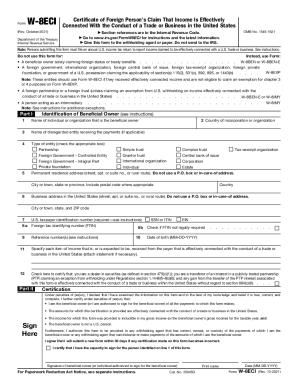

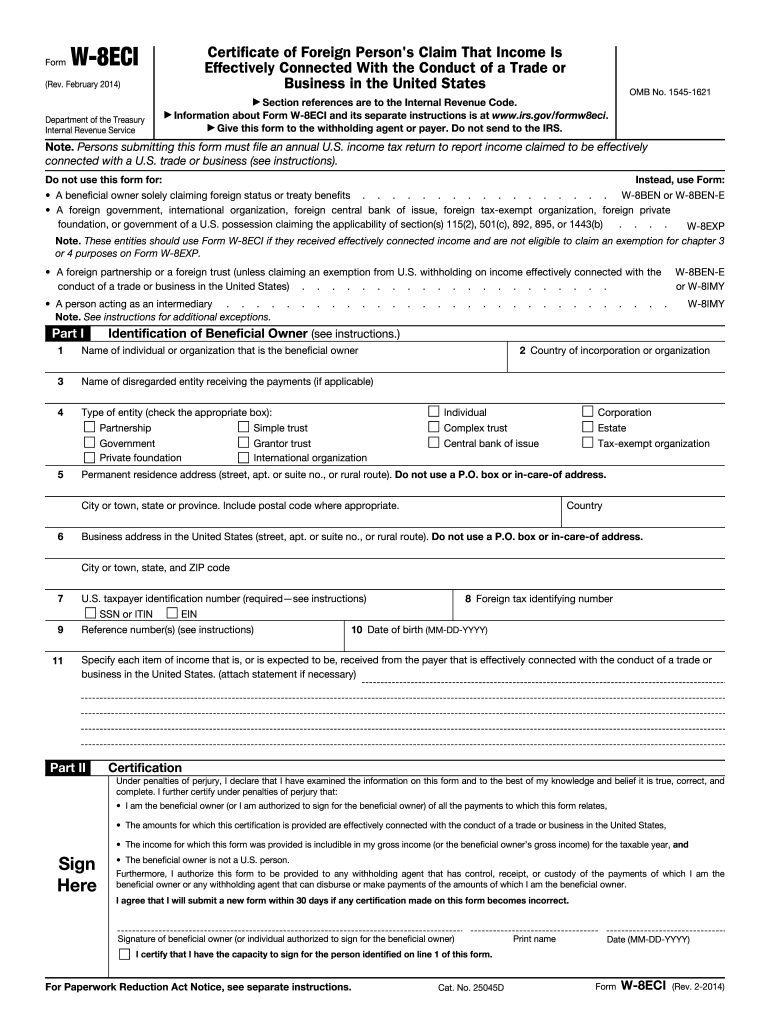

IRS W-8ECI 2014 free printable template

Instructions and Help about IRS W-8ECI

How to edit IRS W-8ECI

How to fill out IRS W-8ECI

About IRS W-8ECI 2014 previous version

What is IRS W-8ECI?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-8ECI

What should I do if I realize I've made a mistake on my foreign governments and certain form after submitting it?

If you discover an error on your foreign governments and certain form after filing, it's important to correct it promptly. You can submit an amended or corrected form to the appropriate agency, ensuring that you indicate it's a correction. Keep a copy for your records and monitor for updates regarding the amendment.

How can I verify that my foreign governments and certain form has been received and processed?

To check the status of your foreign governments and certain form, you may use the designated online portal provided by the agency. There, you can enter your details to track the processing status. Common e-file rejection codes can also guide you on any issues that might need addressing.

What are some common errors I should avoid when filing my foreign governments and certain form?

When submitting your foreign governments and certain form, watch out for frequent mistakes such as incorrect taxpayer identification numbers, disregarding filing status, or failing to include necessary attachments. Double-checking each detail can help you avoid these pitfalls and ensure smooth processing.

In special situations, such as filing on behalf of a nonresident foreign payee, what should I be aware of?

When filing a foreign governments and certain form for a nonresident foreign payee, it’s essential to have the appropriate authority, such as a Power of Attorney (POA). Ensure all relevant data is accurate and that you comply with any specific documentation requirements set forth for nonresident filings.