Get the free RECORD-KEEPING AND REPORTING

Show details

RULES

OF

TENNESSEE DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT

OCCUPATIONAL SAFETY AND HEALTH

CHAPTER 08000103

OCCUPATIONAL SAFETY AND HEALTH STANDARDS

RECORDKEEPING AND REPORTING

TABLE OF CONTENTS

08000103.01

08000103.02

08000103.03

08000103.04

08000103.0508000103.01Purpose

Scope

Record

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign record-keeping and reporting

Edit your record-keeping and reporting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your record-keeping and reporting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit record-keeping and reporting online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit record-keeping and reporting. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out record-keeping and reporting

How to fill out record-keeping and reporting

01

To fill out record-keeping and reporting, follow these points:

02

Gather all necessary information and documents related to the records you need to keep.

03

Organize the information in a systematic manner, keeping track of dates, details, and any required metrics.

04

Ensure accuracy and completeness of the records by double-checking all data before entering it.

05

Use a reliable record-keeping software or spreadsheet to enter and store the information.

06

Regularly update and maintain the records as new information becomes available.

07

Keep backups of your records to ensure data security and prevent loss.

08

Follow any specific guidelines or regulations set by your industry or legal requirements.

09

Review and analyze the records periodically to identify patterns, trends, or areas of improvement.

10

Maintain confidentiality and privacy of sensitive information while handling and storing the records.

11

Seek professional assistance or advice if you are unsure about any aspect of record-keeping or reporting.

Who needs record-keeping and reporting?

01

Record-keeping and reporting may be needed by various individuals and entities, including:

02

- Business owners and entrepreneurs who need to keep track of financial transactions, expenses, and income for legal and tax purposes.

03

- Compliance officers and regulatory bodies who require accurate record-keeping to ensure adherence to laws, regulations, and industry standards.

04

- Accountants and auditors who rely on comprehensive records to analyze financial statements and assess a company's financial health.

05

- Researchers and analysts who use historical data for market research, trend analysis, and decision-making.

06

- Government agencies and tax authorities who depend on detailed records for tax assessment, audit purposes, and public accountability.

07

- Healthcare providers and medical professionals who must maintain patient records for treatment, billing, and compliance with privacy laws.

08

- Non-profit organizations and charities that need to demonstrate transparency and accountability for funding, donations, and grants.

09

- Individuals who want to keep personal records, such as expenses, assets, or health information, for budgeting, planning, or legal reasons.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send record-keeping and reporting to be eSigned by others?

Once your record-keeping and reporting is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in record-keeping and reporting?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your record-keeping and reporting to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the record-keeping and reporting in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your record-keeping and reporting in seconds.

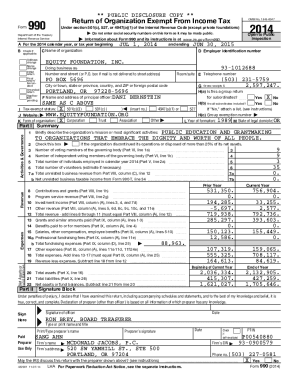

What is record-keeping and reporting?

Record-keeping and reporting is the process of documenting and communicating financial or other business-related information.

Who is required to file record-keeping and reporting?

Businesses, organizations, and individuals may be required to file record-keeping and reporting depending on the regulations set by the governing authorities.

How to fill out record-keeping and reporting?

Record-keeping and reporting can be filled out manually or using software depending on the requirements. It typically involves entering relevant information in designated forms or templates.

What is the purpose of record-keeping and reporting?

The purpose of record-keeping and reporting is to maintain accurate financial or business-related information for compliance, decision-making, and analysis purposes.

What information must be reported on record-keeping and reporting?

The information to be reported on record-keeping and reporting may include financial transactions, expenditures, income, assets, liabilities, and other relevant details depending on the nature of the business or organization.

Fill out your record-keeping and reporting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Record-Keeping And Reporting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.