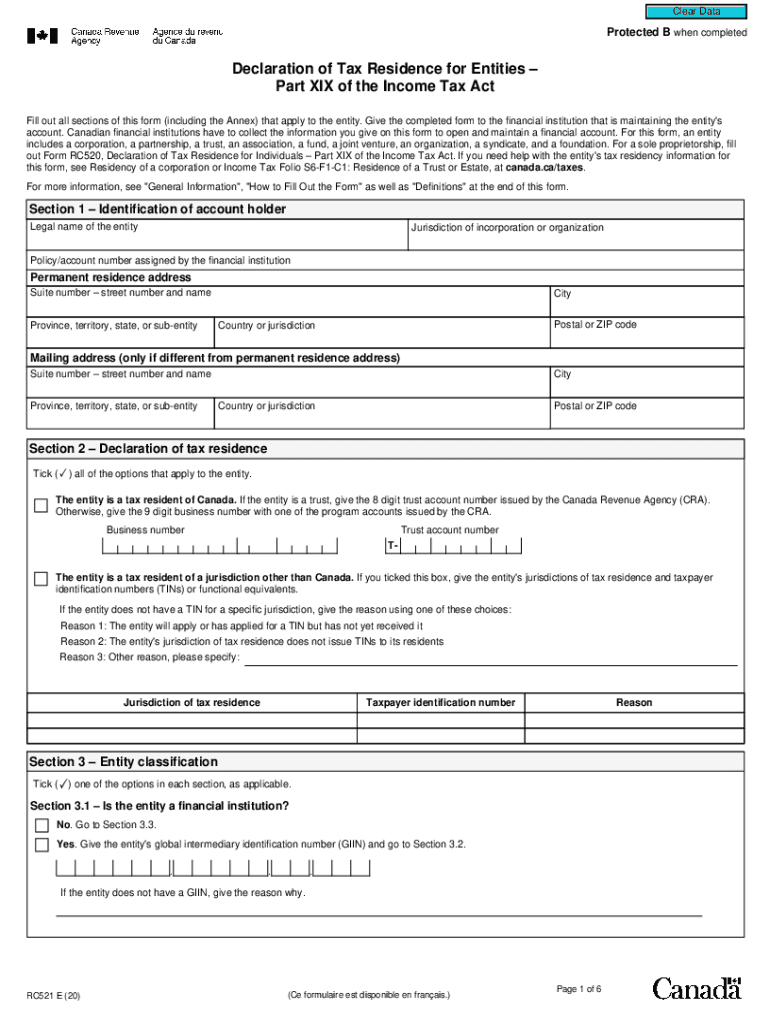

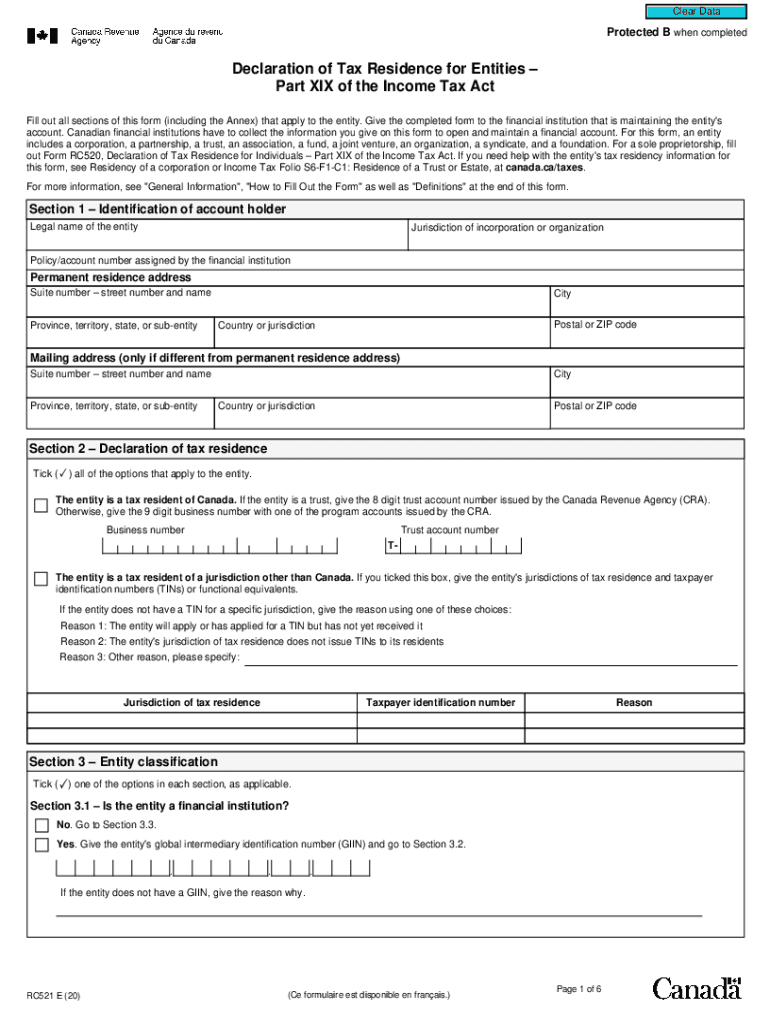

How to fill out rc521 2020-2025 form

How to fill out RC521

01

Gather all necessary financial documents related to your income and expenses.

02

Start by filling in your personal information such as name, address, and identification number.

03

Enter your total income for the reporting period in the designated section.

04

List any deductions or allowances you are eligible for.

05

Calculate your taxable income by subtracting deductions from total income.

06

Complete the sections on tax credits and other relevant information as required.

07

Review the entire form for accuracy before submission.

08

Submit the completed RC521 form to the appropriate tax authority.

Who needs RC521?

01

Individuals or businesses who need to report their income and taxes owed.

02

Self-employed individuals who must document their earnings.

03

Tax professionals preparing tax returns on behalf of clients.

Fill

form

: Try Risk Free

People Also Ask about

How do I declare myself as a non-resident of Canada?

Residency status do not have significant residential ties in Canada and any of the following applies: You live outside Canada throughout the tax year. You stay in Canada for less than 183 days in the tax year.

How do I inform my CRA of leaving Canada?

by phone using our Individual Income Tax Enquiries line at 1-800-959-8281. (The CRA will ask you for your name, address, social insurance number, date of birth, and other information from your tax return or notice of assessment.)

What is my tax residency Canada?

The most important thing to consider when determining your residency status in Canada for income tax purposes is whether or not you maintain, or you establish, significant residential ties with Canada. Significant residential ties to Canada include: a home in Canada. a spouse or common-law partner in Canada.

Why does my bank need to know my tax residency?

Why are you receiving this letter? The letter is intended to fulfill the bank's due diligence obligations under both the OECD Common Reporting Standard (all countries of “tax residence” except the United States) and FATCA (whether you are a “tax resident” of the United States).

How do I declare non residency in Canada?

Residency status normally, customarily, or routinely live in another country and are not considered a resident of Canada. do not have significant residential ties in Canada and any of the following applies: You live outside Canada throughout the tax year. You stay in Canada for less than 183 days in the tax year.

Do I need to file a Canadian tax return as a non-resident?

A lot of non-residents don't need to file a Canadian tax return if they pay withholding tax on their Canadian-sourced income. But if you receive rental, acting or pension income you may be able to choose to file a return and pay tax on taxable income instead of paying the withholding tax on gross income.

Why is CIBC asking for my tax residency?

CRS requires financial institutions to identify clients who are residents of foreign countries other than the United States. CIBC identifies such clients by obtaining client attestation of foreign tax residency as part of the account open process. CIBC reports client information and account details to the CRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rc521 2020-2025 form to be eSigned by others?

When you're ready to share your rc521 2020-2025 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute rc521 2020-2025 form online?

Completing and signing rc521 2020-2025 form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit rc521 2020-2025 form on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share rc521 2020-2025 form on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is RC521?

RC521 is a form used for reporting specific financial transactions to the relevant tax authority, usually related to the income or expenses of an organization.

Who is required to file RC521?

Entities or individuals who meet certain financial thresholds or criteria as defined by the tax authority are required to file RC521.

How to fill out RC521?

To fill out RC521, gather the necessary financial data, complete the form as instructed, ensuring all required sections are filled out accurately, and submit it by the designated deadline.

What is the purpose of RC521?

The purpose of RC521 is to provide a standardized method for reporting financial information to ensure compliance with tax regulations and to assist in the accurate assessment of tax obligations.

What information must be reported on RC521?

RC521 typically requires reporting information such as income, expenses, deductions, and other relevant financial data depending on the specific requirements set by the tax authority.

Fill out your rc521 2020-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rc521 2020-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.