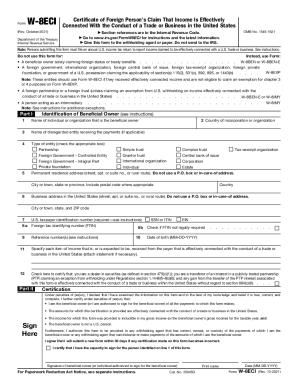

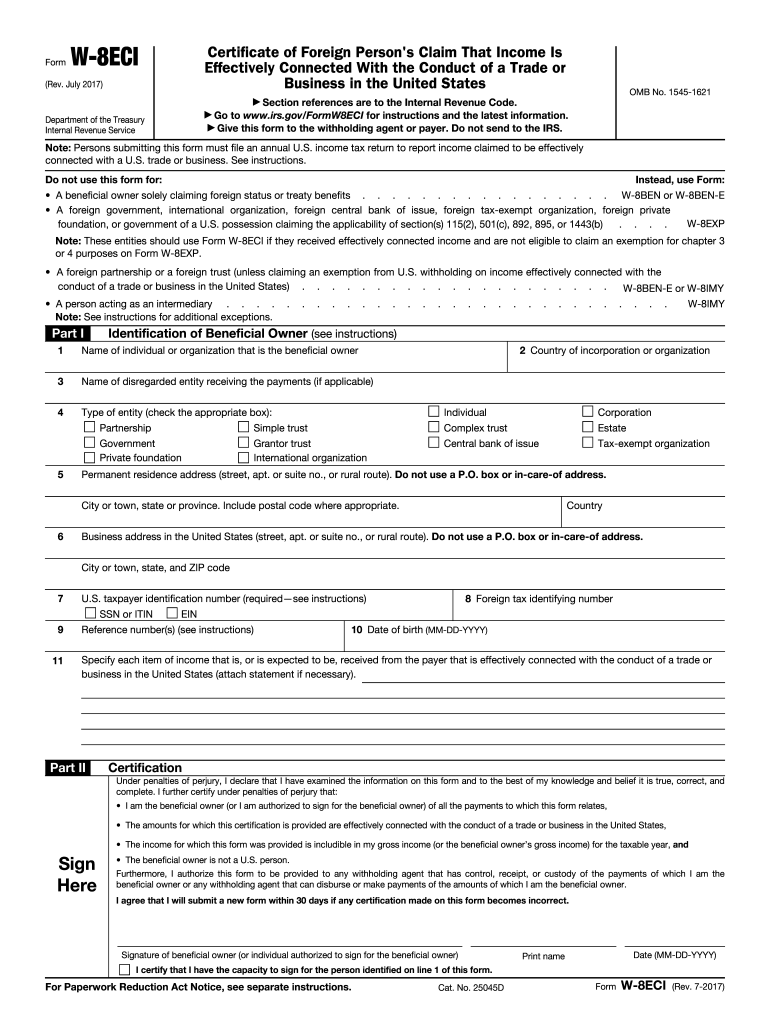

IRS W-8ECI 2017 free printable template

Instructions and Help about IRS W-8ECI

How to edit IRS W-8ECI

How to fill out IRS W-8ECI

About IRS W-8ECI 2017 previous version

What is IRS W-8ECI?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-8ECI

What should I do if I need to correct a mistake on my IRS W-8ECI form?

If you discover a mistake after submitting your IRS W-8ECI, you should prepare a new form with the correct information. Clearly indicate that it is a corrected form, and submit it to the relevant parties. Always keep records of both the original and corrected submissions for your documentation.

How can I track the status of my IRS W-8ECI submission?

You can track the status of your IRS W-8ECI by confirming with the payer or withholding agent to whom you submitted the form. They may provide you information on receipt and processing. If necessary, inquire about common rejection codes if your form was not accepted.

Are electronic signatures accepted on the IRS W-8ECI form?

Yes, electronic signatures are generally acceptable on the IRS W-8ECI form, provided you meet the IRS guidelines for e-signatures. It's important to ensure that your electronic submission complies with all applicable record retention and privacy regulations to maintain validity.

What should I do if I receive a notice regarding my IRS W-8ECI submission?

If you receive a notice related to your IRS W-8ECI, carefully read the information provided in the notification. Prepare any required documentation or clarification and respond promptly to the issuing agency. Keep copies of all correspondence for your records.

What are some common errors to avoid when submitting the IRS W-8ECI?

Common errors when submitting the IRS W-8ECI include providing incorrect taxpayer identification numbers and failing to sign the form. Ensuring all information is accurate and up-to-date can help prevent rejection or delays in processing.