IRS 990 - Schedule F 2017 free printable template

Show details

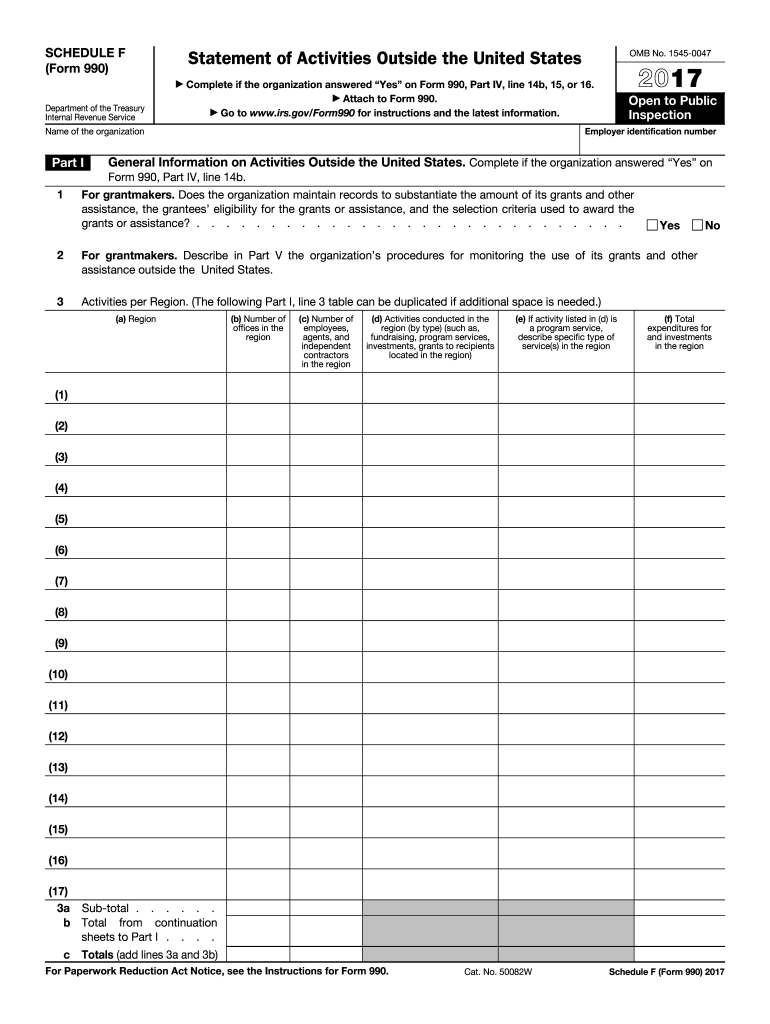

SCHEDULE F Form 990 Statement of Activities Outside the United States Department of the Treasury Internal Revenue Service Complete if the organization answered Yes on Form 990 Part IV line 14b 15 or 16. Attach to Form 990. Go to www.irs.gov/Form990 for instructions and the latest information. Open to Public Inspection Employer identification number Name of the organization Part I OMB No. 1545-0047 General Information on Activities Outside the United States. Cat. No. 50082W Schedule F Form 990...2017 Page 2 Grants and Other Assistance to Organizations or Entities Outside the United States. Complete if the organization answered Yes on Form 990 Part IV line 15 for any recipient who received more than 5 000. Part II can be duplicated if additional space is needed. a Name of organization b IRS code section and EIN if applicable d Purpose of grant e Amount of cash grant f Manner of cash disbursement noncash assistance h Description of noncash assistance i Method of valuation book FMV...appraisal other Enter total number of recipient organizations listed above that are recognized as charities by the foreign country recognized as tax-exempt by the IRS or for which the grantee or counsel has provided a section 501 c 3 equivalency letter. SCHEDULE F Form 990 Statement of Activities Outside the United States Department of the Treasury Internal Revenue Service Complete if the organization answered Yes on Form 990 Part IV line 14b 15 or 16. Attach to Form 990. Go to...www*irs*gov/Form990 for instructions and the latest information* Open to Public Inspection Employer identification number Name of the organization Part I OMB No* 1545-0047 General Information on Activities Outside the United States. Complete if the organization answered Yes on Form 990 Part IV line 14b. For grantmakers. Does the organization maintain records to substantiate the amount of its grants and other assistance the grantees eligibility for the grants or assistance and the selection...criteria used to award the grants or assistance. Yes assistance outside the United States. No Activities per Region* The following Part I line 3 table can be duplicated if additional space is needed* a Region b Number of offices in the region employees agents and independent contractors in the region d Activities conducted in the region by type such as fundraising program services investments grants to recipients located in the region e If activity listed in d is a program service describe...specific type of service s in the region f Total expenditures for and investments 3a Sub-total. b Total from continuation sheets to Part I. c Totals add lines 3a and 3b For Paperwork Reduction Act Notice see the Instructions for Form 990. Cat* No* 50082W Schedule F Form 990 2017 Page 2 Grants and Other Assistance to Organizations or Entities Outside the United States. Complete if the organization answered Yes on Form 990 Part IV line 15 for any recipient who received more than 5 000. Part II can...be duplicated if additional space is needed* a Name of organization b IRS code section and EIN if applicable d Purpose of grant e Amount of cash grant f Manner of cash disbursement noncash assistance h Description of noncash assistance i Method of valuation book FMV appraisal other Enter total number of recipient organizations listed above that are recognized as charities by the foreign country recognized as tax-exempt by the IRS or for which the grantee or counsel has provided a section 501 c 3...equivalency letter.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 - Schedule F

How to edit IRS 990 - Schedule F

How to fill out IRS 990 - Schedule F

Instructions and Help about IRS 990 - Schedule F

How to edit IRS 990 - Schedule F

To edit the IRS 990 - Schedule F, use a reliable form editing tool like pdfFiller. Begin by uploading the completed form onto the platform. Make necessary changes to reflect accurate information, ensuring that all fields are correctly filled in according to IRS guidelines. Once edits are complete, save the document for your records or proceed to the next steps of filing.

How to fill out IRS 990 - Schedule F

Filling out the IRS 990 - Schedule F involves providing specific information about your organization’s activities concerning farming, ranching, or raising animals. Follow these steps to accurately complete the form:

01

Gather necessary financial records related to the nonprofit's agricultural activities.

02

Enter the organization’s basic information at the top of the form, including its name and Employer Identification Number (EIN).

03

Complete details about income and expenses related to agricultural operations in designated sections.

04

Review all entries for accuracy, ensuring compliance with IRS requirements.

About IRS 990 - Schedule F 2017 previous version

What is IRS 990 - Schedule F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 - Schedule F 2017 previous version

What is IRS 990 - Schedule F?

IRS 990 - Schedule F is a supplement to the 990 tax form used by tax-exempt organizations to report income and expenses related to farming and agricultural activities. It is particularly meant for organizations that engage in agricultural endeavors. This form is vital for transparency regarding the financial activities specifically related to farming operations.

What is the purpose of this form?

The purpose of the IRS 990 - Schedule F is to collect information that elucidates how an organization is engaged in farming or ranching activities. This form helps the IRS ensure compliance with tax regulations applicable to such agricultural undertakings, while also providing transparency about the financial interactions related to these activities.

Who needs the form?

Non-profit organizations involved in farming, ranching, or related activities are required to file IRS 990 - Schedule F. Typically, organizations that report gross receipts exceeding a certain threshold from agricultural activities will need to use this schedule. This form is essential for all relevant nonprofits to maintain transparency and comply with IRS requirements.

When am I exempt from filling out this form?

Organizations may be exempt from filling out IRS 990 - Schedule F if they do not engage in any farming or agricultural activities. Additionally, smaller organizations with total gross receipts below applicable thresholds, or those that operate solely on passive income from investments without engaging in direct farming operations, may also qualify for exemption.

Components of the form

The IRS 990 - Schedule F comprises various sections that gather information about agricultural activities, including but not limited to:

01

Reported income derived from farming operations.

02

Expenses directly associated with farming activities.

03

Details on land usage and property considerations.

04

Any additional income or expenses attributed to agricultural operations.

What are the penalties for not issuing the form?

Failing to file IRS 990 - Schedule F when required can result in significant penalties. Organizations may face a fine based on the duration of the failure to file or could potentially lose their tax-exempt status. Compliance with filing deadlines is crucial to avoid such repercussions.

What information do you need when you file the form?

When filing the IRS 990 - Schedule F, be prepared to provide detailed financial information related to agricultural operations. This includes records of income from farming activities, documentation of expenses incurred, and any supporting financial statements to back up reported figures. Having accurate records is critical to ensure compliance and correctness.

Is the form accompanied by other forms?

IRS 990 - Schedule F is typically filed alongside the main Form 990, which provides comprehensive information about the organization’s overall finances and operations. Depending on the organization, additional schedules may also be required, especially if they engage in various activities beyond farming.

Where do I send the form?

Submit the completed IRS 990 - Schedule F along with your main Form 990 to the IRS. The exact address will depend on your organization’s state of formation and the form type. Please consult the IRS website for the most current mailing addresses and any electronic filing options that may be available.

See what our users say