NY DTF IT-214 2017 free printable template

Show details

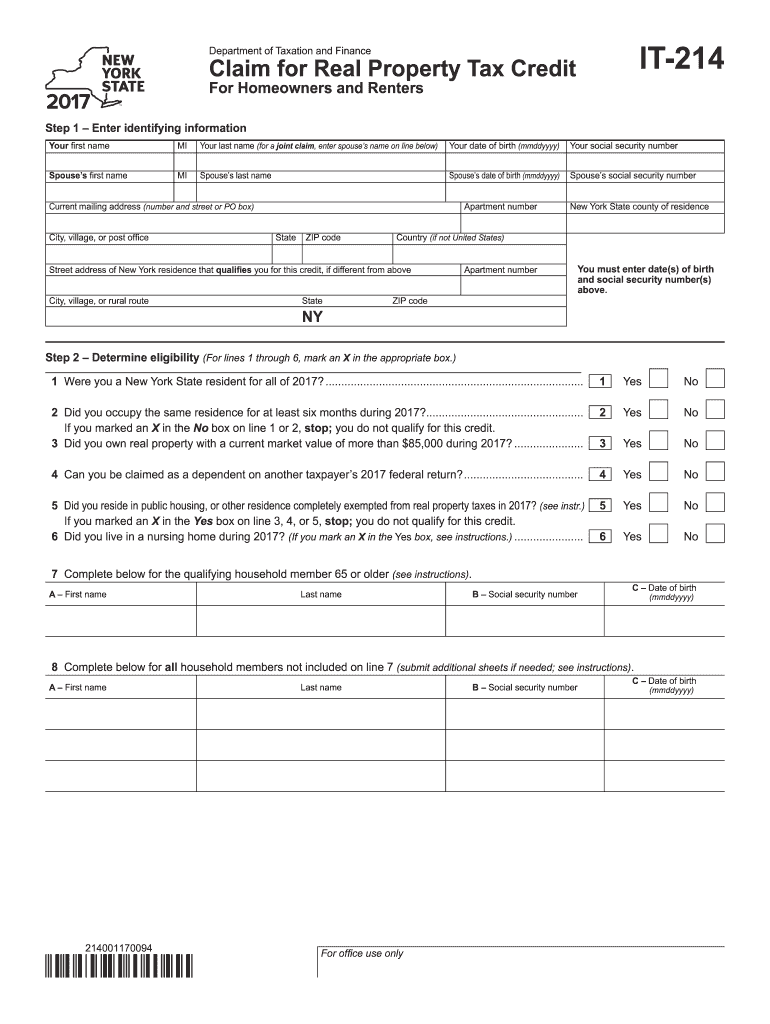

IT214Department of Taxation and FinanceClaim for Real Property Tax Credit For Homeowners and Renters Step 1 Enter identifying information Your first nameMIYour last name (for a joint claim, enter

pdfFiller is not affiliated with any government organization

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

How to fill out NY DTF IT-214

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

To edit the NY DTF IT-214 form, you can utilize tools like pdfFiller, which allow you to upload the form, make necessary changes, and save the updates for your records. Start by downloading the form from the New York Department of Taxation and Finance (DTF) website or access it within pdfFiller. Once the form is uploaded, you can edit fields, add your information, and annotate as needed.

How to fill out NY DTF IT-214

To fill out the NY DTF IT-214 form correctly, follow these steps:

01

Download the form from the New York DTF site or access it via pdfFiller.

02

Enter your personal information, including your name, address, and taxpayer identification number.

03

Complete the sections detailing your eligibility for tax credits or deductions.

04

Review the filled information for accuracy before final submission.

About NY DTF IT previous version

What is NY DTF IT-214?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NY DTF IT previous version

What is NY DTF IT-214?

The NY DTF IT-214 form is a tax document used by individuals in New York to claim certain credits and deductions. Primarily, this form applies to those filing personal income tax returns who are seeking to reduce their tax liability through eligible expenses. It is essential for taxpayers to understand its function to maximize their benefits and ensure compliance.

What is the purpose of this form?

The primary purpose of the NY DTF IT-214 form is to allow eligible New York residents to claim tax credits aimed at reducing their overall taxable income. For example, it may enable taxpayers to claim credits for property tax relief or other applicable deductions. By accurately completing this form, taxpayers can potentially increase their refund or decrease the amount of tax owed.

Who needs the form?

Individuals who own property in New York or have incurred eligible expenses that may qualify for tax credits should complete the NY DTF IT-214 form. This includes homeowners and renters who are filing their state income tax returns. Additionally, if you are a resident who has paid certain types of taxes and seeks to apply for credit, this form is necessary.

When am I exempt from filling out this form?

You may be exempt from completing the NY DTF IT-214 form if your total income falls below a certain threshold or if you do not have qualifying expenses. Furthermore, if you are not a resident of New York State or if you do not meet the specific eligibility criteria set forth by the Department of Taxation and Finance, you do not need to file this form.

Components of the form

The NY DTF IT-214 form comprises different sections requiring you to provide personal information, details of the credits being claimed, and signatures for verification. Key sections include: identification, eligibility criteria, and specific deductions or credits being requested. Each part must be filled out completely for the form to be valid and accepted by the tax authorities.

Due date

The due date for submitting the NY DTF IT-214 form aligns with the New York State personal income tax return deadline. Typically, this means it is due on April 15 unless it falls on a weekend or holiday. It's important to check for any specific updates from the New York DTF regarding deadlines each tax season.

What are the penalties for not issuing the form?

Failure to properly complete and submit the NY DTF IT-214 can lead to penalties imposed by the New York State Department of Taxation and Finance. These penalties can include fines, loss of credits, or increased tax liabilities. It is crucial to ensure that the form is filled out accurately and submitted on time to avoid such consequences.

What information do you need when you file the form?

When filing the NY DTF IT-214 form, you'll need to gather essential information, such as your Social Security number, details about your residence, and documentation related to eligible expenses. Including accurate data regarding your tax situation will help ensure that your claims are processed smoothly.

Is the form accompanied by other forms?

Yes, the NY DTF IT-214 form may need to be submitted alongside other forms or supporting documents, depending on your specific tax situation. For example, if you are claiming deductions related to property taxes, you may need to provide additional documentation to support your claims. Ensure all necessary attachments are included when filing.

Where do I send the form?

The completed NY DTF IT-214 form should be sent to the New York State Department of Taxation and Finance. Make sure to review the official DTF website for the specific mailing address, which may vary based on your location within the state and whether you are filing by mail or electronically.

See what our users say