NY TC 403 HR 2016 free printable template

Show details

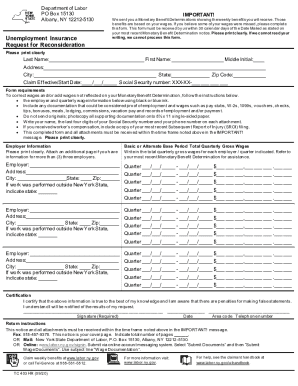

Please print clearly. If you do not we cannot process this form. Em ployer Inform ation have infor mation for more than 3 three employers. Complete the employer and quarterly w age information below using black or blue ink. Inc lude any documentation that could be considered proof of employ ment and w ages such as pay stubs W-2s 1099s vouchers checks tips bonuses meals lodging commissions vacation pay and records of employ ment and/or pay ment. Labor. ny. gov or call Tel-Service at...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC 403 HR

Edit your NY TC 403 HR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC 403 HR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY TC 403 HR online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY TC 403 HR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC 403 HR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TC 403 HR

How to fill out NY TC 403 HR

01

Obtain the NY TC 403 HR form from the New York State Department of Taxation and Finance website or your local tax office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Begin with your personal identification information, such as your name, address, and Social Security number.

04

Provide details about your income sources for the designated tax year.

05

Complete the section regarding any deductions or credits you may be eligible for.

06

Double-check all entries for accuracy to avoid delays or issues with processing.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form by the deadline, either electronically or via mail as instructed.

Who needs NY TC 403 HR?

01

Individuals who are claiming a tax credit under section 403 of the New York State Tax Law.

02

Taxpayers who receive income and need to report it for state tax purposes.

03

Individuals seeking to fulfill their tax obligations in compliance with New York State regulations.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to request a hearing?

A hearing is a formal proceeding with a hearing officer and court reporter. Both the applicant and the Division will be asked to present their case, which may include witnesses and evidence. You are not required to have an attorney, but you are encouraged to seek legal counsel.

How do I correct an error on my NYS unemployment claim?

What should I do if I make a mistake on my weekly certification? You should call the Telephone Claims Center right away, at 888-209-8124. Call during the hours of operation: Monday through Friday, 8 am to 5 pm.

How do I speak to a representative at NYS unemployment?

Press option 2 to speak to a representative at the Department of Labor Contact Center. Call our Telephone Claims Center toll-free at 888-209-8124. Listen to the first message about languages available, then press the number for your language.

How do I speak to a live person at NYS unemployment?

Press option 2 to speak to a representative at the Department of Labor Contact Center. Call our Telephone Claims Center toll-free at 888-209-8124.

What can disqualify you from unemployment benefits in NY?

You may be denied benefits if you: Were fired because you violated a company policy, rule or procedure, such as absenteeism or insubordination. Quit your job without good cause, such as a compelling personal reason.

What disqualifies you from unemployment in NY?

You may be denied benefits if you: Were fired because you violated a company policy, rule or procedure, such as absenteeism or insubordination. Quit your job without good cause, such as a compelling personal reason.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY TC 403 HR online?

pdfFiller has made it simple to fill out and eSign NY TC 403 HR. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in NY TC 403 HR?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your NY TC 403 HR to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out NY TC 403 HR on an Android device?

Use the pdfFiller mobile app to complete your NY TC 403 HR on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NY TC 403 HR?

NY TC 403 HR is a form used by taxpayers in New York to report specific tax information related to certain credits or adjustments.

Who is required to file NY TC 403 HR?

Taxpayers who claim certain tax credits or adjustments under New York State tax rules are required to file NY TC 403 HR.

How to fill out NY TC 403 HR?

To fill out NY TC 403 HR, taxpayers need to provide their personal information, details about the credits or adjustments being claimed, and any necessary documentation as instructed on the form.

What is the purpose of NY TC 403 HR?

The purpose of NY TC 403 HR is to facilitate the reporting and processing of specific tax credits or adjustments that may affect a taxpayer's liability under New York State tax laws.

What information must be reported on NY TC 403 HR?

Information that must be reported on NY TC 403 HR includes the taxpayer's identification information, the type and amount of credits or adjustments being claimed, and any additional supporting documentation required.

Fill out your NY TC 403 HR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC 403 HR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.