AU ANZ M1919 2021-2026 free printable template

Show details

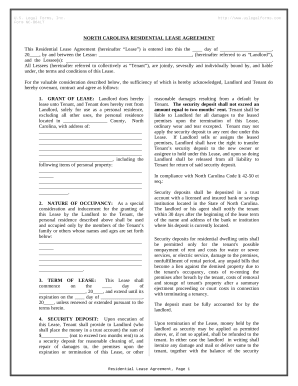

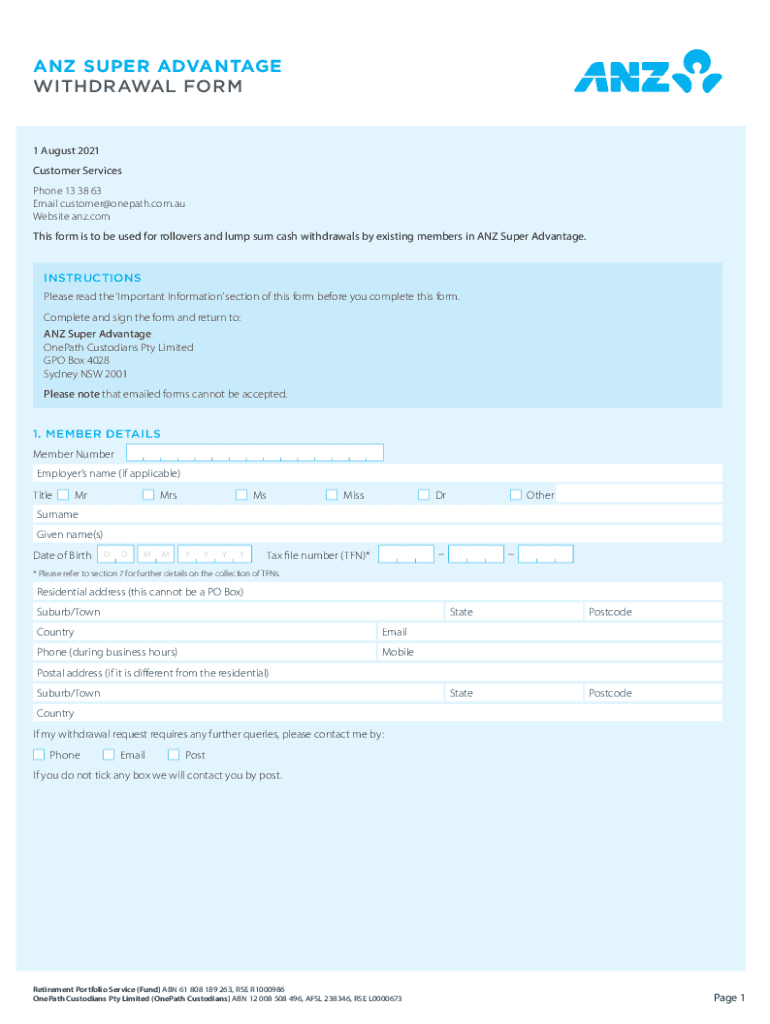

ANZ SUPER ADVANTAGE WITHDRAWAL FORM1 August 2021Customer Services Phone 13 38 63 Email customer@onepath.com.au Website ANZ.this form is to be used for rollovers and lump sum cash withdrawals by existing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anz super withdrawal form

Edit your AU ANZ M1919 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU ANZ M1919 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU ANZ M1919 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU ANZ M1919. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU ANZ M1919 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU ANZ M1919

How to fill out AU ANZ M1919

01

Gather all necessary information required to complete the AU ANZ M1919 form.

02

Begin by entering the applicant's personal details in the designated fields.

03

Provide any relevant identification numbers, such as tax file numbers or business IDs.

04

Fill in the financial details as requested, making sure to double-check the accuracy.

05

Include any additional supporting documentation required as per the instructions.

06

Review the completed form for any errors or missing information.

07

Submit the form via the specified method (online or by mail) as instructed.

Who needs AU ANZ M1919?

01

Individuals looking to apply for financial assistance or services through AU ANZ.

02

Businesses seeking to process claims or complete necessary documentation as part of their operations.

03

Anyone requiring compliance with government regulations pertaining to financial forms.

Fill

form

: Try Risk Free

People Also Ask about

Can you withdraw money from deceased bank account Australia?

Depending on the value of the Estate, the bank may also ask for further proof through documents such as the Will, Probate or Letters of administration. After the bank validates the death, there is a permanent hold on any transaction accounts, which includes: You can't withdraw money from the accounts. Direct debits

When someone dies can you take money out of their bank account?

Once a Grant of Probate has been awarded, the executor or administrator will be able to take this document to any banks where the person who has died held an account. They will then be given permission to withdraw any money from the accounts and distribute it as per instructions in the Will.

How long after probate can funds be distributed Australia?

After the grant of Probate or Letters of Administration is made by the Court the executor or administrator can start to distribute the estate. The estate should not be distributed until at least six months after the date of death. This allows time for any claims against the estate.

How long does it take for the bank to release estate funds?

It can take 12 to 18 months to complete an average estate settlement. In cases involving more complex estates, settlement can sometimes take years — all while requiring you to keep the beneficiaries informed and ensure proper documentation is completed for each step of the process.

How long do banks take to release money after probate in Australia?

Once the bank has all the necessary documents, typically, they will release the funds within two weeks. Many will release a sum of money before the grant to deal with essential expenses such as funeral costs. The executor should approach the relevant bank promptly to determine the approach they take.

How do I transfer a title of a deceased person in Victoria?

To transfer car ownership to a beneficiary, you need to give copies of the death certificate, the will and proof of the executor's identity to VicRoads. You will also need to fill out a Transfer of registration from a deceased estate form.

Is there a time limit to settle an estate in Australia?

Where the executor has not paid the legacy to the beneficiary within 12 months from the date of death, the beneficiary is entitled to claim interest until the legacy is received.

What to do if an executor is taking too long?

If there is unreasonable delay however you should write to the Executor, pointing out his obligation to keep all beneficiaries updated on the progress of managing the Estate. You can also demand that the Executor provide an “account” of the Estate which should outline how much you are due to receive.

How do you change a land title after death in BC?

To remove an owner from title upon death requires application to the court to have the will proved and appointment of an executor. If you are unsure, do a title search to confirm what your tenancy is on title.

Can an executor delay distribution?

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

How do I notify the CRA of a death?

You should provide the CRA with the deceased's date of death as soon as possible. You can call the CRA at 1-800-959-8281, or complete the form and send it to your tax services office or tax centre.

How long does it take to get inheritance money Australia?

Finalising the estate Straightforward estates are often wound up in less than 6 months. Others can take more than a year. It depends on: the complexity of the Will.

What happens to joint bank accounts when one person dies in Australia?

Do all joint bank accounts have rights of survivorship? Generally, the 'principle of survivorship' applies to jointly held bank accounts. This means that in the case of a joint account holder's death, the surviving joint account holder receives the remaining funds, and full control of the account.

How do I transfer property to a deceased spouse in Victoria?

Joint owners with a surviving owner The executor, or surviving owner, will need to lodge a surviving proprietor (owner) application with the Land Registry Services office of Land Use Victoria. An Application by Surviving Proprietor lets Land Registry Services know that one of the owners has died.

What happens after probate is granted in Victoria?

What happens after probate is granted? After probate is granted, the assets of the deceased will vest in the executor. This means the assets are placed under the executor's authority. The executor will also have authority to distribute those assets in ance with the will-maker's will.

How long can a solicitor hold money after probate?

This is because there is a six month time limit under the Inheritance (Provision for Family and Dependents) Act 1975, which runs from the date of the grant of probate. If a claim were to be brought, it would be far better that the beneficiaries have not received the money rather than being asked to repay the money.

How long does an executor have to settle an estate in Australia?

Where the executor has not paid the legacy to the beneficiary within 12 months from the date of death, the beneficiary is entitled to claim interest until the legacy is received.

Are bank accounts frozen when someone dies in Australia?

Yes, typically Australian bank accounts are frozen when someone dies. If you are a family member or beneficiary, contact the deceased's financial institution(s) as soon as possible to inform them of the situation.

Can an executor operate the deceased bank account?

The executor can deposit the deceased person's money, such as tax refunds or insurance proceeds, into this account. They can then use this money to pay the deceased person's debts and bills, and to distribute money to the beneficiaries of the estate. assets and property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the AU ANZ M1919 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your AU ANZ M1919 in seconds.

Can I create an electronic signature for signing my AU ANZ M1919 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your AU ANZ M1919 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit AU ANZ M1919 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing AU ANZ M1919, you can start right away.

What is AU ANZ M1919?

AU ANZ M1919 is a specific form used for reporting certain financial or taxation information in Australia and New Zealand.

Who is required to file AU ANZ M1919?

Entities or individuals who meet specific criteria related to income or tax obligations in Australia and New Zealand are required to file AU ANZ M1919.

How to fill out AU ANZ M1919?

To fill out AU ANZ M1919, gather all relevant financial data, complete each section as per the guidelines, and ensure all required information is accurately reported before submission.

What is the purpose of AU ANZ M1919?

The purpose of AU ANZ M1919 is to ensure compliance with tax regulations and to report financial information to the respective authorities in Australia and New Zealand.

What information must be reported on AU ANZ M1919?

Information that must be reported on AU ANZ M1919 typically includes income details, deductions, credits, and any other relevant financial information as stipulated by the tax authorities.

Fill out your AU ANZ M1919 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU ANZ m1919 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.