IRS 4852 2017 free printable template

Instructions and Help about IRS 4852

How to edit IRS 4852

How to fill out IRS 4852

About IRS 4 previous version

What is IRS 4852?

Who needs the form?

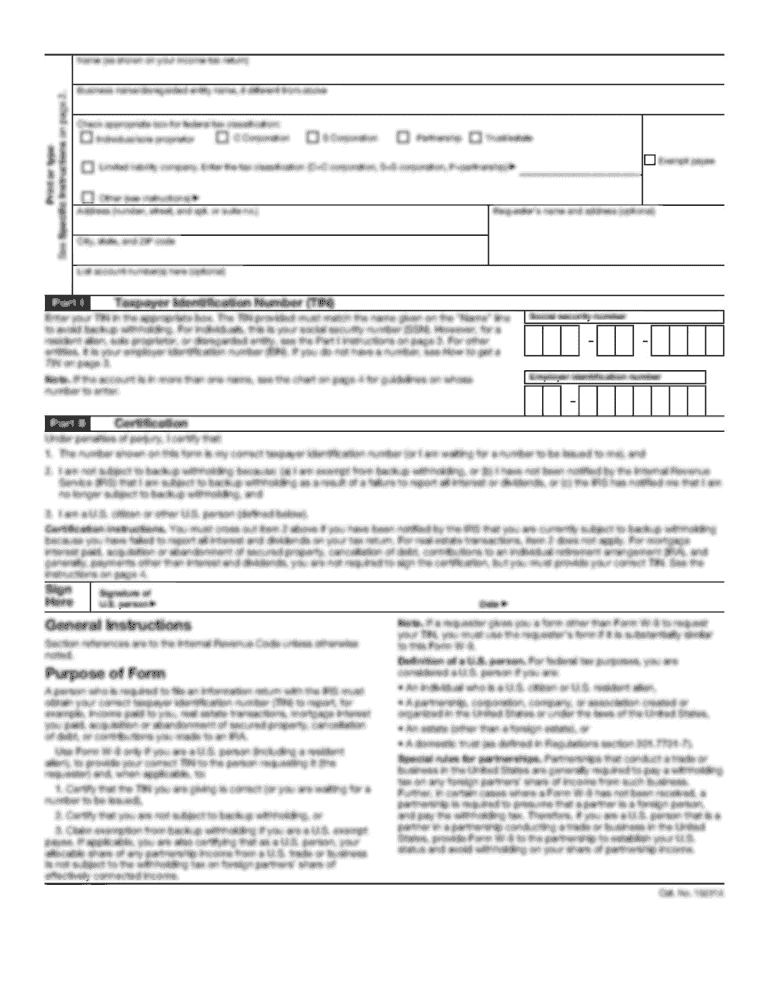

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4852

How do I complete [SKS] online?

pdfFiller has made filling out and eSigning [SKS] easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit [SKS] online?

The editing procedure is simple with pdfFiller. Open your [SKS] in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out [SKS] using my mobile device?

Use the pdfFiller mobile app to complete and sign [SKS] on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is IRS 4852?

IRS Form 4852 is a substitute form for the W-2 or Form 1099-R that taxpayers can use when they have not received these forms from their employer or payer.

Who is required to file IRS 4852?

Taxpayers who do not receive a W-2 or 1099-R form from their employer or financial institution by the tax filing deadline are required to file IRS 4852.

How to fill out IRS 4852?

To fill out IRS 4852, taxpayers must provide their personal information, estimate their wages or distributions, and report the taxes withheld. They should obtain information from their employer or payer to complete the form accurately.

What is the purpose of IRS 4852?

The purpose of IRS 4852 is to provide a way for taxpayers to report income and withholding when official documentation like a W-2 or 1099-R is not available.

What information must be reported on IRS 4852?

IRS 4852 requires taxpayers to report their name, address, Social Security number, estimated wages or distributions, taxes withheld, and the reason for not receiving the original forms.

See what our users say