GA Macon Housing Authority Verification of Self-Employment Income 2008 free printable template

Show details

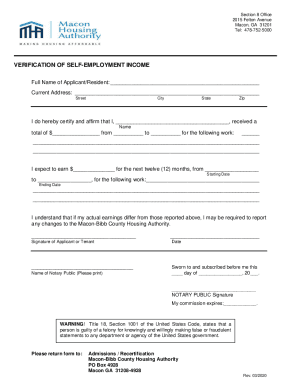

Housing Assistance 2015 Elton Avenue PO Box 4928 Macon, GA 31208 VERIFICATION OF REEMPLOYMENT INCOME Section 8 Public Housing Full Name of Applicant/Resident: Current Address: Street City State Zip

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA Macon Housing Authority Verification of Self-Employment

Edit your GA Macon Housing Authority Verification of Self-Employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA Macon Housing Authority Verification of Self-Employment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA Macon Housing Authority Verification of Self-Employment online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit GA Macon Housing Authority Verification of Self-Employment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Macon Housing Authority Verification of Self-Employment Income Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA Macon Housing Authority Verification of Self-Employment

How to fill out GA Macon Housing Authority Verification of Self-Employment Income

01

Obtain the GA Macon Housing Authority Verification of Self-Employment Income form from the housing authority's website or office.

02

Provide your personal information at the top of the form, including your name, address, and contact information.

03

List the type of self-employment or business you operate.

04

Indicate your income from self-employment for the past year, ensuring you include gross income and any relevant deductions.

05

Attach supporting documents such as tax returns, profit and loss statements, or bank statements that validate your income claims.

06

Complete any additional sections of the form that may ask for information regarding expenses or business operations.

07

Review your completed form for accuracy and completeness before submitting it to the GA Macon Housing Authority.

08

Submit the form and attached documentation in person or via the designated submission method outlined by the housing authority.

Who needs GA Macon Housing Authority Verification of Self-Employment Income?

01

Individuals or families applying for housing assistance through the GA Macon Housing Authority who are self-employed and need to verify their income.

02

Self-employed individuals seeking to qualify for housing programs or subsidies offered by the GA Macon Housing Authority.

03

Residents of Macon seeking assistance in demonstrating their income stability and eligibility for housing assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the IL444 2790 self employment record?

The Il 444 2790 Self Employment Record Form is used to report self-employment income and calculate the self-employment tax. This form is used to report net earnings from self-employment in ance with federal guidelines. The form must be completed regardless of whether or not taxes are owed on the income.

What is a ledger for proof of income?

A self-employment ledger form is an accurate, detailed record or document of your self-employment income and expenses. A self-employment ledger can be kept online via a spreadsheet, a document from an accounting software program, or even on a handwritten records book or spreadheet.

What is a self employment document?

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

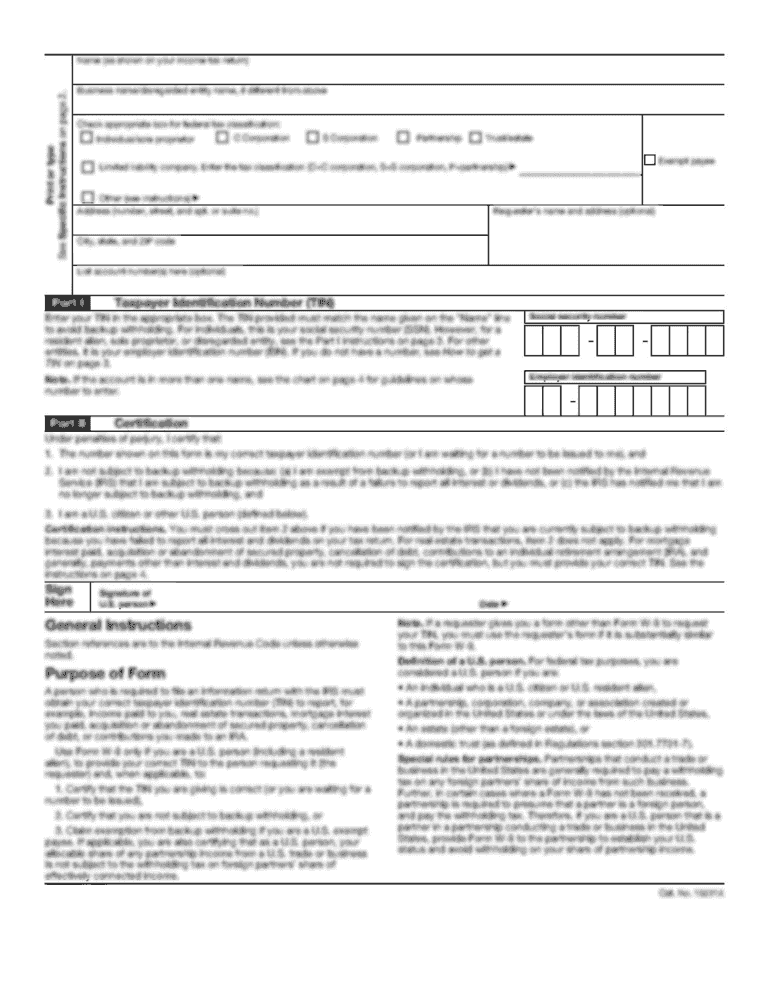

How do I record self-employment income?

Answer: Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more. You may need to make estimated tax payments.

How do I verify a self-employed person?

Independent contractors can use employment verification letters to show when they worked for a particular company, what their duties were and what they were paid. This letter can also be submitted with pay stubs, tax returns or bank statements as employment confirmation for independent contractors.

How do I fill out a self employment ledger?

How to use a manual self-employment ledger Open a spreadsheet or download a self-employment ledger template. Create a column for Income (money you've received) and Expenses (cost of running your business) Under Income add three columns: Date, Invoice, and Service/Product.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify GA Macon Housing Authority Verification of Self-Employment without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your GA Macon Housing Authority Verification of Self-Employment into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in GA Macon Housing Authority Verification of Self-Employment?

The editing procedure is simple with pdfFiller. Open your GA Macon Housing Authority Verification of Self-Employment in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit GA Macon Housing Authority Verification of Self-Employment on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign GA Macon Housing Authority Verification of Self-Employment on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is GA Macon Housing Authority Verification of Self-Employment Income?

GA Macon Housing Authority Verification of Self-Employment Income is a form used to verify income for individuals who are self-employed seeking assistance from the housing authority.

Who is required to file GA Macon Housing Authority Verification of Self-Employment Income?

Individuals who are self-employed and are applying for housing assistance through the GA Macon Housing Authority are required to file this verification form.

How to fill out GA Macon Housing Authority Verification of Self-Employment Income?

To fill out the form, provide your business information, report your monthly or annual income, list any business expenses, and include any additional documentation required by the housing authority.

What is the purpose of GA Macon Housing Authority Verification of Self-Employment Income?

The purpose of this verification is to assess and confirm the income of self-employed individuals to determine eligibility for housing assistance programs.

What information must be reported on GA Macon Housing Authority Verification of Self-Employment Income?

Required information includes the type of business, gross income, net income after expenses, and any relevant financial documents that support your self-employment income.

Fill out your GA Macon Housing Authority Verification of Self-Employment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA Macon Housing Authority Verification Of Self-Employment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.