NY TC 403 HR 2009 free printable template

Show details

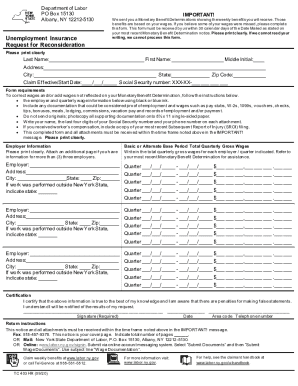

NEW YORK STATE DEPARTMENT OF LABOR PO Box 15130 ALBANY, NY 12212-5130 UNEMPLOYMENT INSURANCE Request for Reconsideration Complete the following information NAME: IMPORTANT! Response must be received

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC 403 HR

Edit your NY TC 403 HR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC 403 HR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY TC 403 HR online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY TC 403 HR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC 403 HR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TC 403 HR

How to fill out NY TC 403 HR

01

Obtain the NY TC 403 HR form from the New York State Department of Taxation and Finance website.

02

Read the instructions provided with the form carefully to understand the requirements.

03

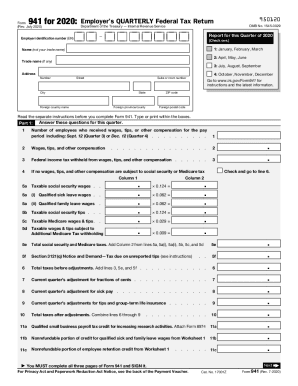

Enter your name and address in the appropriate fields at the top of the form.

04

Input your Social Security number or Employer Identification Number (EIN) as required.

05

Complete sections pertaining to your income and any applicable deductions or credits.

06

Fill out the part of the form that pertains to your tax status for the year.

07

Review all provided information for accuracy and completeness.

08

Sign and date the form before submitting it.

Who needs NY TC 403 HR?

01

Individuals who have claimed a tax credit in New York State.

02

Taxpayers who have received certain types of income that require reporting.

03

Residents of New York State who are required to reconcile their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is good cause for quitting a job in NJ?

Good cause for leaving employment or reducing work effort shall also include: 1. Discrimination by an employer based on age, race, sex, color, handicap, religious beliefs, national origin, or political beliefs; 2.

What reasons can you quit a job and still get unemployment in NJ?

While in most cases you cannot voluntarily quit a job and collect unemployment insurance benefits, where you can show “unsafe, unhealthful, or dangerous” working conditions, that were so intolerable that you had “no choice but to leave the employment,” you could be eligible to collect unemployment insurance benefits.

What disqualifies you from unemployment in NY?

You may be denied benefits if you: Were fired because you violated a company policy, rule or procedure, such as absenteeism or insubordination. Quit your job without good cause, such as a compelling personal reason.

What disqualifies you from unemployment in New Jersey?

There are a variety of reasons why an applicant may be disqualified from receiving New Jersey unemployment benefits, which include voluntarily leaving their employment, committing misconduct, gross misconduct and failing to apply for or to accept suitable work.

Why would I be denied unemployment in New York?

Benefit Denials Voluntarily leaving work without good cause. Being discharged for misconduct connected with work. Not being able to work or available for work. Refusing an offer of suitable work. Knowingly making false statements to obtain benefit payments.

How many hours can you work and still collect unemployment in NY?

Under the new rules, you can work up to 7 days per week without losing full unemployment benefits for that week, if you work 30 hours or fewer and earn $504 or less in gross pay excluding earnings from self-employment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY TC 403 HR for eSignature?

When you're ready to share your NY TC 403 HR, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the NY TC 403 HR in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit NY TC 403 HR on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NY TC 403 HR from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is NY TC 403 HR?

NY TC 403 HR is a tax form used in New York State to report certain tax credits and liabilities related to business entities.

Who is required to file NY TC 403 HR?

Businesses and entities operating in New York State that are subject to specific tax regulations and wish to claim credits or report liabilities must file NY TC 403 HR.

How to fill out NY TC 403 HR?

To fill out NY TC 403 HR, gather necessary financial documents, complete all required fields accurately, and provide detailed information about your business activities and tax credits being claimed.

What is the purpose of NY TC 403 HR?

The purpose of NY TC 403 HR is to allow businesses to report their tax liabilities and claim various tax credits available under New York State law.

What information must be reported on NY TC 403 HR?

NY TC 403 HR requires reporting information such as the business's identification details, tax year, income details, credits being claimed, and any other relevant financial data.

Fill out your NY TC 403 HR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC 403 HR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.