GA Macon Housing Authority Verification of Self-Employment Income 2017 free printable template

Show details

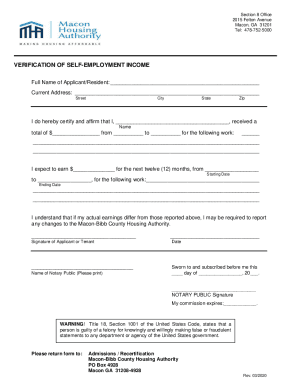

Section 8 Office 2015 Elton Avenue Macon, GA 31201 Tel: 4787525000VERIFICATION OF REEMPLOYMENT INCOMEFull Name of Applicant/Resident: Current Address: StreetCityStateZipI do hereby certify and affirm

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA Macon Housing Authority Verification of Self-Employment

Edit your GA Macon Housing Authority Verification of Self-Employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA Macon Housing Authority Verification of Self-Employment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit GA Macon Housing Authority Verification of Self-Employment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit GA Macon Housing Authority Verification of Self-Employment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Macon Housing Authority Verification of Self-Employment Income Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA Macon Housing Authority Verification of Self-Employment

How to fill out GA Macon Housing Authority Verification of Self-Employment Income

01

Obtain the GA Macon Housing Authority Verification of Self-Employment Income form from the housing authority's website or office.

02

Fill out your personal information: name, address, and contact details at the top of the form.

03

Provide a detailed description of your self-employment business, including the nature of the business and how long you have been operating.

04

List your monthly income from self-employment sources for the past year, providing detailed monthly income statements if available.

05

Document your business expenses, including all necessary receipts or statements that support your income claims.

06

Sign and date the form, certifying that the provided information is true and accurate.

07

Submit the completed form along with any supporting documents to the GA Macon Housing Authority as instructed.

Who needs GA Macon Housing Authority Verification of Self-Employment Income?

01

Individuals applying for housing assistance through the GA Macon Housing Authority who are self-employed.

02

Residents who need to verify their income status as part of their application process for public housing or rental assistance.

Fill

form

: Try Risk Free

People Also Ask about

What is the IL444 2790 self employment record?

The Il 444 2790 Self Employment Record Form is used to report self-employment income and calculate the self-employment tax. This form is used to report net earnings from self-employment in ance with federal guidelines. The form must be completed regardless of whether or not taxes are owed on the income.

What is a ledger for proof of income?

A self-employment ledger form is an accurate, detailed record or document of your self-employment income and expenses. A self-employment ledger can be kept online via a spreadsheet, a document from an accounting software program, or even on a handwritten records book or spreadheet.

What is a self employment document?

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

How do I record self-employment income?

Answer: Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more. You may need to make estimated tax payments.

How do I verify a self-employed person?

Independent contractors can use employment verification letters to show when they worked for a particular company, what their duties were and what they were paid. This letter can also be submitted with pay stubs, tax returns or bank statements as employment confirmation for independent contractors.

How do I fill out a self employment ledger?

How to use a manual self-employment ledger Open a spreadsheet or download a self-employment ledger template. Create a column for Income (money you've received) and Expenses (cost of running your business) Under Income add three columns: Date, Invoice, and Service/Product.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the GA Macon Housing Authority Verification of Self-Employment in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your GA Macon Housing Authority Verification of Self-Employment and you'll be done in minutes.

How do I fill out the GA Macon Housing Authority Verification of Self-Employment form on my smartphone?

Use the pdfFiller mobile app to fill out and sign GA Macon Housing Authority Verification of Self-Employment. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit GA Macon Housing Authority Verification of Self-Employment on an Android device?

With the pdfFiller Android app, you can edit, sign, and share GA Macon Housing Authority Verification of Self-Employment on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is GA Macon Housing Authority Verification of Self-Employment Income?

GA Macon Housing Authority Verification of Self-Employment Income is a form used to verify the income of individuals who are self-employed and are applying for housing assistance or benefits through the Macon Housing Authority.

Who is required to file GA Macon Housing Authority Verification of Self-Employment Income?

Individuals who are self-employed and seeking housing assistance from the GA Macon Housing Authority are required to file this verification form as part of their application process.

How to fill out GA Macon Housing Authority Verification of Self-Employment Income?

To fill out the GA Macon Housing Authority Verification of Self-Employment Income, individuals must provide details about their business, including income, expenses, and any relevant supporting documentation such as profit and loss statements or tax returns.

What is the purpose of GA Macon Housing Authority Verification of Self-Employment Income?

The purpose of the GA Macon Housing Authority Verification of Self-Employment Income is to accurately assess the income of self-employed individuals in order to determine their eligibility for housing assistance and to calculate the amount of assistance they may receive.

What information must be reported on GA Macon Housing Authority Verification of Self-Employment Income?

The information that must be reported includes the name of the business, nature of the business, gross income, expenses, and net income, as well as any additional documentation to support the reported figures.

Fill out your GA Macon Housing Authority Verification of Self-Employment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA Macon Housing Authority Verification Of Self-Employment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.