Get the free PCOE Compensation Reduction Agreement 2010-2011

Show details

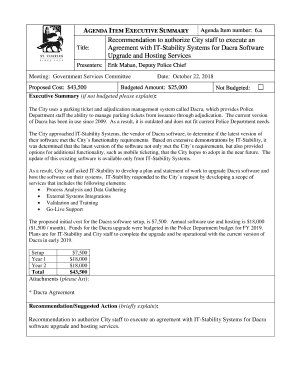

PLACER COUNTY OFFICE OF EDUCATION SECTION 125 FLEXIBLE BENEFITS PLAN COMPENSATION REDUCTION AGREEMENT Plan Year: July 1, 2010, June 30, 2011, Section A: EMPLOYEE INFORMATION EMPLOYEE NAME MAILING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pcoe compensation reduction agreement

Edit your pcoe compensation reduction agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pcoe compensation reduction agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pcoe compensation reduction agreement online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pcoe compensation reduction agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pcoe compensation reduction agreement

How to fill out pcoe compensation reduction agreement:

01

Start by obtaining the necessary form: The pcoe compensation reduction agreement form can typically be obtained from your employer or human resources department. If it is not readily available, you can inquire about it with the relevant personnel.

02

Read and understand the agreement: Take the time to carefully read through the pcoe compensation reduction agreement. Familiarize yourself with its contents, terms, and any conditions associated with reducing your compensation.

03

Enter personal details: Begin filling out the form by providing your personal information, such as your full name, employee identification number, position within the company, and contact details. Ensure that all the information provided is accurate and up to date.

04

Specify the reason for compensation reduction: Indicate why you are requesting a reduction in compensation. This could be due to various reasons, such as temporary financial difficulties, personal obligations, or any other valid reasons that warrant a reduction.

05

Outline the proposed reduction: Clearly state the amount or percentage by which you are requesting to reduce your compensation. It is essential to be specific and realistic in your proposal, making sure it aligns with your current financial situation and needs.

06

Provide supporting documentation (if required): Depending on the company's policies, you may need to attach any necessary supporting documents to substantiate your request for compensation reduction. This could include financial statements, medical bills, or any other relevant paperwork, as requested by your employer.

07

Sign and date the agreement: Once you have completed filling out the pcoe compensation reduction agreement, carefully review all the information provided. If everything looks accurate, sign and date the document where indicated.

Who needs pcoe compensation reduction agreement:

01

Employees facing temporary financial difficulties: Those who are experiencing financial hardships due to unforeseen circumstances may need to consider a pcoe compensation reduction agreement to temporarily lower their income.

02

Individuals with personal obligations: Employees who have personal obligations, such as caring for a sick family member or pursuing further education, may find it necessary to request a reduction in their compensation to better manage their responsibilities.

03

Individuals seeking work-life balance: Some individuals may opt for a pcoe compensation reduction to achieve a better work-life balance. By reducing their income and working fewer hours, they can allocate more time to personal pursuits, hobbies, or family commitments.

In summary, filling out a pcoe compensation reduction agreement involves obtaining the necessary form, reading and understanding its contents, providing personal details, specifying the reason for the reduction, outlining the proposed reduction, attaching supporting documentation (if required), and signing the agreement. This agreement may be beneficial for employees facing temporary financial difficulties, those with personal obligations, or individuals seeking work-life balance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pcoe compensation reduction agreement?

Pcoe compensation reduction agreement is a contract between an employer and employee where the employee agrees to reduce their compensation for certain benefits or purposes.

Who is required to file pcoe compensation reduction agreement?

Both employer and employee are required to file pcoe compensation reduction agreement.

How to fill out pcoe compensation reduction agreement?

Pcoe compensation reduction agreement can be filled out by including details of the reduction in compensation, reasons for the agreement, signatures of both parties, and effective date.

What is the purpose of pcoe compensation reduction agreement?

The purpose of pcoe compensation reduction agreement is to formalize the agreement between employer and employee regarding the reduction in compensation.

What information must be reported on pcoe compensation reduction agreement?

Information such as the amount of compensation reduction, reasons for the reduction, duration of the agreement, and signatures of both parties must be reported on pcoe compensation reduction agreement.

Can I create an electronic signature for the pcoe compensation reduction agreement in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your pcoe compensation reduction agreement in seconds.

Can I create an electronic signature for signing my pcoe compensation reduction agreement in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your pcoe compensation reduction agreement and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete pcoe compensation reduction agreement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your pcoe compensation reduction agreement. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your pcoe compensation reduction agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pcoe Compensation Reduction Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.