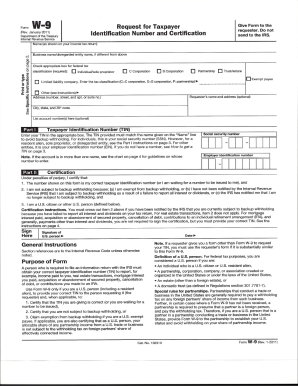

IRS W-9 2017 free printable template

Show details

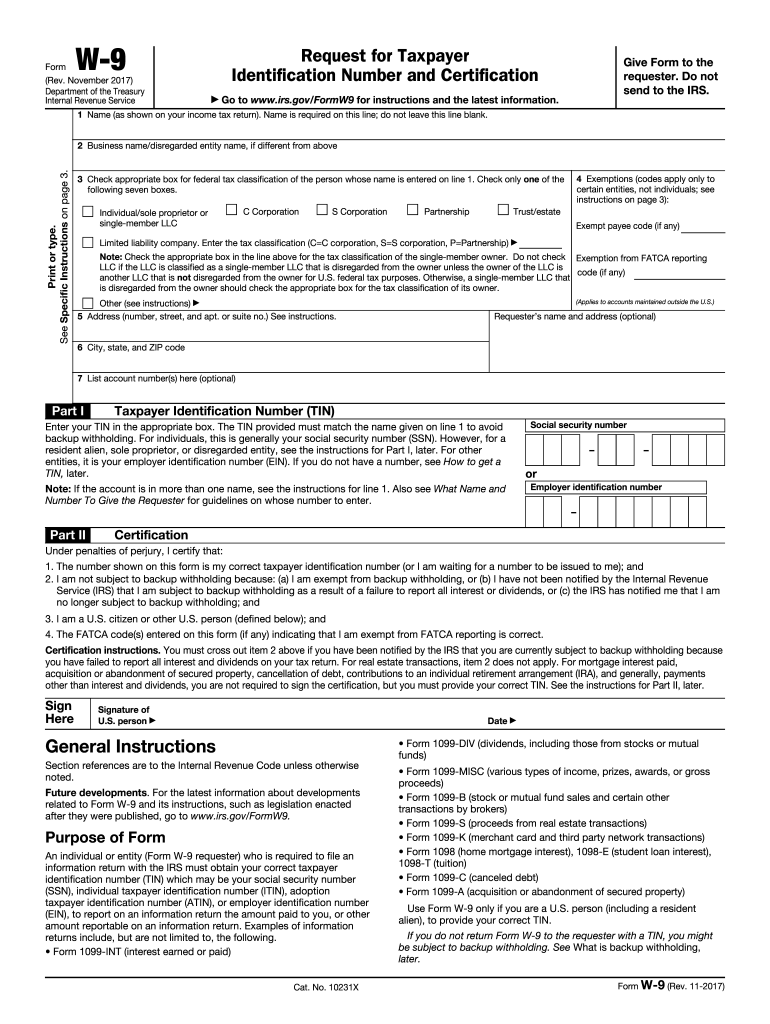

If you are providing Form W-9 to an FFI to document a joint account each holder of the account that is a U.S. person must provide a Form W-9. See What is backup withholding later. Form W-9 Rev. 11-2017 Page 2 By signing the filled-out form you 1. Also see Special rules for partnerships earlier. Note The grantor also must provide a Form W-9 to trustee of trust. In addition you must furnish a new Form W-9 if the name or TIN changes for the account for example if the grantor of a grantor trust...dies. Enter the name. If the owner of the disregarded entity is a foreign person the owner must complete an appropriate Form W-8 instead of a Form W-9. Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person do not use Form W-9. See What is FATCA reporting later for further information. Note If you are a U.S. person and a requester gives you a form other than Form W-9 to request your TIN you must use the requester s form if...it is substantially similar to this Form W-9. For the latest information about developments related to Form W-9 and its instructions such as legislation enacted after they were published go to www.irs.gov/FormW9. Do not send to the IRS* Go to www*irs*gov/FormW9 for instructions and the latest information* 1 Name as shown on your income tax return. Name is required on this line do not leave this line blank. Print or type. See Specific Instructions on page 3. 2 Business name/disregarded entity...name if different from above 4 Exemptions codes apply only to certain entities not individuals see instructions on page 3 3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of the following seven boxes. Individual/sole proprietor or single-member LLC C Corporation Partnership Trust/estate Exempt payee code if any Limited liability company. Enter the tax classification C C corporation S S corporation P Partnership Note Check the...appropriate box in the line above for the tax classification of the single-member owner. Do not check Exemption from FATCA reporting LLC if the LLC is classified as a single-member LLC that is disregarded from the owner unless the owner of the LLC is code if any another LLC that is not disregarded from the owner for U*S* federal tax purposes. Otherwise a single-member LLC that is disregarded from the owner should check the appropriate box for the tax classification of its owner. Other see...instructions 5 Address number street and apt. or suite no. See instructions. Applies to accounts maintained outside the U*S* Requester s name and address optional 6 City state and ZIP code 7 List account number s here optional Part I Taxpayer Identification Number TIN Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals this is generally your social security number SSN. However for a resident alien sole...proprietor or disregarded entity see the instructions for Part I later.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

Instructions and Help about IRS W-9

How to edit IRS W-9

Editing the IRS W-9 form requires accuracy to ensure compliance with tax regulations. Utilize tools like pdfFiller to modify your form effectively. Simply upload the form to pdfFiller, use the editing tools to input or change required information, and save your updated document.

How to fill out IRS W-9

Filling out the IRS W-9 is essential for individuals or businesses to provide taxpayer identification information. Follow these steps:

01

Obtain a blank W-9 form from the IRS website or a trusted source.

02

Provide your name as it appears on your tax return in the first line.

03

If applicable, enter your business name in the second line.

04

Select your federal tax classification, such as Individual/sole proprietor or LLC.

05

Fill in your address, including city, state, and ZIP code.

06

Input your taxpayer identification number (SSN or EIN).

07

Sign and date the form before submission.

About IRS W-9 2017 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-9 2017 previous version

What is IRS W-9?

The IRS W-9 form is a Request for Taxpayer Identification Number and Certification. It is used to provide your correct taxpayer identification number to entities that need to report payments made to you to the IRS.

What is the purpose of this form?

The main purpose of the IRS W-9 is to gather taxpayer details that enable proper reporting of income, dividends, or interest paid to individuals or businesses. This information helps the IRS ensure accurate taxation of earnings.

Who needs the form?

Individuals who are U.S. citizens or permanent residents typically need to fill out a W-9 form. Additionally, entities such as corporations, partnerships, and LLCs may also be required to provide a W-9 under certain circumstances for accurate tax documentation.

When am I exempt from filling out this form?

Generally, you are exempt from filling out the W-9 if you are a foreign person or entity. Furthermore, charities or certain government organizations may also have different filing requirements that could render the W-9 unnecessary.

Components of the form

The IRS W-9 consists of several key components, including your name, business name (if applicable), address, taxpayer identification number, and signature. Each section is crucial for ensuring compliance with tax reporting standards.

What are the penalties for not issuing the form?

Not issuing the IRS W-9 when required can lead to penalties, including backup withholding on payments made to you. Failure to provide accurate information can also result in fines from the IRS.

What information do you need when you file the form?

When completing the IRS W-9, you will need your legal name, business name (if applicable), mailing address, and taxpayer identification number (either your Social Security Number or Employer Identification Number). Ensure you have this information readily available for accurate filing.

Is the form accompanied by other forms?

The IRS W-9 is usually provided without additional forms. However, it may be requested alongside other documents depending on the entity requesting the tax identification number. Always follow any specific instruction that accompanies the W-9 request.

Where do I send the form?

The IRS W-9 does not get submitted directly to the IRS. Instead, you provide the completed form to the person or entity that requested it, often your employer or a financial institution. Ensure that you keep a copy for your records.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

wasn't aware i was paying for it until i saw the charge on my bank statement. that should have been clearer. will know more about how much i like it when i print the documents i have entered. i also would like a tech support number as i am very bad with computers.

I am glad I found this so I could access forms quickly for year end. Thank You!

See what our users say