USDA CCC-941 2014 free printable template

Show details

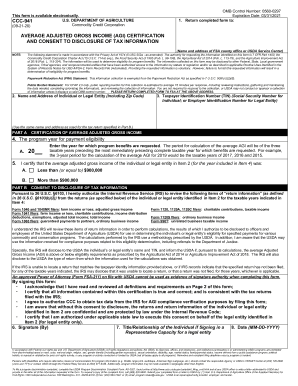

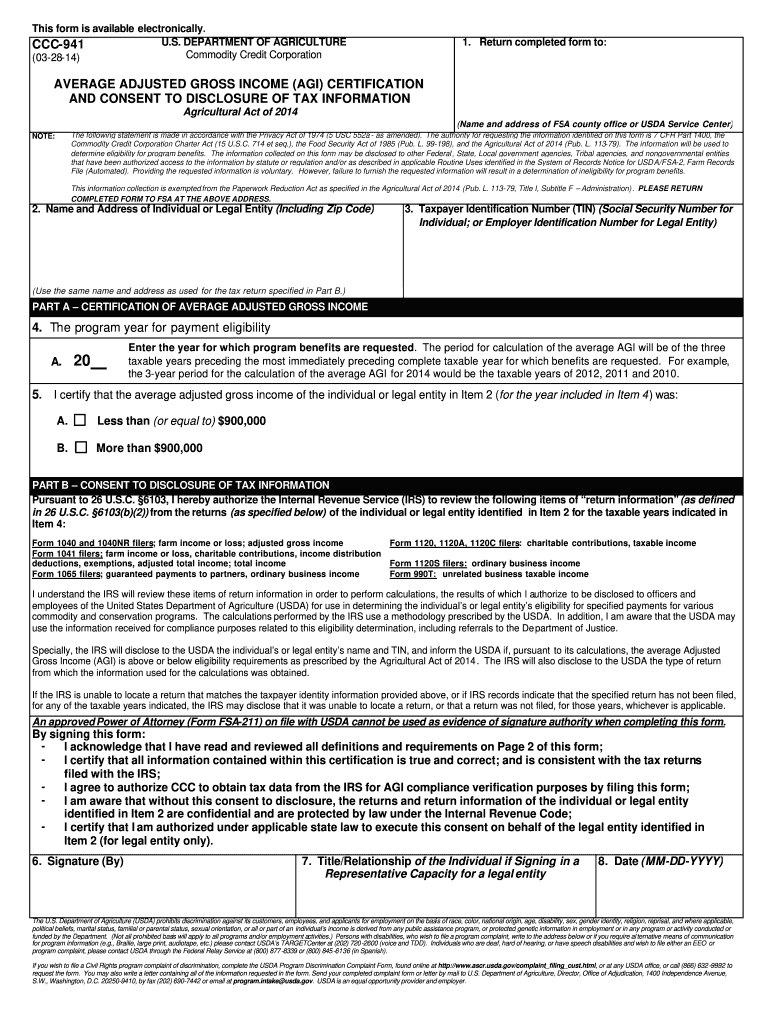

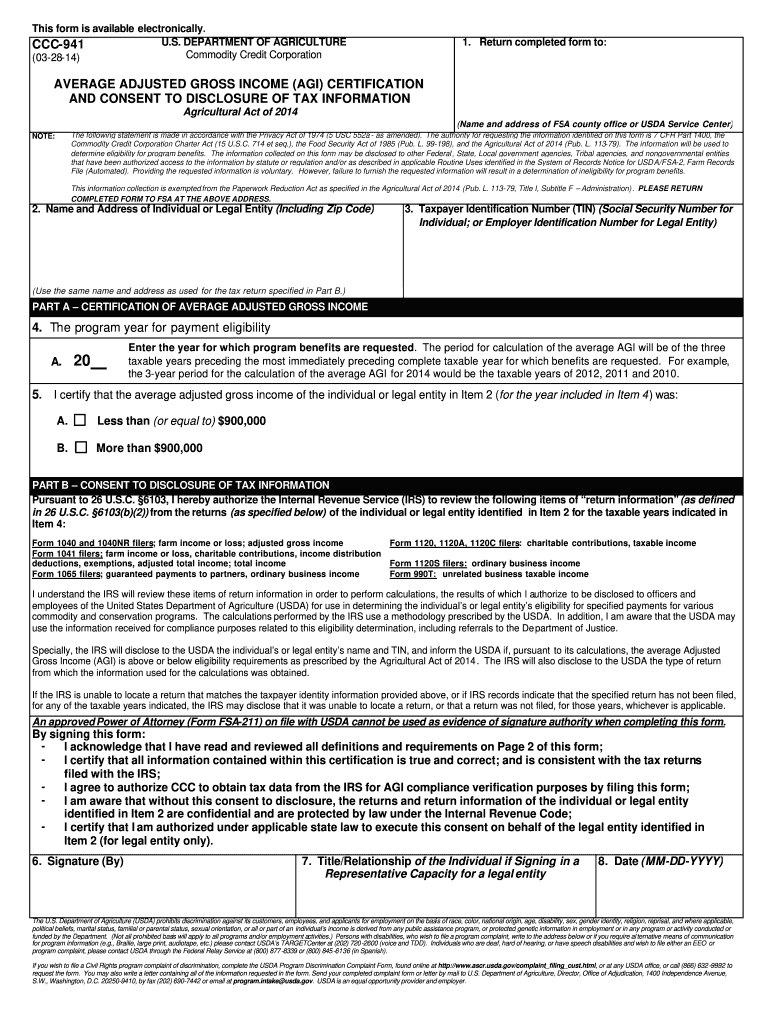

This form is available electronically. U.S. DEPARTMENT OF AGRICULTURE CCC-941 Commodity Credit Corporation 03-28-14 1. CCC-941 03-28-14 Page 2 of 2 GENERAL INFORMATION ON AVERAGE ADJUSTED GROSS INCOME PART A Individuals or legal entities that receive benefits under most programs administered by CCC cannot have incomes that exceed a certain limit set by law. An approved Power of Attorney Form FSA-211 on file with USDA cannot be used as evidence of signature authority when completing this...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign USDA CCC-941

Edit your USDA CCC-941 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your USDA CCC-941 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing USDA CCC-941 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit USDA CCC-941. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

USDA CCC-941 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out USDA CCC-941

How to fill out USDA CCC-941

01

Gather required information: Collect your personal, business, and agricultural data.

02

Obtain a copy of Form CCC-941: Ensure you have the latest version of the form from the USDA website.

03

Complete Part A: Fill in your name, address, and other identification details.

04

Complete Part B: Provide details about the type of farming operation, crop production, and farm location.

05

Complete Part C: Report the number of acres planted, expected production, and any relevant assistance programs.

06

Review for accuracy: Double-check all entries for correctness and completeness.

07

Sign and date the form: Complete the certification section at the end of the form.

08

Submit the form: Send your completed CCC-941 to your local USDA service center by the due date.

Who needs USDA CCC-941?

01

Farmers and ranchers who are applying for various USDA programs and support.

02

Agricultural producers seeking disaster relief or emergency assistance.

03

Participants in the Farm Service Agency (FSA) programs needing to report their production and acreage.

Fill

form

: Try Risk Free

What is form ccc 941?

CCC-941, Average Adjusted Gross Income (AGI) Certification and Consent To Disclosure of Tax Information.

People Also Ask about

What is a CCC 941?

CCC-941 (Also Available in Spanish) – Reports your average adjusted gross income for programs where income restrictions apply. CCC-942 – If applicable, this certification reports income from farming, ranching, and forestry, for those exceeding the adjusted gross income limitation.

What is the adjusted gross income for CCC 941?

Corporation – the adjusted gross income is the total of the final taxable income and any charitable contributions reported to IRS.

What is adjusted gross income from farming?

It is the net income generated by the farm compared to all of your other sources of income that is reported on your tax return.

How do I figure out my adjusted gross income?

How to calculate Adjusted Gross Income (AGI)? The AGI calculation is relatively straightforward. Using the income tax calculator, simply add all forms of income together, and subtract any tax deductions from that amount. Depending on your tax situation, your AGI can even be zero or negative.

What is the adjusted gross income for college financial aid?

Adjusted Gross Income (AGI) | Federal Student Aid. Your or your family's wages, salaries, interest, dividends, etc., minus certain deductions from income as reported on a federal income tax return. Commonly referred to as AGI.

What is the AGI limit for CRP?

$900,000 (AGI, or comparable measure, of the person or legal entity over the 3 taxable years preceding the most immediately preceding complete taxable year for which payments or benefits are requested.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get USDA CCC-941?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the USDA CCC-941. Open it immediately and start altering it with sophisticated capabilities.

How do I edit USDA CCC-941 online?

With pdfFiller, the editing process is straightforward. Open your USDA CCC-941 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit USDA CCC-941 on an Android device?

You can make any changes to PDF files, like USDA CCC-941, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is USDA CCC-941?

USDA CCC-941 is a form used by the USDA to collect information related to regulatory compliance and reporting for agricultural programs.

Who is required to file USDA CCC-941?

Producers and participants in specific USDA programs that require reporting of their operations and compliance with regulations are required to file USDA CCC-941.

How to fill out USDA CCC-941?

To fill out USDA CCC-941, individuals must provide accurate information regarding their operations, ensure that all required sections are completed, and submit the form to the appropriate USDA office.

What is the purpose of USDA CCC-941?

The purpose of USDA CCC-941 is to ensure compliance with USDA program requirements and to facilitate the effective administration of agricultural programs.

What information must be reported on USDA CCC-941?

The USDA CCC-941 requires reporting of producer identification information, details about the agricultural commodities produced, compliance with program requirements, and other relevant operational data.

Fill out your USDA CCC-941 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

USDA CCC-941 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.