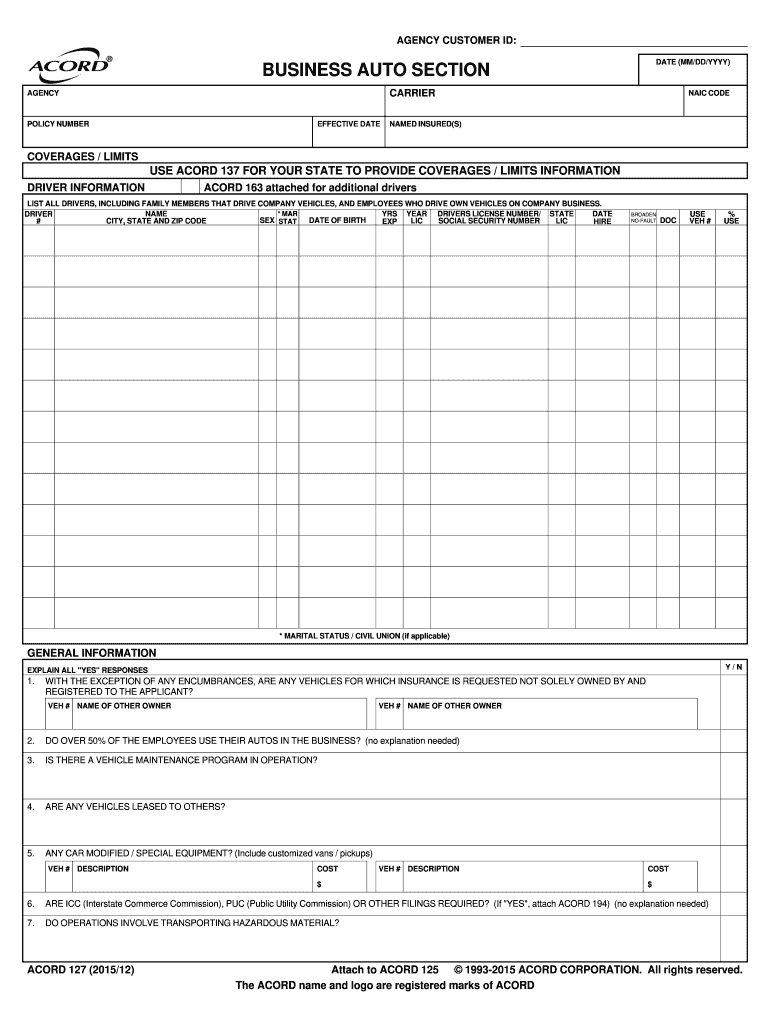

Get the free COVERAGES / LIMITS

Show details

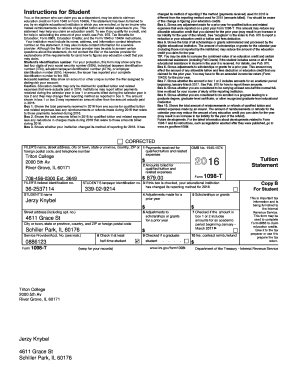

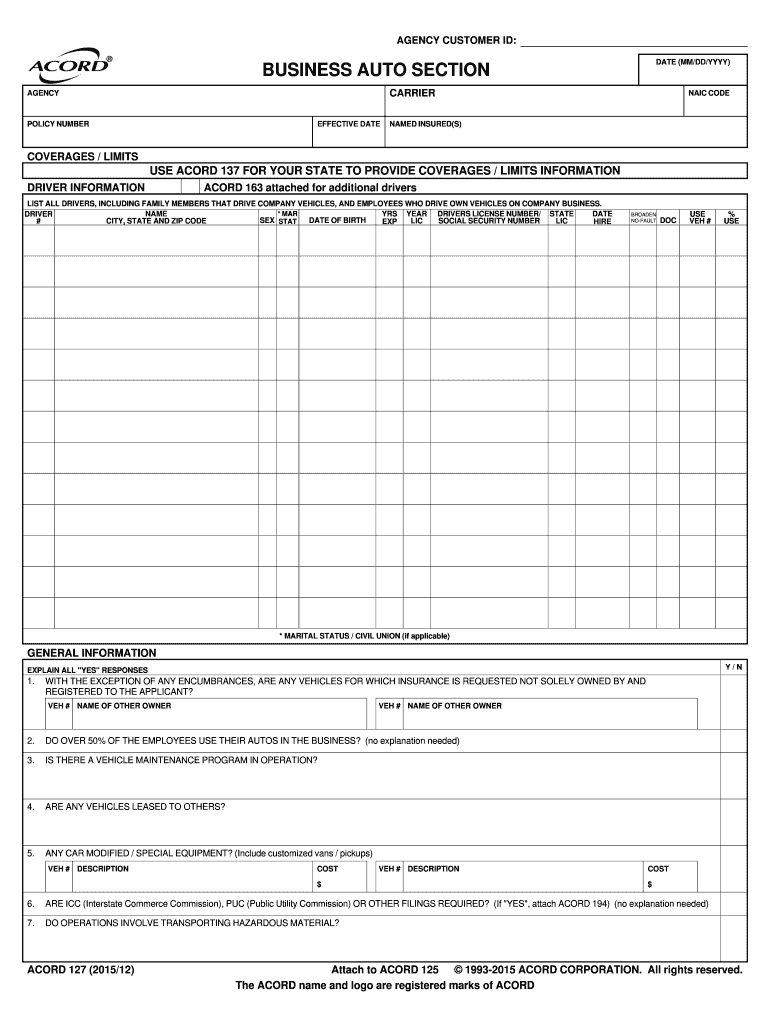

AGENCY CUSTOMER ID: DATE (MM/DD/YYY)BUSINESS AUTO SECTION CARRIERAGENCYPOLICY NUMBEREFFECTIVE DIATONIC CODE-NAMED INSURED(S)COVERAGES / LIMIT SUSE 137 FOR YOUR STATE TO PROVIDE COVERAGES / LIMITS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign coverages limits

Edit your coverages limits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your coverages limits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit coverages limits online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit coverages limits. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out coverages limits

How to fill out coverages limits

01

Gather necessary information: Before filling out coverages limits, make sure you have all the necessary information such as your policy details, the types of coverage you have, and any applicable limits set by your insurance provider.

02

Review your assets: Assess your current assets and determine their value. This will help you determine the appropriate coverage limits for each asset.

03

Consider your risks: Identify the potential risks you may face and assess the potential financial impact of these risks. This will help you determine the appropriate coverage limits for each type of coverage.

04

Consult with an insurance agent: If you are unsure about the appropriate coverage limits, it is recommended to consult with an insurance agent. They can provide expert advice based on your specific needs and circumstances.

05

Fill out the coverages limits form: Once you have gathered all the necessary information and determined the appropriate coverage limits, fill out the coverages limits form provided by your insurance provider.

06

Double-check the information: Before submitting the form, double-check all the information you have provided to ensure accuracy and completeness.

07

Submit the form: After reviewing and verifying all the information, submit the completed coverages limits form to your insurance provider.

08

Review and update periodically: It is important to review and update your coverage limits periodically to ensure they still align with your current needs and circumstances. This can be done during your policy renewal or whenever significant changes occur in your life.

Who needs coverages limits?

01

Everyone: It is recommended for everyone to have coverage limits for their insurance policies to protect their assets and finances in case of unexpected events or accidents.

02

Homeowners: Homeowners should have coverage limits to safeguard their property and belongings against risks such as fire, theft, or natural disasters.

03

Vehicle owners: Vehicle owners should have coverage limits for their auto insurance to protect themselves and others in case of accidents or damage to their vehicles.

04

Business owners: Business owners should have coverage limits for various types of insurance to protect their business assets, employees, and customers against potential risks and liabilities.

05

Renters: Even if you don't own a home, it is still important to have coverage limits for renters insurance to protect your personal belongings and liability in case of accidents or damages within the rental property.

06

Individuals with valuable assets: Individuals with valuable assets such as expensive jewelry, artwork, or antiques should have coverage limits to protect the value of these assets.

07

Families with dependents: Families with dependents should have coverage limits to ensure financial security and stability in case of unexpected events or accidents.

08

Professionals: Professionals such as doctors, lawyers, or architects should have coverage limits for professional liability insurance to protect against potential claims or lawsuits related to their profession.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get coverages limits?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the coverages limits in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit coverages limits in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your coverages limits, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit coverages limits straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing coverages limits, you need to install and log in to the app.

What is coverages limits?

Coverage limits refer to the maximum amount an insurance policy will pay for a covered loss.

Who is required to file coverages limits?

Insurance policy holders are typically required to provide their coverage limits when applying for or renewing an insurance policy.

How to fill out coverages limits?

Coverage limits can be filled out on insurance application forms or by contacting your insurance provider directly.

What is the purpose of coverages limits?

The purpose of coverage limits is to establish the maximum amount an insurance company will pay for a covered claim.

What information must be reported on coverages limits?

Coverage limits typically include details such as the maximum amount payable for bodily injury, property damage, and other covered losses.

Fill out your coverages limits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Coverages Limits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.