Get the free form sc 112a - courtinfo ca

Show details

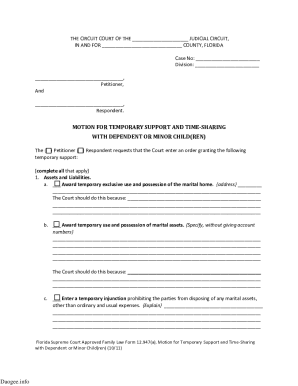

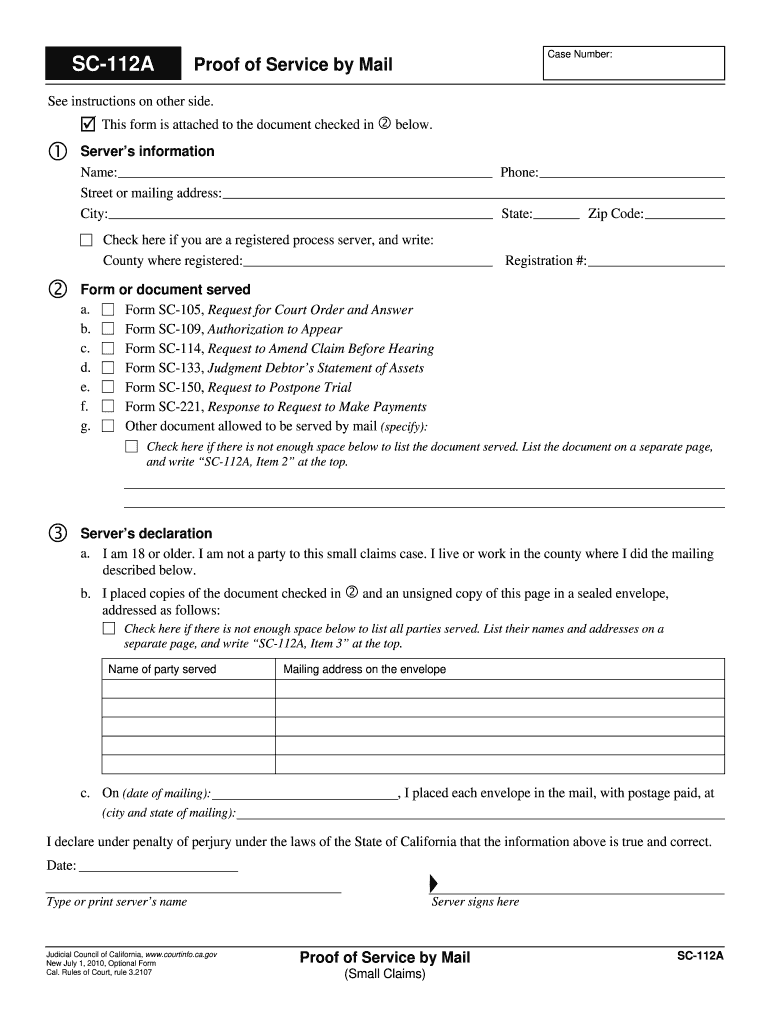

To keep other people from seeing what you entered on your form, please press the Clear This Form button at the end of the form when finished. SC-112A Case Number: Proof of Service by Mail See instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form sc 112a

Edit your form sc 112a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form sc 112a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form sc 112a online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form sc 112a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form sc 112a

How to Fill Out Form SC 112a:

01

Start by obtaining a copy of Form SC 112a. This form is typically used by individuals who need to declare their income and expenses for a particular period.

02

Begin by filling in your personal information. This includes your full name, address, social security number, and any other required identification details.

03

Move on to the income section of the form. Here, you must provide accurate information about your various sources of income during the specified period. This may include wages, self-employment income, rental income, or any other relevant income streams. Make sure to enter each income source separately and provide the corresponding amounts.

04

Next, you will need to outline your expenses. This section requires you to list your expenses categorized into different categories such as housing, transportation, healthcare, etc. Be thorough and accurate when recording your expenses, as any discrepancies may lead to complications.

05

After noting down your expenses, calculate the total income and total expenses. This will help you determine your net income or loss for the given period.

06

In some cases, you might be required to provide additional supporting documentation to substantiate your income and expenses. Ensure you attach any necessary documents or schedules as specified by the form instructions.

07

Finally, review the completed form to ensure accuracy and double-check all the provided information. Any errors or omissions could result in delays or complications with your filing.

Who Needs Form SC 112a:

01

Individuals who are self-employed or have income from non-traditional sources often need to complete Form SC 112a.

02

It is also required by individuals who have rental income, receive royalties, or are involved in partnerships where they share revenues and expenses.

03

Besides, individuals who are not covered by traditional employment but still have income and expenses to report may require to fill out this form.

Overall, anyone who needs to declare their income and expenses for a specific period, other than those covered by regular tax forms, should use Form SC 112a.

Fill

form

: Try Risk Free

People Also Ask about

What is the limit for small claims court in Los Angeles?

How much can I sue for? An individual or a business owned by an individual can file two cases each calendar year for as much as $10,000. For each additional case filed in the same calendar year, you can only sue for $2,500 or less.

How much does it cost to file in small claims court Los Angeles?

Filing fee Amount of Your ClaimFiling Fee$0- $1500$30$1500.01- $5000$50*$5000.01- $10,000$75**Frequent Filer$1001 more row

What is the maximum damages for small claims court in California?

Small claims basics Generally, you can only sue for up to $10,000 in small claims court (or up to $5,000 if you're a business). You can ask a lawyer for advice before you go to court, but you can't have one with you in court. Starting November 1, 2021, you can sue or be sued for COVID-19 rental debt in small claims.

What is the maximum amount for small claims court in California?

In general, claims are limited to disputes up to $5,000. However, natural persons (individuals) can claim up to $10,000. Corporations, partnerships, unincorporated associations, governmental bodies, and other legal entities cannot claim more than $5,000.

What is SC 130 form?

States that the judge has made a decision in your Small Claims case. Get form SC-130.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form sc 112a?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the form sc 112a in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my form sc 112a in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your form sc 112a and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit form sc 112a on an iOS device?

You certainly can. You can quickly edit, distribute, and sign form sc 112a on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is form sc 112a?

Form SC 112a is a specific tax form used for reporting certain income and expenses related to self-employment.

Who is required to file form sc 112a?

Individuals who are self-employed and have income or expenses that need to be reported to the tax authorities are required to file form SC 112a.

How to fill out form sc 112a?

Form SC 112a can be filled out by providing accurate information about the self-employment income and expenses in the designated sections of the form.

What is the purpose of form sc 112a?

The purpose of form SC 112a is to accurately report self-employment income and expenses to the tax authorities for proper tax assessment.

What information must be reported on form sc 112a?

Information such as income from self-employment activities, expenses related to self-employment, and any other relevant financial details must be reported on form SC 112a.

Fill out your form sc 112a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Sc 112a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.