Get the free Corporate Capital LLC

Show details

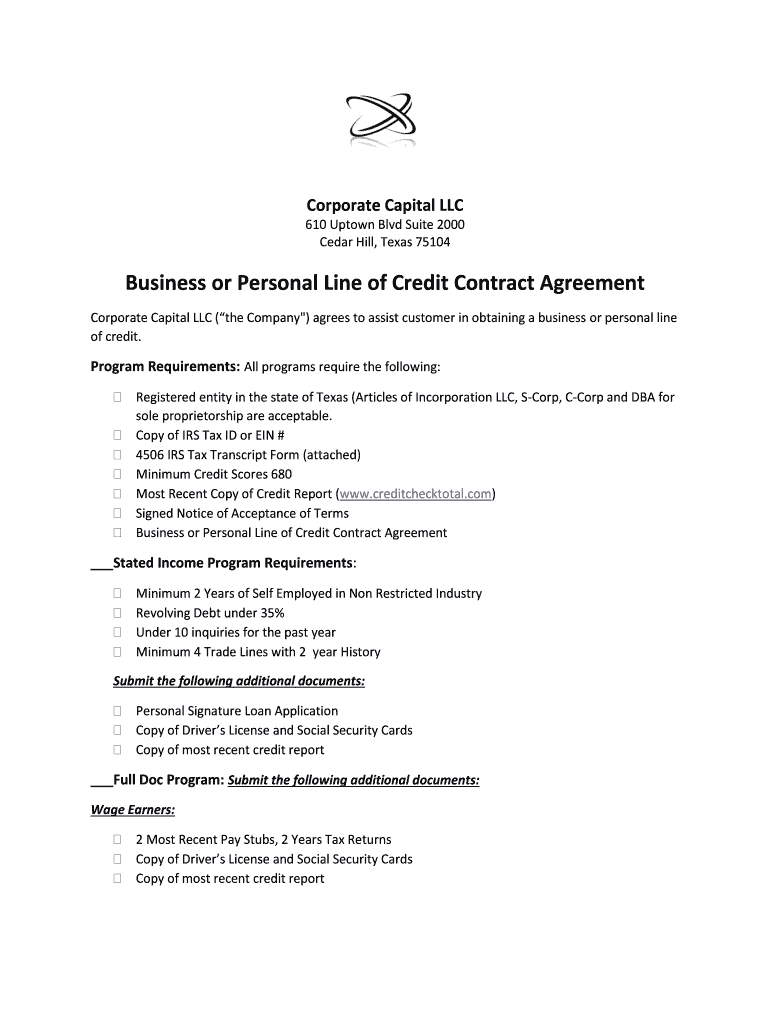

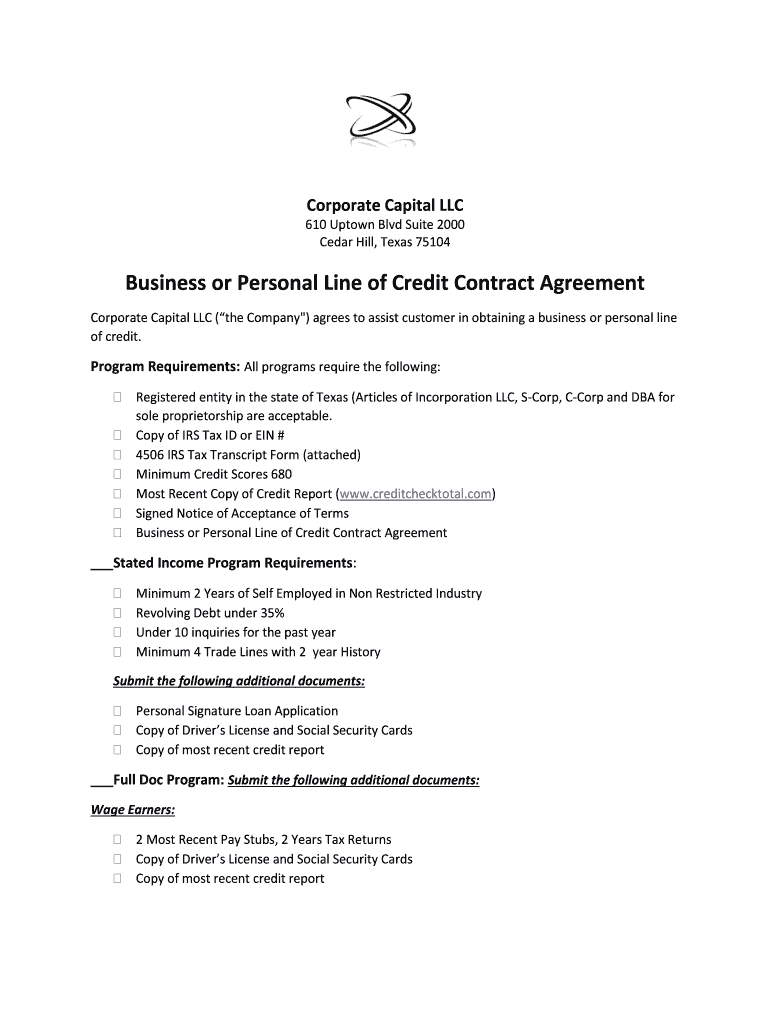

Corporate Capital LLC 610 Uptown Blvd Suite 2000 Cedar Hill, Texas 75104Business or Personal Line of Credit Contract Agreement Corporate Capital LLC (the Company “) agrees to assist customer in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate capital llc

Edit your corporate capital llc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate capital llc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate capital llc online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate capital llc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate capital llc

How to fill out corporate capital llc

01

Check the requirements: Before starting the process, make sure you meet the requirements for filling out a corporate capital LLC. These requirements may vary depending on your jurisdiction.

02

Gather necessary information: Collect all the required information such as the business name, address, contact details, purpose of the LLC, and the names and addresses of the owners or members.

03

Choose a registered agent: A registered agent is required for an LLC. Select a person or an organization who will be responsible for receiving legal documents on behalf of the LLC.

04

Prepare and file the documents: Complete the necessary forms, such as the Articles of Organization, which includes information about the LLC's purpose and structure. File these documents with the appropriate government agency.

05

Pay the filing fees: Pay the required fees associated with filing the LLC documents. The amount may vary depending on your jurisdiction.

06

Create an Operating Agreement: While not always required, it is recommended to create an operating agreement that outlines the ownership, management, and operating procedures of the LLC.

07

Obtain necessary licenses and permits: Depending on your industry and location, you may need to obtain specific licenses and permits to operate your LLC legally.

08

Publish a notice (if required): In some jurisdictions, you may be required to publish a notice of your LLC formation in a local newspaper.

09

Keep accurate records: Maintain good record-keeping practices by documenting all important LLC transactions, financial statements, and meeting minutes.

10

Consult with professionals: If you are unsure about any step of the process, it is wise to consult with a legal or tax professional who can guide you through the process.

Who needs corporate capital llc?

01

Entrepreneurs and business owners: Corporate capital LLC can be beneficial for entrepreneurs and business owners looking to separate their personal assets from their business liabilities.

02

Small to medium-sized businesses: LLCs are often the preferred choice for small to medium-sized businesses due to their ease of formation, flexibility, and potential tax advantages.

03

Real estate investors: Many real estate investors choose to utilize a corporate capital LLC to protect their personal assets from potential legal issues or liabilities related to their investment properties.

04

Professionals and consultants: Individuals operating as professionals or consultants, such as lawyers, accountants, or healthcare providers, can benefit from the liability protection provided by a corporate capital LLC.

05

Partnerships and joint ventures: When individuals or businesses come together to collaborate on a project or venture, forming a corporate capital LLC can help define and protect each party's rights and responsibilities.

06

Creative freelancers: Freelancers working in creative industries, such as graphic designers or photographers, can use a corporate capital LLC to establish themselves as a legitimate business entity.

07

Foreign investors: Foreign investors looking to invest in the United States can establish a corporate capital LLC as a way to conduct business and protect their investments.

08

Sole proprietors looking to expand: Sole proprietors who want to expand their business and gain additional liability protection often choose to convert their sole proprietorship into an LLC.

09

Startups and new businesses: Startups and new businesses can benefit from the flexibility and protection offered by a corporate capital LLC structure as they grow and navigate the early stages of their business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit corporate capital llc on an iOS device?

You certainly can. You can quickly edit, distribute, and sign corporate capital llc on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit corporate capital llc on an Android device?

You can make any changes to PDF files, like corporate capital llc, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete corporate capital llc on an Android device?

Use the pdfFiller Android app to finish your corporate capital llc and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is corporate capital llc?

Corporate Capital LLC is a type of limited liability company (LLC) that is specifically formed to raise capital for corporate ventures.

Who is required to file corporate capital llc?

Any business entity or individual that has formed a Corporate Capital LLC is required to file the necessary documents with the appropriate state authorities.

How to fill out corporate capital llc?

Filing requirements for Corporate Capital LLC vary by state, but generally involve submitting articles of organization, paying any required fees, and providing information about the company's capital structure.

What is the purpose of corporate capital llc?

The purpose of a Corporate Capital LLC is to attract investors and raise capital for business ventures by offering ownership stakes in exchange for funding.

What information must be reported on corporate capital llc?

Information typically reported on Corporate Capital LLC documents includes the company's name, address, members, managers, capital contributions, and purpose.

Fill out your corporate capital llc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Capital Llc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.