Get the free Financial Profile Scores - (Unadjusted) by District Name

Show details

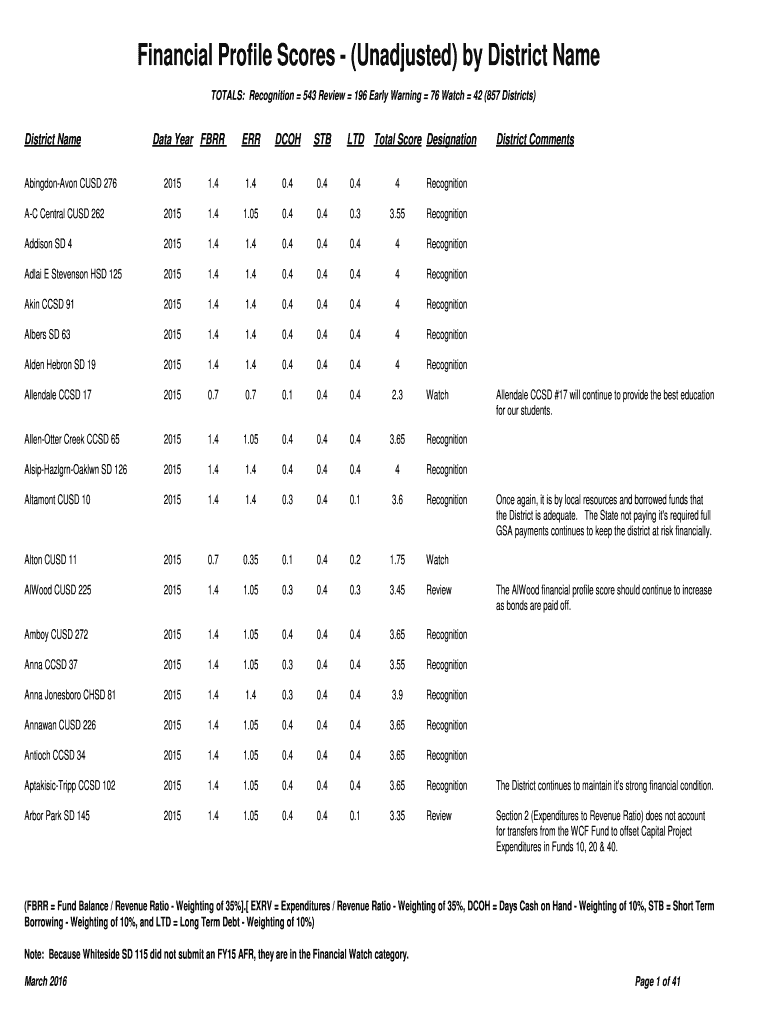

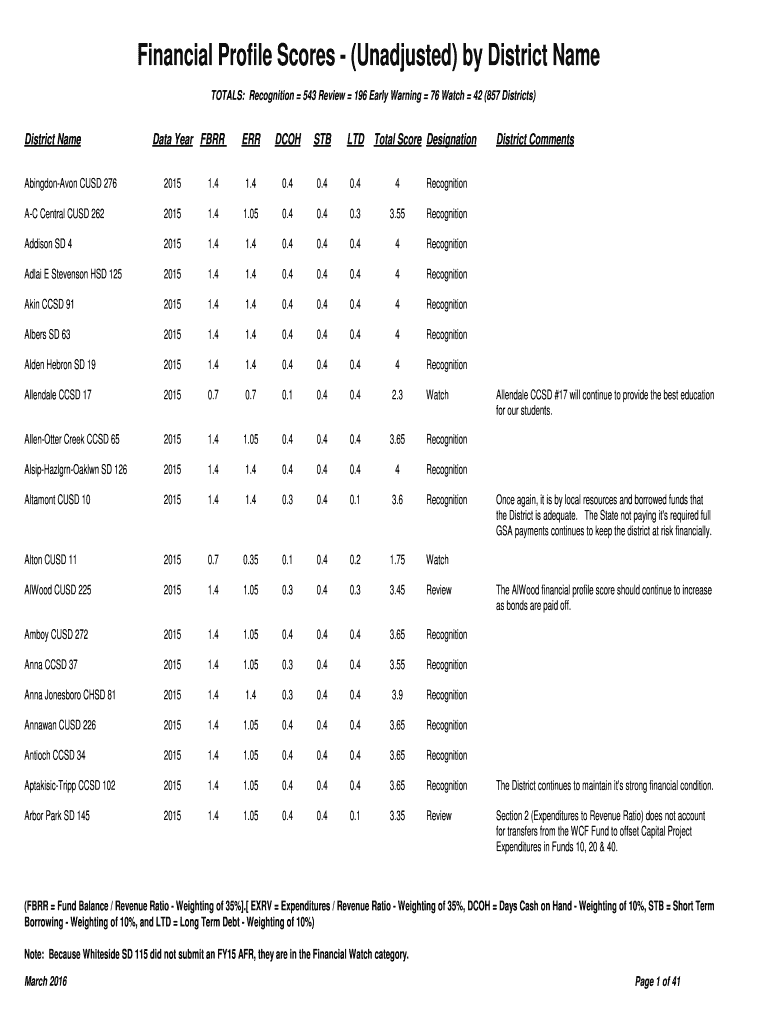

Financial Profile Scores (Unadjusted) by District Name TOTALS: Recognition 543 Review 196 Early Warning 76 Watch 42 (857 Districts)District Named Year FBRRERRDCOHSTBLTDTotal Score DesignationDistrict

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial profile scores

Edit your financial profile scores form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial profile scores form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial profile scores online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit financial profile scores. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial profile scores

How to fill out financial profile scores

01

Start by gathering all necessary financial documents, such as bank statements, tax returns, and investment records.

02

Next, analyze your income and expenses to calculate your monthly cash flow.

03

Determine your net worth by subtracting your liabilities from your assets.

04

Assess your risk tolerance by considering factors like your age, financial goals, and comfort level with market fluctuations.

05

Evaluate your investment knowledge and experience to determine your financial literacy level.

06

Consider your investment time horizon and determine the appropriate investment strategies.

07

Calculate your debt-to-income ratio by dividing your total monthly debts by your monthly income.

08

Review your credit score and credit history to understand your creditworthiness.

09

Assess your financial goals and priorities, such as saving for retirement, buying a house, or paying off debt.

10

Based on the above information, assign scores to different aspects of your financial profile.

11

Regularly update and review your financial profile scores to track your progress and make necessary adjustments as needed.

Who needs financial profile scores?

01

Individuals who want to evaluate their overall financial health and make informed financial decisions.

02

Financial institutions that use financial profile scores to assess loan applicants' creditworthiness.

03

Wealth management firms that use financial profile scores to tailor investment strategies for their clients.

04

Financial advisors who need to understand their clients' financial situations to provide personalized advice.

05

Insurance companies that use financial profile scores to assess policy applicants' risk profiles.

06

Employers who use financial profile scores as part of the hiring process to gauge candidates' financial responsibility.

07

Government agencies that use financial profile scores to determine eligibility for financial assistance programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit financial profile scores online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your financial profile scores to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit financial profile scores in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your financial profile scores, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the financial profile scores in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your financial profile scores in minutes.

What is financial profile scores?

Financial profile scores are numerical values that indicate an individual's or organization's financial health and creditworthiness.

Who is required to file financial profile scores?

Individuals and organizations that are seeking financial assistance or credit may be required to file financial profile scores.

How to fill out financial profile scores?

Financial profile scores are typically filled out by providing information about income, expenses, assets, debts, and other financial details.

What is the purpose of financial profile scores?

The purpose of financial profile scores is to help lenders and financial institutions assess the creditworthiness and financial stability of individuals and organizations.

What information must be reported on financial profile scores?

Information such as income, expenses, assets, debts, credit history, and financial commitments must be reported on financial profile scores.

Fill out your financial profile scores online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Profile Scores is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.