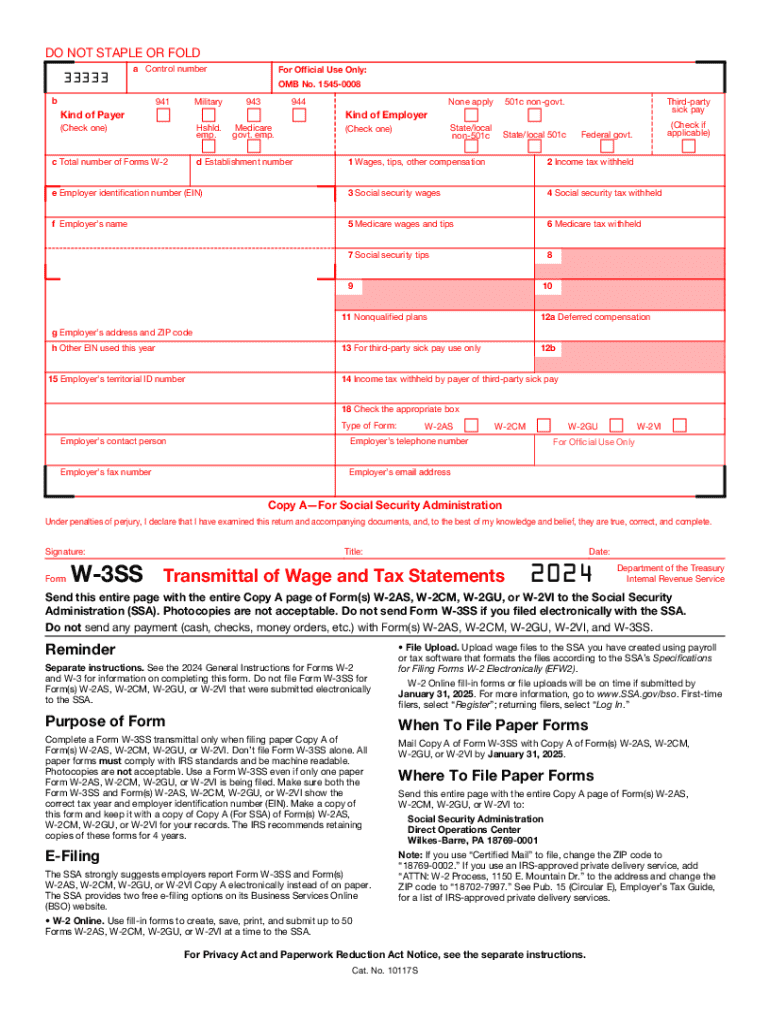

IRS W-3SS 2024 free printable template

Instructions and Help about ga 8453

How to edit ga 8453

How to fill out ga 8453

Latest updates to ga 8453

All You Need to Know About ga 8453

What is ga 8453?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-3SS

What should I do if I need to correct an error on a submitted ga 8453?

If you discover an error after filing the ga 8453, you must file an amended form. Ensure that you clearly indicate that it is a correction. Keep copies of both the original and amended forms for your records.

How can I verify the status of my submitted ga 8453?

To check the status of your ga 8453, you can use the IRS online tracking system if you filed electronically. For mailed submissions, waiting could take several weeks, and contacting IRS customer service may provide updates. Note common rejection codes to troubleshoot any issues.

Are e-signatures valid for the ga 8453, and how should I manage data security?

Yes, e-signatures are accepted for the ga 8453, provided your filing software supports them. Always ensure your data is transmitted through secure channels to protect sensitive information, maintaining compliance with privacy regulations.

What common mistakes should I watch out for when submitting the ga 8453?

One common error is incorrect taxpayer identification numbers, which can lead to processing delays. Ensure all data matches IRS records to avoid rejection. Additionally, verify that you have the correct forms for your filing situation.

What happens if my e-filed ga 8453 is rejected, and can I receive a refund?

If your e-filed ga 8453 is rejected, you should receive a notification with the reason for rejection. Correct the errors and resubmit. Refunds may depend on the specific circumstances of your case, and consulting the IRS guidelines will give clarity.

See what our users say