USDA CCC-941 2019 free printable template

Show details

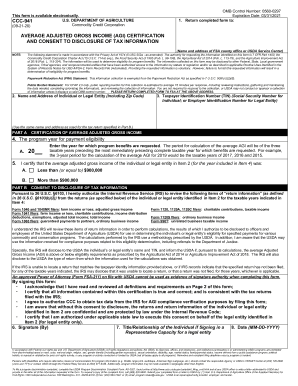

This form is available electronically. U.S. DEPARTMENT OF AGRICULTURE CCC-941 Commodity Credit Corporation 01-24-19 1. 6. Signature By 7. Title/Relationship 8. Date - CCC-941 01-24-19 Page 2 of 2 GENERAL INFORMATION ON AVERAGE ADJUSTED GROSS INCOME PART A Individuals or legal entities that receive benefits under most programs administered by CCC cannot have incomes that exceed a certain limit set by law. Date Enter the name and address of the FSA county office or USDA service center where...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign USDA CCC-941

Edit your USDA CCC-941 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your USDA CCC-941 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit USDA CCC-941 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit USDA CCC-941. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

USDA CCC-941 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out USDA CCC-941

How to fill out USDA CCC-941

01

Obtain the USDA CCC-941 form from the official USDA website or local USDA office.

02

Begin filling out the form by providing your contact information, including name, address, and phone number.

03

Indicate your farm operation details, such as the type of farming and the location of the farm.

04

Provide information regarding your commodities produced or any relevant agricultural data.

05

Review the eligibility requirements and ensure you meet them before proceeding.

06

Complete the sections related to your financial status and any assistance you are seeking.

07

Sign and date the form, certifying that the information provided is accurate and true.

08

Submit the completed form by mailing it to the appropriate USDA office or via their online portal if available.

Who needs USDA CCC-941?

01

Farmers and ranchers who are seeking financial assistance or benefits from USDA programs.

02

Producers of agricultural commodities who need to report their crop production and program eligibility.

Fill

form

: Try Risk Free

What is form ccc 941?

CCC-941, Average Adjusted Gross Income (AGI) Certification and Consent To Disclosure of Tax Information.

People Also Ask about

What is Form CCC 941 used for?

IRS requires written consent from the individual or legal entity to provide USDA verification of compliance with AGI limitation provisions. The annual certification is made possible by completing the CCC-941 form, Average Adjusted Gross Income Certification and Consent to Disclosure of Tax Information.

What is the adjusted gross income for CCC 941?

Trust or Estate – the adjusted gross income is the total income and charitable contributions reported to IRS. Corporation – the adjusted gross income is the total of the final taxable income and any charitable contributions reported to IRS.

How do you calculate your AGI from last year?

The AGI calculation is relatively straightforward. It is equal to the total income you report that's subject to income tax—such as earnings from your job, self-employment, dividends and interest from a bank account—minus specific deductions, or “adjustments” that you're eligible to take.

How do I get my last year's AGI?

If you do not have a copy of your tax return, you can get your AGI from one of the IRS self-service tools: Use your online account to immediately view your AGI on the Tax Records tab. If you're a new user, have your photo identification ready.

Are USDA FSA payments taxable?

Generally, government program payments are taxable and are reported on lines 4a and 4b. One exception is market gain shown on Form CCC-1099-G if the farmer elected to report CCC loan proceeds as income in the year received (more information on this is discussed in the line 5 section).

How do I find my last year's AGI on my w2?

You can't find AGI on W-2 Forms. You'll calculate your adjusted gross income (AGI) on Form 1040. Your AGI includes amounts from your W-2. However, it isn't based solely on those amounts.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send USDA CCC-941 for eSignature?

To distribute your USDA CCC-941, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in USDA CCC-941?

The editing procedure is simple with pdfFiller. Open your USDA CCC-941 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit USDA CCC-941 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign USDA CCC-941 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is USDA CCC-941?

USDA CCC-941 is a form used by the United States Department of Agriculture's Commodity Credit Corporation to collect information from producers regarding their commodity production and sales, which is necessary for evaluating eligibility for various government programs.

Who is required to file USDA CCC-941?

Producers who receive certain agricultural payments or benefits from USDA programs, particularly those related to commodity products, are required to file USDA CCC-941.

How to fill out USDA CCC-941?

To fill out USDA CCC-941, producers must provide specific details about their farming operations, including total production, sales, and any relevant commodity information. The form should be completed accurately and submitted to the local USDA office.

What is the purpose of USDA CCC-941?

The purpose of USDA CCC-941 is to gather necessary agricultural production data from producers, which helps the USDA manage its programs effectively and ensure compliance with regulations.

What information must be reported on USDA CCC-941?

The information required on USDA CCC-941 includes details about the types of commodities produced, the quantity produced, the quantity sold, and any other relevant data that reflects the producer's agricultural activities.

Fill out your USDA CCC-941 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

USDA CCC-941 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.