IRS 1095-C 2017 free printable template

Show details

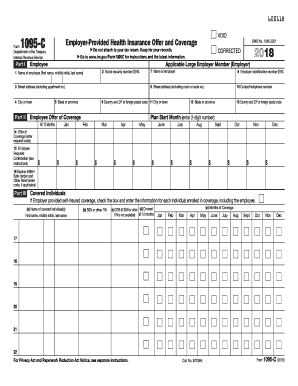

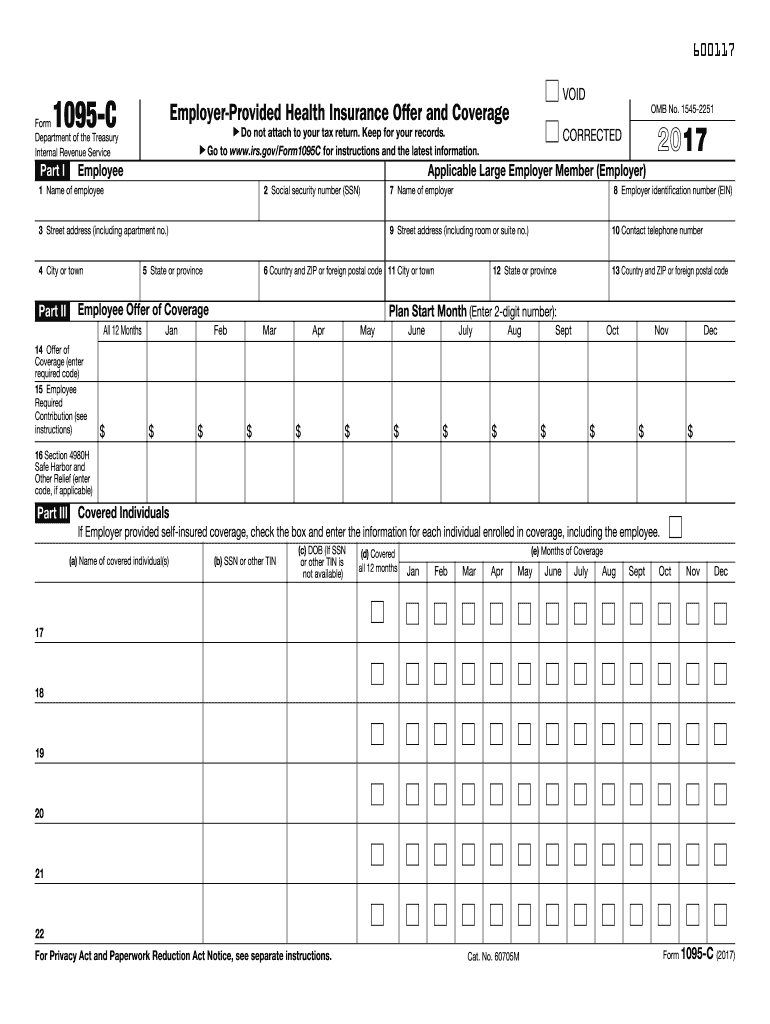

Cat. No. 60705M Form 1095-C 2017 600216 Page 2 Part II. Employer Offer of Coverage Lines 14 16 Lines 1 6. This Form 1095-C includes information about the health insurance coverage offered to you by your employer. 600117 1095-C Form Department of the Treasury Internal Revenue Service Part I Go Do not attach to your tax return. Keep for your records. As the recipient of this Form 1095-C you should provide a copy to any family members covered under a self-insured employer-sponsored plan listed in...Part III if they request it for their records. Covered Individuals Lines 17 22 You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared responsibility provision in the Affordable Care Act. Form 1095-C Part II includes information about the coverage if any your employer offered to you and your spouse and and wish to claim the premium tax credit this information will assist you in determining whether you are eligible. Similarly if you...or a family member obtained minimum essential coverage from another source such as a government-sponsored program an individual market plan or miscellaneous coverage designated by the Department of Health and Human Services the provider of that coverage will furnish you health plan through a Health Insurance Marketplace the Health Insurance Marketplace will report TIP Employers are required to furnish Form 1095-C only to the employee. In that situation each Form 1095-C would have information...only about the health insurance coverage offered to you by the employer identified on the form. If your employer is not an Applicable Large Employer it is not required to furnish you a Form 1095-C providing information about the health coverage it offered. In addition if you or any other individual who is offered health coverage because of their relationship to you referred to here as family members enrolled in your employer s health plan and that plan is a type of plan referred to as a...self-insured plan Form 1095-C Part III provides information to assist you in completing your income tax return by showing you or those family members had qualifying health coverage referred to as minimum essential coverage for some or all months during the year. to www*irs*gov/Form1095C for instructions and the latest information* Employee 2 Social security number SSN 5 State or province All 12 Months Jan 8 Employer identification number EIN 10 Contact telephone number 13 Country and ZIP or...foreign postal code Plan Start Month Enter 2-digit number Feb 7 Name of employer Employee Offer of Coverage 14 Offer of Coverage enter required code Required Contribution see instructions CORRECTED 9 Street address including room or suite no. OMB No* 1545-2251 Applicable Large Employer Member Employer 4 City or town VOID Employer-Provided Health Insurance Offer and Coverage Mar Apr May June July Aug Sept Oct Nov Dec 16 Section 4980H Safe Harbor and Other Relief enter code if applicable Covered...Individuals If Employer provided self-insured coverage check the box and enter the information for each individual enrolled in coverage including the employee.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1095-C

How to edit IRS 1095-C

How to fill out IRS 1095-C

Instructions and Help about IRS 1095-C

How to edit IRS 1095-C

To edit IRS 1095-C, you can use pdfFiller's editing tools. This platform allows you to make necessary changes directly on the form. Once you access the document, select the parts you wish to correct, and make your edits. After editing, ensure that the changes reflect accurately before saving the document.

How to fill out IRS 1095-C

Filling out IRS 1095-C requires accurate information about your health insurance coverage. Follow these steps to complete the form:

01

Gather essential information including your employer's name and address.

02

Input details about the employee, including their name, Social Security number (SSN), and address.

03

Provide information about the health insurance offered, including the months coverage was available.

04

Complete Part III with information about covered individuals, if applicable.

About IRS 1095-C 2017 previous version

What is IRS 1095-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1095-C 2017 previous version

What is IRS 1095-C?

IRS 1095-C is a form used by applicable large employers (ALEs) to report health insurance coverage offered to eligible employees under the Affordable Care Act (ACA). It details the coverage provided and whether the employer met the requirements for employer-shared responsibility payments.

What is the purpose of this form?

The purpose of IRS 1095-C is to inform the IRS and employees about the health coverage offered and whether the employee was enrolled. This is essential for determining compliance with the ACA provisions, impacting both tax filing and potential penalties.

Who needs the form?

Employers that meet the criteria as applicable large employers, defined as those with 50 or more full-time employees, must provide this form to eligible employees. Employees who receive this form should keep it for their tax records.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1095-C if you are not classified as an applicable large employer or if you are covered under a different employer's health plan. Additionally, employees with health coverage from a spouse's employer may not need to receive this form.

Components of the form

The IRS 1095-C includes various parts, each serving a specific purpose. Part I contains employee and employer information, Part II details the health coverage offered, and Part III provides a record of any covered individuals under the plan. Carefully check each part to ensure all information is accurate and complete.

What are the penalties for not issuing the form?

Penalties for not issuing IRS 1095-C can be significant. Employers may face fines up to $270 per form for failure to timely file or furnish the form. It is crucial for ALEs to adhere to the reporting requirements to avoid these penalties.

What information do you need when you file the form?

Your submission of IRS 1095-C requires several key pieces of information, including your employer's identification number (EIN), your SSN, and the details of the health insurance coverage provided. This information ensures accurate reporting to both the IRS and to your health plan record.

Is the form accompanied by other forms?

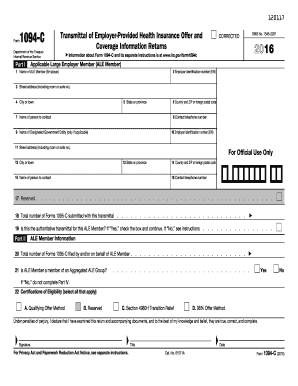

IRS 1095-C is generally submitted along with IRS 1094-C, which acts as a transmittal form summarizing the information reported for multiple 1095-C forms. Properly submitting both forms ensures compliance with ACA reporting requirements.

Where do I send the form?

Submit IRS 1095-C to the IRS at the designated address listed for forms submitted via mail. Depending on whether you are filing electronically or by paper, the submission address may vary. Check the IRS website for the most current addresses related to form filing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am not able to give my newly created file a name in

"save as" mode. Help!

Great program! Easy to use! It is just a little too expensive.

See what our users say