AU ANZ M1919 2014 free printable template

Show details

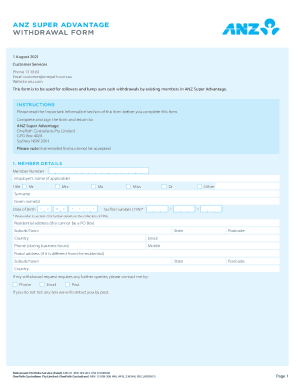

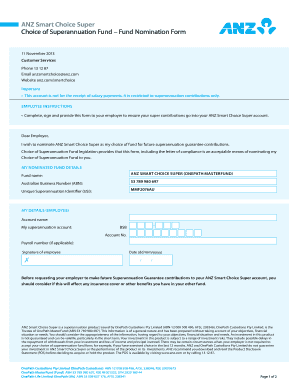

ANZ Super Advantage Withdrawal Form 12 March 2014 Customer Services Phone 13 38 63 Email customer onepath.com.AU Website anz.com/wealth/super This form is to be used for rollovers and lump sum cash

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU ANZ M1919

Edit your AU ANZ M1919 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU ANZ M1919 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU ANZ M1919 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AU ANZ M1919. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU ANZ M1919 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU ANZ M1919

How to fill out AU ANZ M1919

01

Start by gathering all necessary personal and financial information required to fill out the AU ANZ M1919 form.

02

Read the instructions at the top of the form carefully to understand the requirements.

03

Fill in your personal details, such as your name, address, and contact information in the designated fields.

04

Provide information related to your financial status, including income, expenses, and any other relevant financial data.

05

Ensure all sections of the form are completed; if a section does not apply to you, indicate this clearly.

06

Review the filled-out form for accuracy, checking for any errors or missing information.

07

Sign and date the form where required to authenticate the information provided.

08

Submit the completed form as per the instructions provided, whether online or via mail.

Who needs AU ANZ M1919?

01

Individuals seeking financial services in Australia or New Zealand that require a formal declaration of financial circumstances.

02

Applicants for loans, grants, or other financial aids who need to report their financial status.

03

Businesses and organizations looking to provide financial information to comply with regulations or apply for funding.

Fill

form

: Try Risk Free

People Also Ask about

How do I withdraw from ANZ super?

If you wish to complete a rollover of your superannuation monies or make a lump sum withdrawal please call 13 12 87 to speak with a specialised consultant.

How do I access my ANZ super?

If you hold an ANZ Bank account, you can access your super via ANZ Internet banking and the ANZ App. If you can't see your super account, go to settings > link / delink personal account and then enter your member number.

Can you make withdrawals from super?

You may be able to withdraw your super in several lump sums. However, if you ask your provider to make regular payments from your super it may be an income stream. Once you take a lump sum out of your super, it is no longer considered to be super.

How can I withdraw my superannuation?

You need to contact your super provider to request access to your super due to severe financial hardship. You may be able to withdraw some of your super if you are experiencing severe financial hardship. There are no special tax rates for a super withdrawal because of severe financial hardship.

Can I pull money out of my super?

You may be able to withdraw some of your super if you are experiencing severe financial hardship. There are no special tax rates for a super withdrawal because of severe financial hardship. Withdrawals are paid and taxed as a normal super lump sum.

Can I make a lump sum withdrawals from super?

You may withdraw a lump sum from super at retirement of any amount up to your total balance. A lump sum payment can be useful if you need to repay debts, or you have some large expenses such as making home renovations or purchasing a vehicle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify AU ANZ M1919 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including AU ANZ M1919. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute AU ANZ M1919 online?

pdfFiller has made it simple to fill out and eSign AU ANZ M1919. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the AU ANZ M1919 form on my smartphone?

Use the pdfFiller mobile app to complete and sign AU ANZ M1919 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is AU ANZ M1919?

AU ANZ M1919 is a form used in Australia and New Zealand for reporting specific financial or tax-related information, often associated with the Australian Taxation Office (ATO) or the New Zealand Inland Revenue Department (IRD).

Who is required to file AU ANZ M1919?

Individuals or entities that meet certain financial thresholds or engage in specific financial activities are required to file the AU ANZ M1919 form. This typically includes businesses, trust funds, and certain financial institutions.

How to fill out AU ANZ M1919?

To fill out the AU ANZ M1919 form, you need to gather the required financial information, follow the instructions provided on the form, fill in personal or business details, report the necessary financial figures, and ensure all required signatures are completed before submission.

What is the purpose of AU ANZ M1919?

The purpose of AU ANZ M1919 is to ensure compliance with specific tax regulations and to provide the tax authorities with accurate financial information for assessment, verification, and audit purposes.

What information must be reported on AU ANZ M1919?

The information that must be reported on AU ANZ M1919 typically includes financial statements, income details, expenditure, asset values, liabilities, and any other specific information required by the tax regulations.

Fill out your AU ANZ M1919 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU ANZ m1919 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.