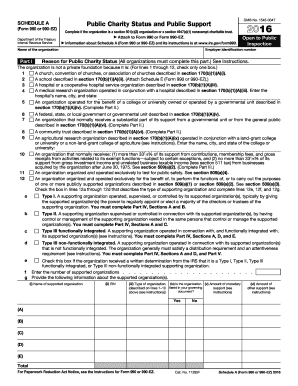

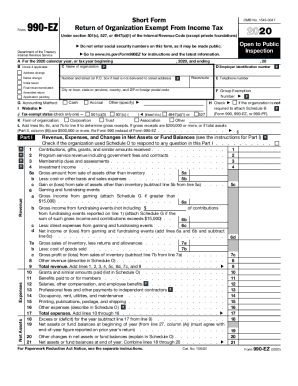

IRS 990 - Schedule O 2017 free printable template

Instructions and Help about IRS 990 - Schedule O

How to edit IRS 990 - Schedule O

How to fill out IRS 990 - Schedule O

About IRS 990 - Schedule O 2017 previous version

What is IRS 990 - Schedule O?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 - Schedule O

How can I send [SKS] for eSignature?

When you're ready to share your [SKS], you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make changes in [SKS]?

The editing procedure is simple with pdfFiller. Open your [SKS] in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete [SKS] on an Android device?

Complete your [SKS] and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is IRS 990 - Schedule O?

IRS 990 - Schedule O is a supplemental schedule used by tax-exempt organizations to provide additional information and explanations regarding their Form 990, which is the annual information return for these entities.

Who is required to file IRS 990 - Schedule O?

Organizations that are required to file Form 990, including 501(c)(3) charities and other tax-exempt entities, must also file Schedule O to provide narratives that clarify their activities, governance, and the financial information reported in Form 990.

How to fill out IRS 990 - Schedule O?

To fill out IRS 990 - Schedule O, organizations should review the specific questions asked within the schedule, provide clear and concise narrative responses, and ensure that the information aligns with what is reported in other parts of Form 990.

What is the purpose of IRS 990 - Schedule O?

The purpose of IRS 990 - Schedule O is to give organizations the opportunity to explain their financial activities, governance structure, and any other important context that is relevant for understanding the information reported in Form 990.

What information must be reported on IRS 990 - Schedule O?

On IRS 990 - Schedule O, organizations must report information such as program accomplishments, changes in the organizational structure, policies related to governance and operations, and explanations of any unique transactions or financial reporting issues.

See what our users say