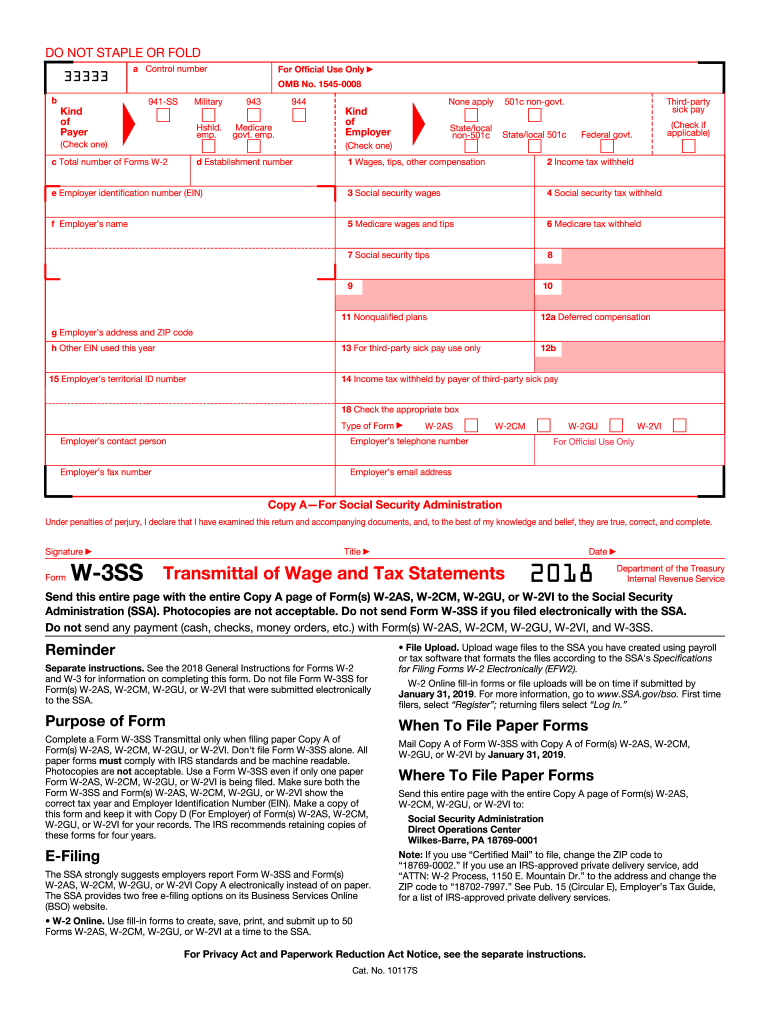

IRS W-3SS 2018 free printable template

Instructions and Help about IRS W-3SS

How to edit IRS W-3SS

How to fill out IRS W-3SS

About IRS W-3SS 2018 previous version

What is IRS W-3SS?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-3SS

What should I do if I need to correct an error after submitting the blank W3 form 2017?

If you discover a mistake after filing the blank W3 form 2017, you must submit a corrected form to rectify the error. Clearly indicate on the form that it is a correction, and ensure all information is accurate. It's important to maintain copies of both the original and corrected forms for your records.

How can I verify the status of my submitted blank W3 form 2017?

To track the status of your blank W3 form 2017 submission, you can contact the IRS or use the IRS online tools if you e-filed. It’s crucial to retain any confirmation numbers from your e-filing to facilitate tracking and resolution of any potential issues.

What are the privacy and data security measures for filing the blank W3 form 2017 electronically?

When filing the blank W3 form 2017 electronically, ensure you are using secure channels and compliant software solutions. Follow best practices for data security, such as using strong passwords and encryption. Additionally, be aware of the IRS guidelines for e-signatures and record retention to protect sensitive information.

Are there any special considerations for nonresident payees when filing the blank W3 form 2017?

When dealing with nonresident payees, it’s essential to understand specific rules regarding taxation and reporting. These payees may need an Individual Taxpayer Identification Number (ITIN) instead of a Social Security number, and proper documentation must be submitted along with the blank W3 form 2017 to ensure compliance.

See what our users say