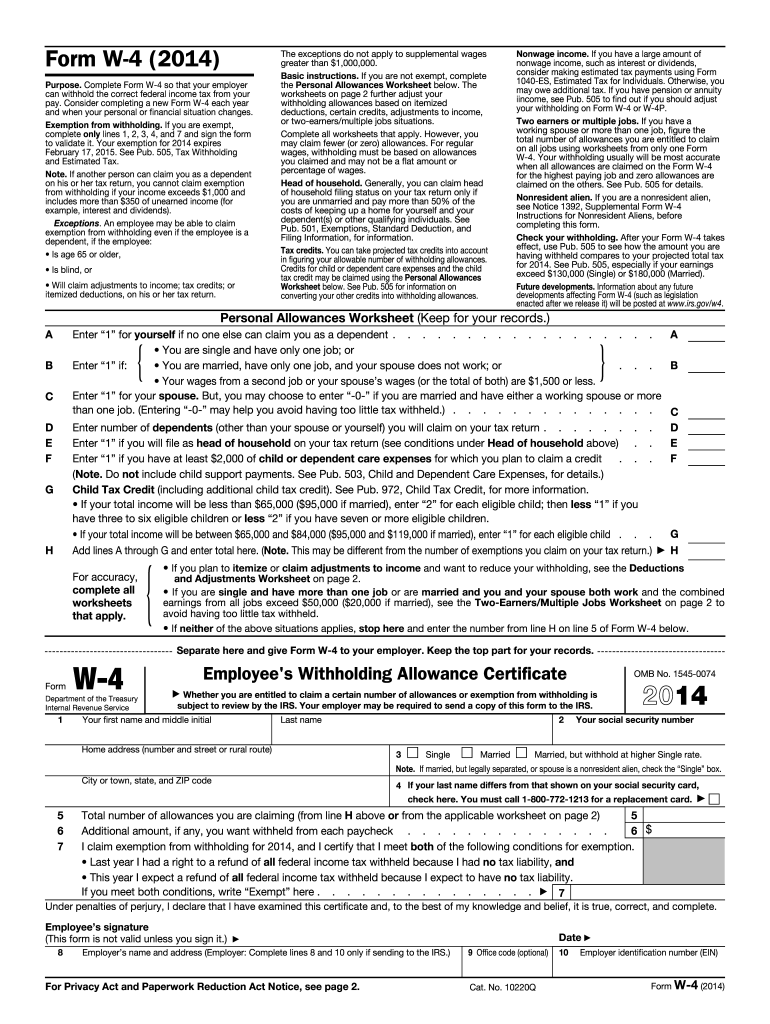

IRS W-4 2014 free printable template

Instructions and Help about IRS W-4

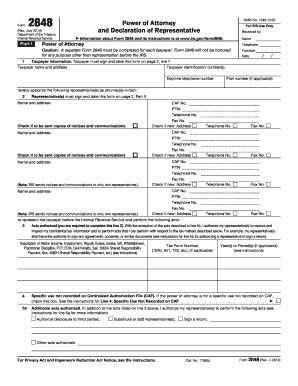

How to edit IRS W-4

How to fill out IRS W-4

About IRS W-4 2014 previous version

What is IRS W-4?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

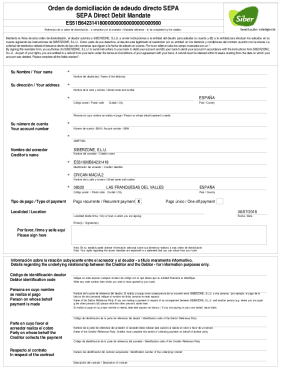

Is the form accompanied by other forms?

FAQ about IRS W-4

What should I do if I realize there's an error on my submitted IRS W-4?

If you discover an error on your submitted IRS W-4, you can submit a corrected form to your employer. It’s essential to indicate that it is a correction on the new form. The employer will process the new information and update your tax withholding accordingly.

How can I verify if my IRS W-4 has been processed?

To verify if your IRS W-4 has been processed, you can check with your employer’s payroll department as they maintain records of submitted forms. Additionally, observe your paycheck for changes in withholding that reflect your new IRS W-4 details.

Are there any requirements for submitting an e-signature on my IRS W-4?

An e-signature on an IRS W-4 is acceptable as long as it complies with the IRS's electronic signature requirements for payroll documents. Ensure that the proper authentication process is followed to maintain compliance and security.

What common mistakes should I avoid when submitting my IRS W-4?

Common mistakes when submitting an IRS W-4 include not updating personal information, forgetting to sign the form, and miscalculating deductions. To avoid issues, double-check all entries and ensure clarity on how many allowances you're claiming.

What should I do if I receive a notice regarding my IRS W-4?

If you receive a notice concerning your IRS W-4, read it carefully to understand the issue and follow the instructions provided. You may need to gather additional documentation or submit corrections to resolve the matter swiftly.

See what our users say